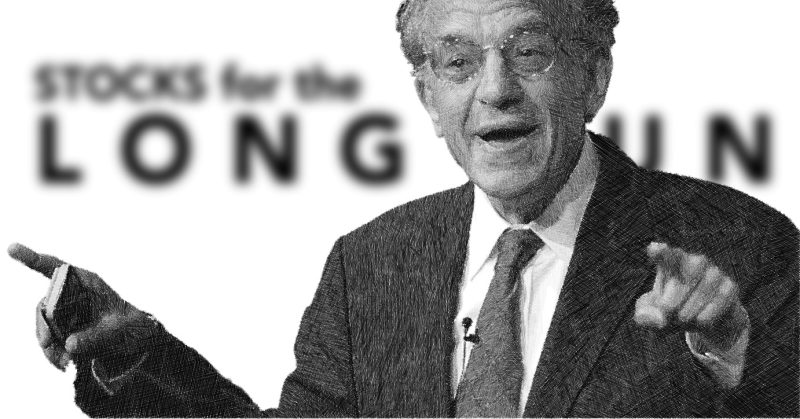

by Professor Jeremy J. Siegel, Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania

The S&P 500 reached a new all-time high on Friday as the economy continues to show strength with our favorite high frequency weekly jobless claims indicator falling under 200,000—which is nearly a 60-year low in that series. That is clearly indicative of strength in the economy.

There was some weakness in the manufacturing surveys, particularly the Empire State Manufacturing Survey. These surveys are referred to as ‘soft data’ and they reflect the sentiment of the survey respondents. But the hard data has been coming in strong. Housing data was good and retail sales came in ahead of expectations. All signs point to a resilient economy with over 2% gross domestic product (GDP) growth in the fourth quarter of 2023 and good momentum continuing in January 2024. Furthermore, there was a sharp increase in consumer confidence in the University of Michigan Consumer Sentiment Survey, certainly another good sign for the economy.

Interest rates started moving higher with these strong economic data points—particularly the 10-year rate. With these recent strong data points, commentary from Fed members has indicated push back as to whether the first rate cut should occur in March.

Just to reiterate my position on the Fed. I do not think we need five to six cuts from the Fed to have continued equity market gains this year. The Dot Plot penciled in three rate cuts—but the key insight I took from Powell’s December discussion was the willingness by the Fed to cut rates if the economy weakens. I previously was concerned the Fed might be stubborn in its inflation fight even in a softer economic scenario. Now we see the Fed weighing the employment side of its mandate as much as the inflationary side. And that’s the key flexibility we need to lower downside risks. If the economy is strong and the Fed does not cut rates as much as some expect—earnings growth may end up being supportive for the market.

Higher duration growth stocks (those with higher valuation multiples based on future cash flows)—have held up very well in the face of these higher interest rates relative to the value stocks. This is not usually the case, but I am attributing this strength to the continued strong performance in the semiconductor companies, which are spreading excitement over the impact from artificial intelligence (AI) technology. For the full year, I still expect greater participation in the rally from a broader cross section of the market, but sentiment still favors the high quality, big tech stocks.

Copyright © WisdomTree