by Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, BlackRock

Key points

- The recent retraction of an academic paper after another paper highlighted key errors in its methodology underscores the challenges in applying equity factor research to corporate bonds. Less reliable pricing data, higher transaction costs, and security fragmentation and availability issues in credit markets are among several challenges to implementing factor-based fixed income strategies.

- Within BlackRock Systematic, our fixed income strategies validate our research1 that generating active returns can build off of factors in fixed income markets to manage bond portfolios effectively.

- Our Investment Grade and High Yield ETFs seek to track indices that combine two diversifying insights, company quality and valuations, to deliver strong risk-adjusted returns relative to standard benchmark indices.

The use of “factors,” or broad and persistent drivers of investment returns, has grown rapidly in equity markets, but with less adoption in fixed income. Recently, deficiencies in academic literature on the topic led to the retraction of a paper on factors in corporate bonds.2 Beyond identifying fundamental errors in the work, the researchers found a lack of differentiation in the behavior of individual fixed income factors and generally failed to uncover an investment advantage from factors relative to benchmark returns when trying to replicate the original published research.

This raises key questions for bond investors. Does factor investing work in fixed income? Can bond investors benefit from the same differentiation between factor, beta, and alpha-seeking return sources as equity investors? In this insight, we’ll explore the long-standing difficulties of applying a factor lens to fixed income investing and whether those challenges can be overcome to help investors build more effective bond portfolios. In contrast to the academic debate, our systematic investment approach that builds off fixed income factor insights has delivered a track record outperforming both market benchmarks and peers.

What’s all the fuss about fixed income factors?

One point that this recent criticism gets right is that it’s easy to get fixed income factor investing wrong. There are several hurdles to overcome when applying factor-based strategies in fixed income.

This starts with a limited base of academic research around fixed income factors relative to equities. Factor research on equities began in the in the 1970s and most of the market has come to a commonly shared framework. Fixed income factor research is still a developing field of study without an established market consensus—leaving room for error (as pointed out by the authors) and a general lack of both academic and investor familiarity.

What’s even more challenging than the lack of established research is the difficulty that comes with applying and implementing fixed income factors. Credit markets have a history of less reliable market-wide pricing data, higher transaction costs, and security fragmentation and availability issues—all of which contribute to implementation headwinds. Complete and comprehensive data is both difficult to find and accurately interpret. Research has found that only roughly a fifth of bond-factor research could be replicated using clean data.3 Unlike in equity returns where researchers benefit from the use of the CRSP database for equity returns and the Compustat database for company fundamental data, corporate bond returns lack a similarly publicly available source for robust, reliable, and repeatable historical corporate bond data. This leads to differences in approaches when it comes to addressing the unique challenges of applying a factor lens to corporate bonds. These challenges include different approaches to extracting interest rate factor returns from credit returns and the treatment of normalizing returns across bond instruments with several complexities including capital structure, maturity, and call feature differences. This in addition to the complexities of incorporating corporate actions and the transition across corporate entities (successors) and avoiding survivorship bias—especially in the High Yield credit space where rising stars (issuers exiting the universe due to credit upgrades), fallen angels (issues entering the universe due to downgrades), and a high incidence of default, all make the practice of investigating corporate bond return attribution to factors much more involved than for comparable studies in stock returns.

Even for bond investors who get it right, the asymmetric return profile of bonds (with limited upside versus equities) may also require a more nuanced approach to building factor portfolios that will satisfy investors’ risk and return targets. For example, a value factor-based portfolio may immediately generate higher yield and total return than the market index, but it may come with securities that are at a higher risk of default and susceptible to large drawdowns—not an outcome that bond investors are typically seeking.

A time-tested approach to fixed income factor investing

Despite the now acknowledged failings pointed out in the Dickerson paper, the potential for leveraging factor insights to seek excess returns in fixed income markets is not only useful for portfolio management, return attribution and risk evaluation, but for systematic investing.

Within BlackRock Systematic, we have over 20 years of experience overcoming the implementation challenges in striving to turn model alpha into realized alpha—one of the most important ingredients in running quantitative fixed income strategies.4 Our out of sample, real world experience and track record of consistently delivering active returns over the benchmark using a systematic implementation that builds off of factor expressions in corporate bonds validates our own research conclusions that building portfolios leveraging factor insights has led to excess returns relative to a market portfolio passive benchmark.5

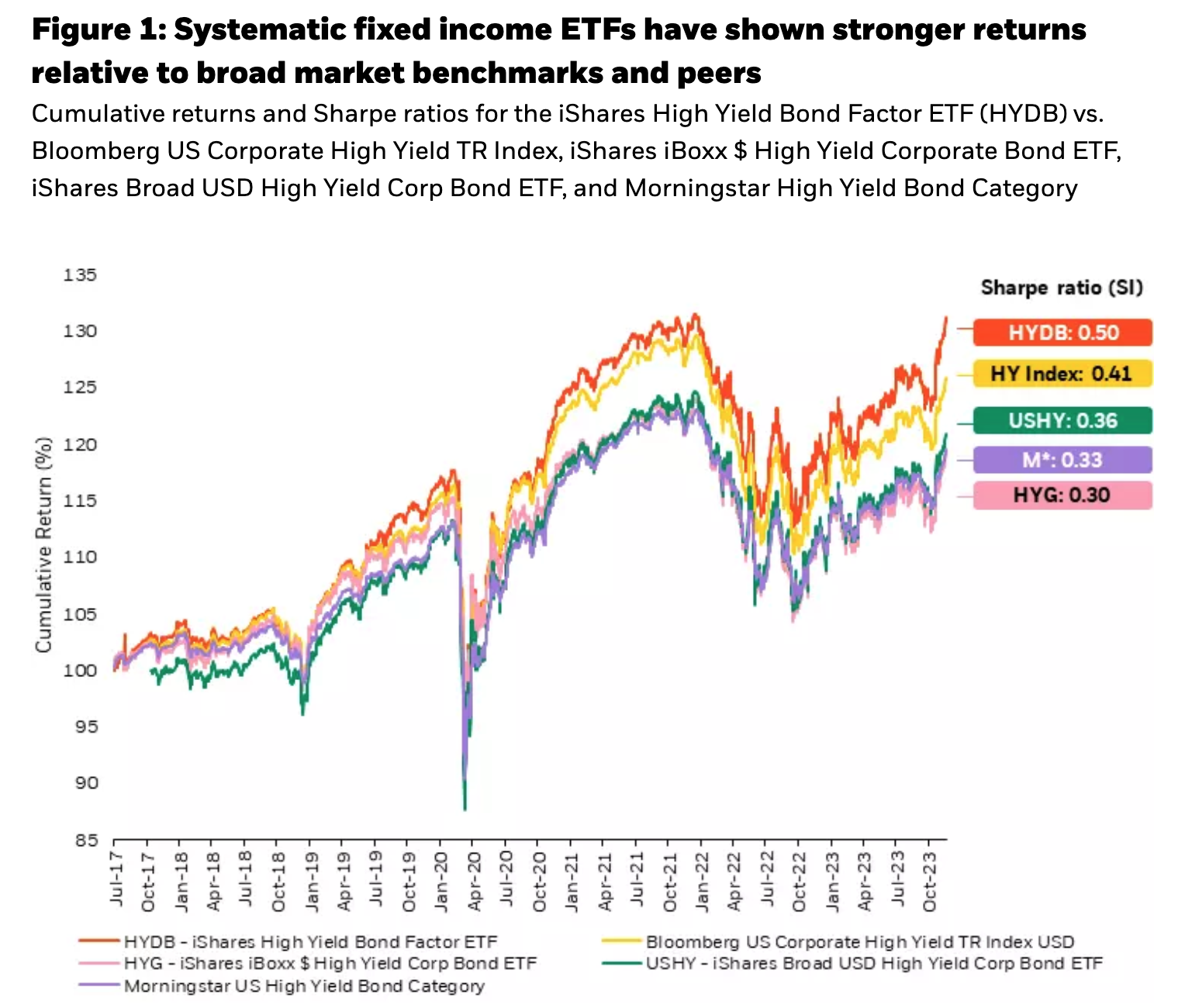

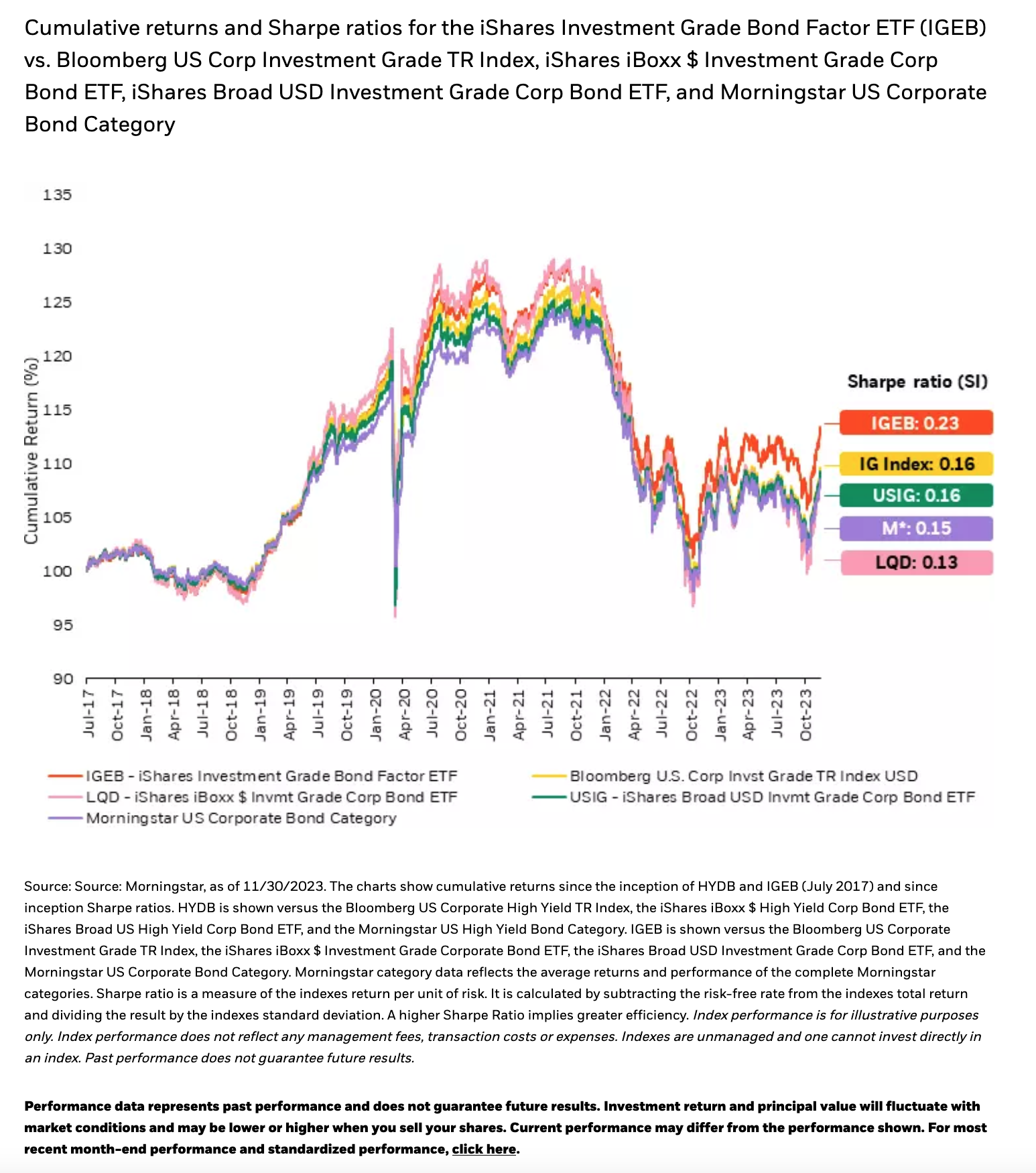

Let’s consider how we have incorporated style factors to build proprietary methodologies within BlackRock Systematic that are tracked by two of our US corporate bond ETFs, the iShares Investment Grade Bond Factor ETF (“IGEB”) and iShares High Yield Bond Factor ETF (“HYDB”). Since inception of these funds in 2017, the strategies have delivered returns—both in absolute terms and risk adjusted—significantly outperforming both passive benchmarks and peer group comparisons. Despite the debate over the ability to determine whether factors help explain historical returns in academic studies, our funds demonstrate they have delivered for investors.

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For most recent month-end performance and standardized performance, click here.

The why

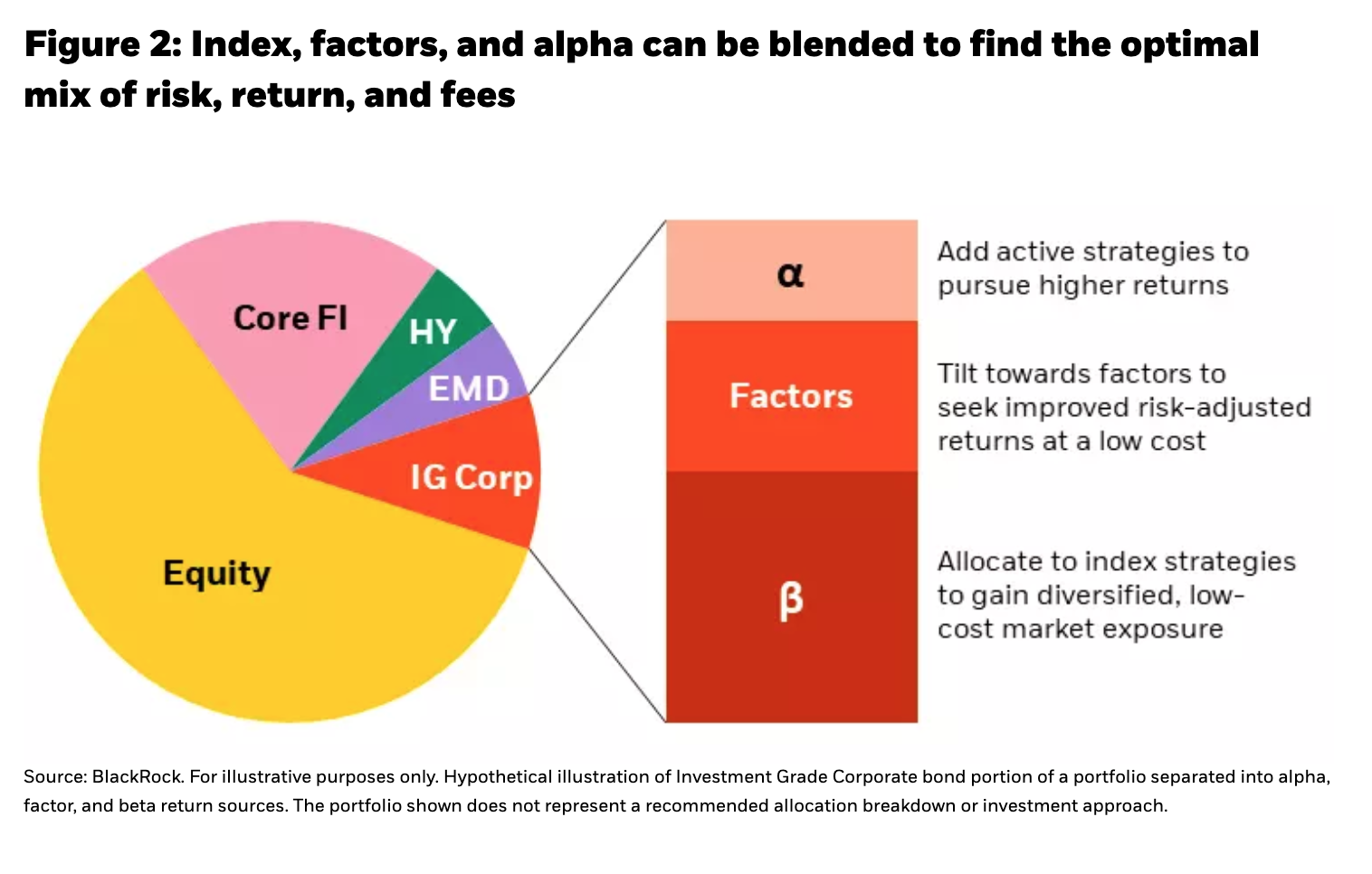

Understanding fixed income factors may help investors appreciate the true sources of risk and return across their entire portfolios, not just the equity allocation. Research has shown that a large portion of the excess returns generated by many bond managers can be explained by persistent tilts to factor exposures—even more so than equities in some cases.6As a result, properly attributing these sources of active returns above the benchmark to risks associated with factors rather than associated with pure alpha returns can allow to be managed effectively.

The below Image illustrates this more granular approach to building a fixed income allocation, blending factor, beta, and alpha-seeking return sources to a targeted mix of risk, return, and fees.

Systematic fixed income investing starts with the infrastructure and expertise to effectively clean and process the large volume of data in fixed income markets. The use of cutting-edge technology and an extensive toolkit for security analysis helps us address the immediate barriers of less transparency and less reliable market-wide data in fixed income markets.

We discussed how the return profile of bonds may require a more nuanced and sophisticated approach to building portfolios to satisfy risk and return targets. We navigate this by taking the approach of blending multiple insights, including style factors into a single portfolio.

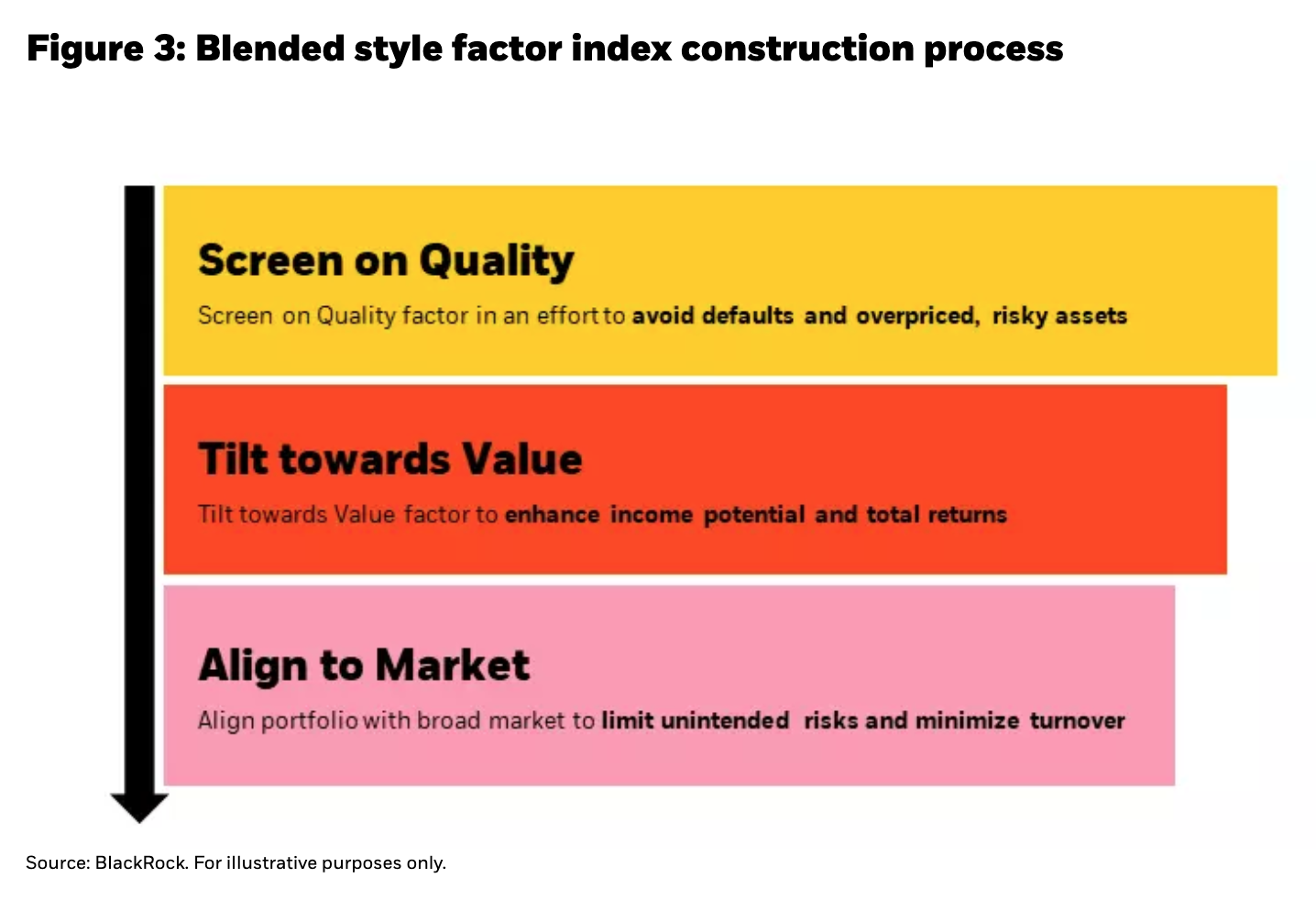

The indices used in IGEB and HYDB are built off of two diversifying insights, Quality and Value, to create corporate bond portfolios which seek to add resiliency in periods of market decline (Quality) and enhance returns during periods of positive market sentiment (Value). Critically, we observe that these two insights are diversifying—their returns tend to move in opposite directions—and combining them in the relevant proportions can help determine a better overall result. The below figure illustrates this portfolio construction process.

First, a quality screen is used to filter out securities that may be at a higher risk of rating downgrades or defaults, which can help minimize drawdowns during market downturns and periods of economic stress. Next, a tilt towards value is applied to the index to potentially enhance income and total returns of the portfolio after removing the lower quality securities. And finally, each index is optimized to align risk characteristics with the broad market and limit turnover and potential transaction costs.

The bottom line

In both research and practice, BlackRock Systematic corporate bond ETFs show that factors play a pivotal role in the risk and return outcomes within fixed income markets. Specifically, blending style factors—such as value and quality can help differentiate returns within security selection in corporate bonds. So, a style factor lens can be used to seek improved security selection within the corporate bond universe. While fixed income factor investing undoubtedly comes with challenges, our deep history of systematic fixed income investing illustrates the important role of factors in helping to differentiate return sources and striving to enhance portfolio outcomes.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics “"factor”"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Tom Parker, Chief Investment Officer, Systematic Fixed Income

Eugene Pauksta, Research Analyst, Systematic Fixed Income

Scott Radell, Senior Portfolio Manager, Systematic Fixed Income

Jeffrey Rosenberg, Senior Portfolio Manager, Systematic Fixed Income

Copyright © BlackRock