by Paul Eitelman & Pierre Donga-Soria, Russell Investments

Executive summary:

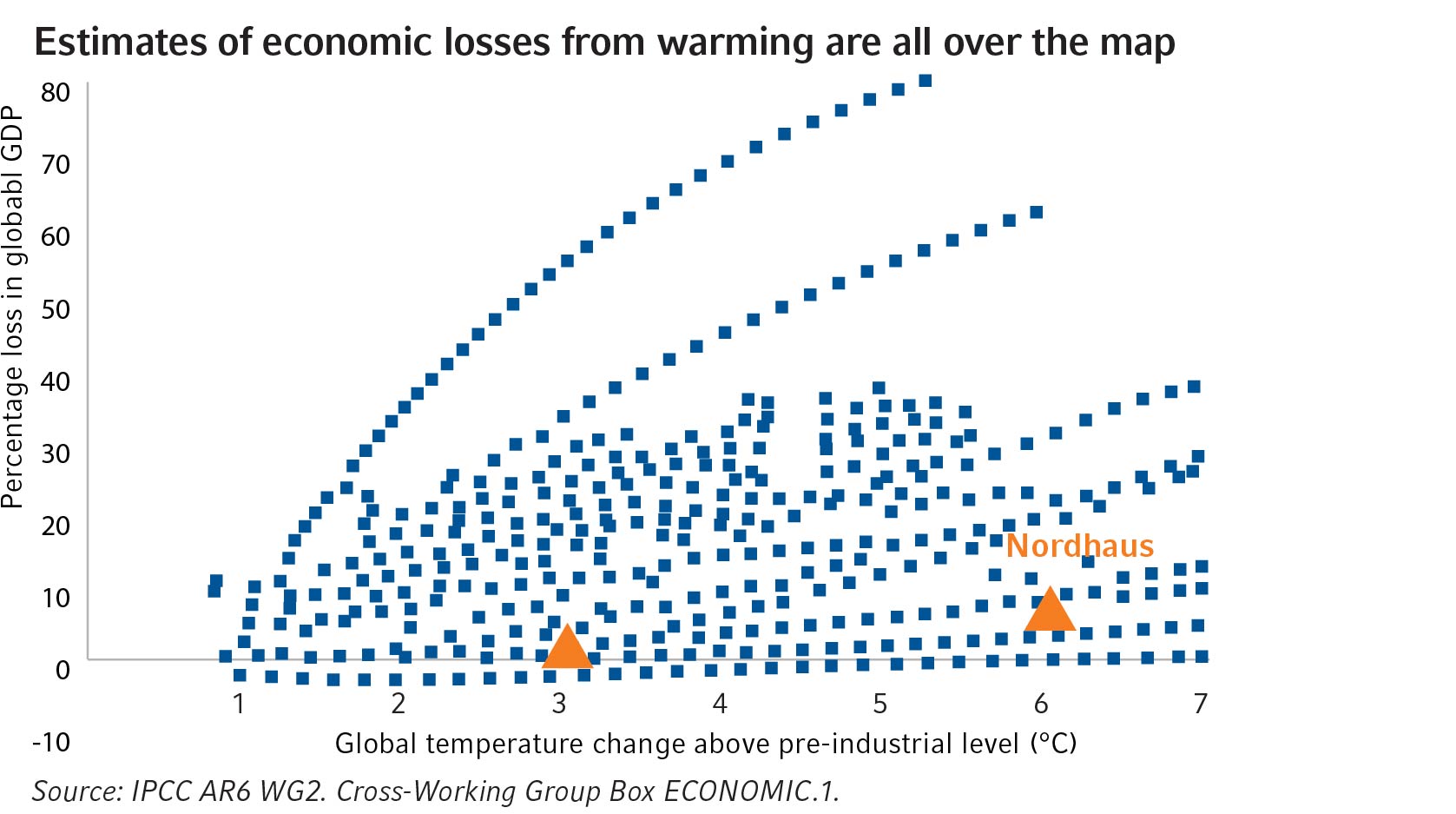

- There is broad agreement that economic damages will increase with warming, but there is substantial disagreement on the magnitude of these damages.

- An energy transition would increase investment demand globally, raising long-term equilibrium interest rates by an estimated 20-30 bps. It would also trigger higher inflation rates.

- Private capital markets are likely to play a vital role in financing a green energy transition.

This final article in our three-part series looks at the economic and market implications of a shift away from fossil fuels toward more sustainable and renewable energy sources.

This is a complex topic, as there is broad agreement that warming the planet will harm economies and markets, but there is also broad disagreement about the likely scale of that damage.

Physical damages

The first article in this series examined the economic and social risks of our reliance on fossil fuels and possible interventions to curb those impacts. To recap, a warming planet could cause physical damage that would affect economies and markets in several ways. For instance:

- A changing climate could threaten agricultural production and food security, with low-income and emerging economies more at risk than developed markets.

(Click image to enlarge)

- More volatile climate systems would increase volatility in soft commodity markets and headline CPI inflation—particularly in developing economies where food represents a larger share of consumer spending. This could exacerbate geopolitical instability.

- Increased risks to human health through the spread of tropical disease, heat stroke, and a worsening of other common health problems (e.g., high blood pressure) would increase healthcare expenditures.

- Incoming data on the economy and earnings would be harder to interpret. For example, unusually warm winters allow construction activity to continue during what would normally be a slower period for the sector. Demand would remain constant but would shift around within the calendar year, making it harder to discern underlying trends in the cycle. This is likely to create more volatility in asset prices.

The scale of economic impacts is uncertain

Estimates of the effect of climate change on global income range from modest to severe. For example, Nobel Prize winning climate economist Bill Nordhaus estimates losses of 2.1% of global income for 3°C of warming and 8.5% of global income for a 6°C increase (red triangles, chart). Other studies suggest damages could total more than 35% of global income in a severe emissions scenario.

As we noted in our first article, the carbon intensity of global output has decreased over the decades, but further interventions will be needed to hit net zero targets by 2050.

Investors should not assume an aggressive energy transition: it could be slow and bumpy.

Market impacts – a status quo scenario

A slower transition will have long-term consequences for markets but is unlikely to be disruptive in the short term. Most physical damages from a warming planet are expected to occur beyond the effective duration of assets, constraining the effects on prices.

The traditional energy sector would continue to play an important role in powering the global economy in this scenario. We currently estimate that the energy sector’s equity valuation multiples are cheaper than broad index exposure as of September 2023, and maintaining allocations to the sector within a diversified portfolio could prove beneficial.

Developing economies with fewer resources to adapt to a changing climate and those emerging economies with more sensitivity to fluctuations in food prices would face larger headwinds and could underperform over the medium-term.

Long-term interest rates would likely decline in this scenario as investors downgrade expectations for capital investment and inflation over the longer term. The International Monetary Fund and other intergovernmental agencies will likely require more funding to promote resilience and equitable growth around the world.

Market impacts – energy transition scenario

Achieving current net zero targets will require an investment boom, but as outlined in our second article, there will be challenges to overcome. How the energy transition plays out will depend on how key variables are addressed:

Speed – The cost of renewable energy technologies is falling sharply but challenges remain with intermittent supply, transmission, and storage. A rapid energy transition would be more costly and inflationary—but lower physical damages. The optimal solution requires tradeoffs that minimize total costs.

Obstacles – Export restrictions on raw materials and long ramp-up times for new mines are likely to be a recipe for bottlenecks and higher prices. That would create a bumpy pathway for the economy but would likely benefit the materials sector and emerging market commodity exporters.

Government incentives – A transition motivated through a carbon tax or windfall profits on the energy sector, with proceeds redirected towards clean energy alternatives, would:

- Be very disruptive to the traditional energy sector

- Generate greenflation as retail gasoline prices increase while consumer demand rotates toward more immature and expensive technologies

- Put pressure on raw minerals prices

In contrast, subsidizing green energy could dampen the inflationary effects somewhat.

Green energy incentives financed by government deficits would better support aggregate demand and economic growth than fully funded incentives—but would come with higher government debt levels.

Impacts on interest rates and inflation

It’s hard to generalize the outcomes of a future energy transition when the details matter. Nevertheless, two observations generally hold.

- A large green energy investment boom would increase the demand for savings globally, raising long-term equilibrium interest rates—by 20-30 basis points, according to our estimates. We have adjusted our internal modeling in recent months to reflect this.

- An energy transition will lead to higher inflation rates—so-called greenflation. Some prominent economists have suggested that—over time—central banks should relax their inflation targets to allow for some of this greenflation. While that could happen eventually, central banks are still fighting inflation and to stop now could be dangerous. Another medium-term outcome could be higher policy rates and weaker growth, with inflation steadfastly held to central bank targets.

Effects on emerging markets

An energy transition that mandates high-tech clean manufacturing processes powered by clean energy may disrupt the growth arc from developing economy to developed economy – which have traditionally moved from primary (agriculture) to secondary (manufacturing) to tertiary (services) industries. Separately, subsidies in developed markets would skew the competitive landscape globally and make it more difficult for emerging markets to participate in the required innovation.

The role of private markets

Private capital markets will play a key role in financing a green energy transition. Impact investments could include exposure to essential global infrastructure, venture capital targeted at new green technologies, farmland, and an active approach for investing in commodity markets. Having a long-term strategic plan is always important.

As discussed in this series, an energy transition looks likely to occur, but the pace of change is difficult to predict. Transitioning away from fossil fuels toward more sustainable and renewable sources will bring challenges and will have implications for economies, markets, and investment. Please read the full report for more detailed analysis.

Copyright © Russell Investments