by Jean-Sébastien Nadeau, MBA, CFA®, Co-Portfolio Manager, AGF Investments Inc.

Most fixed income investors are hoping the current losing streak in longer-dated government bonds ends at three years.

Source: Bloomberg LP as of November 9, 2023. Past performance is not indicative of future results. One cannot invest directly in an index.

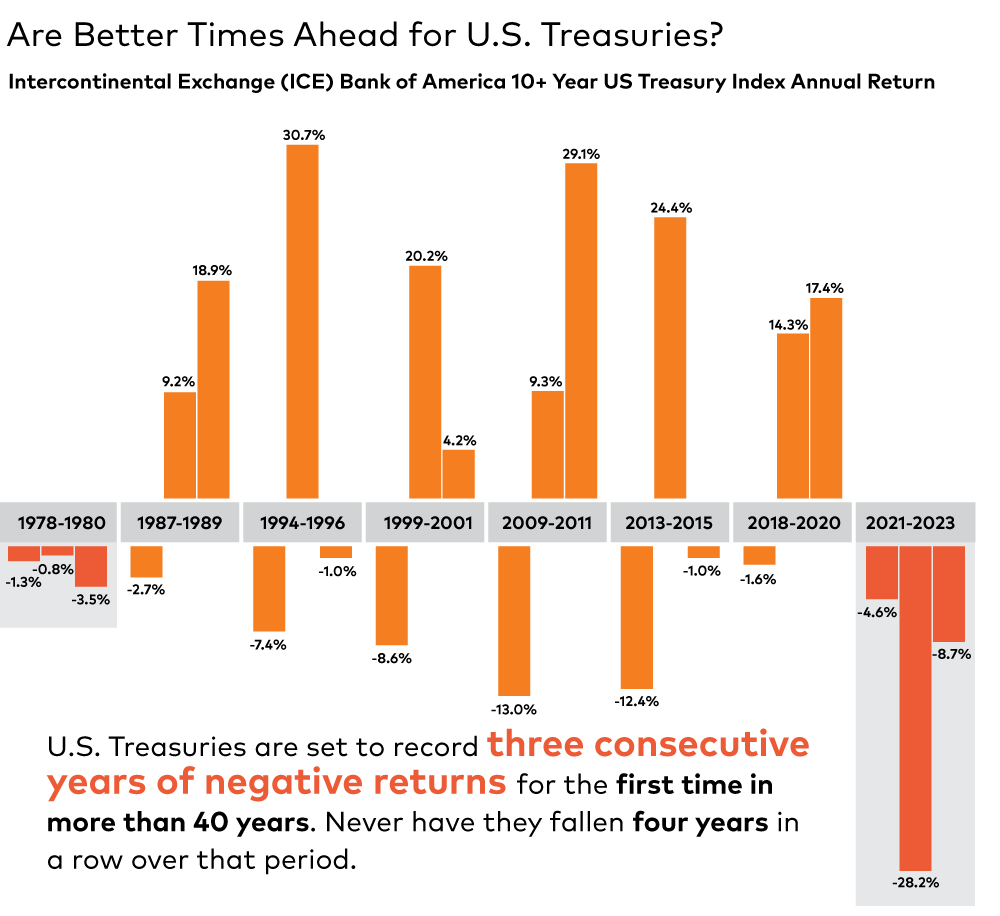

Unless something drastically changes over the next six weeks, U.S. Treasuries on the longer end of the yield curve are set to record the rare feat of having three consecutive years of negative returns (see chart). How rare? The only other time it’s happened in the past 45 years was in the late 1970s and into 1980 when Jimmy Carter was the U.S. President and interest rates rose to 20%.

Of course, most fixed income investors are hoping the current losing streak ends at three – just like it did back then. Yet whether it pans out that way may very well hinge on the strength of the U.S. economy and central bank policy moving forward. In fact, the best-case scenario for Treasuries could be a recession accompanied by rate cuts from the U.S. Federal Reserve (Fed), but it is possible a more resilient economy and less accommodative Fed than expected could end up limiting the extent to which they rebound.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced from Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of November 9, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs. AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

RO:20231115-3228953