by, Mike Archibald, CFA®, CMT, CAIA, VP & Portfolio Manager, AGF Investments Inc.

As we near the end of 2023, new market trends are taking shape that may influence investor choices for sector allocations as we move into 2024. As has been the case in the past three years, both macro and micro forces could influence these themes, and one potential area of focus for investors maybe another “energy resurgence,” with oil and other energy stocks becoming a favoured investment theme once again. In our view, the fundamentals behind this potential resurgence suggest that Energy could offer investors good inflation protection as well as both an absolute and relative positive return profile over the next 12 months.

In the third quarter of 2023, the market witnessed a sharp rise in bond yields, which has resulted in significant pressure on defensive and yielding areas of the market. Sectors like Utilities and Telecommunications were both down more than 10% in Q3, and liquidation in these areas is resulting in money flowing to other asset classes and sectors. So far, the primary beneficiaries have been oil and energy stocks, with the sector up 13% for Q3.

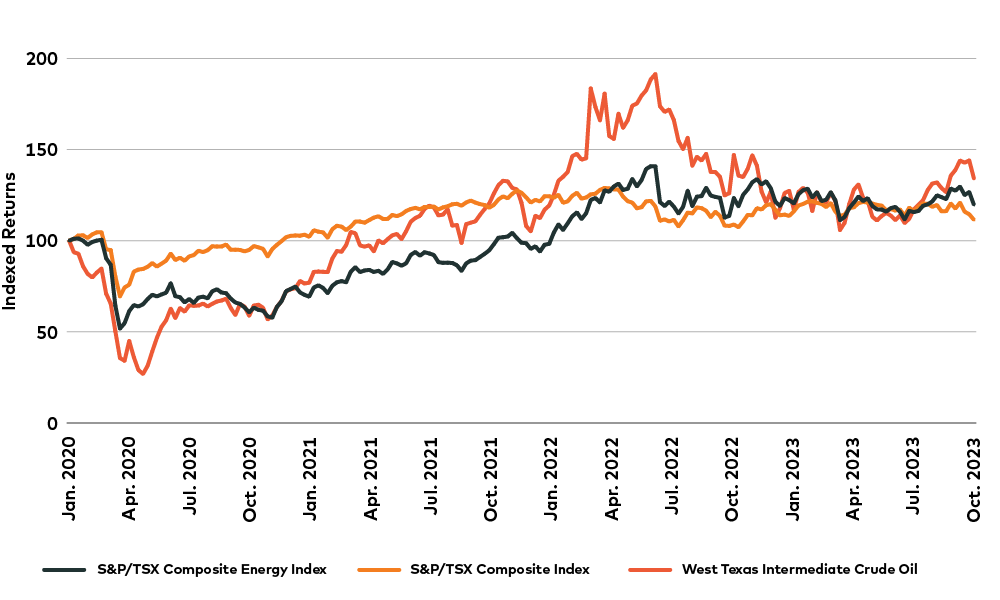

Could this trend continue? The chart below tracks the price of crude oil, the S&P/TSX Energy sector and the S&P/TSX Composite index, all indexed to a January 1, 2020, start date. Despite the market crash in late Q1 2020, all three investments have returned better than 18% through September of this year, with crude oil leading the charge, up 38%, and energy stocks up 26%, both outpacing the TSX return over that period. Oil price volatility has been high over this four-year span, collapsing during the COVID-19 pandemic and spiking in the first half of 2022 as the Russia-Ukraine war began. Energy stocks notably outperformed during the economic recovery of 2021 and the onset of the war in 2022, and they have traded largely flat for the past 18 months.

Relative Performance: S&P/TSX Energy Index Versus S&P/TSX Composite Index and West Texas Intermediate (WTI) Oil

Source: Bloomberg LP as of October 4, 2023. Returns have been indexed to a common starting point of 100 as of January 1, 2020. Past performance is not indicative of future returns. One cannot directly invest in an index.

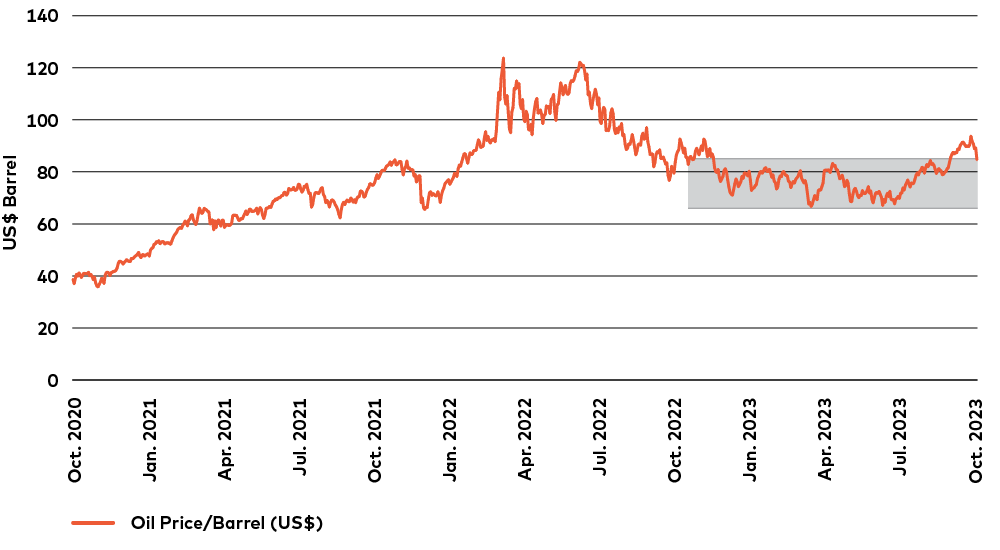

Oil prices, too, were in a tug-of-war trading range for the first eight months of 2023, rangebound between US$66 per barrel and US$83 per barrel until very recently. In September, oil broke through to the upside, ending Q3 in the low US$90-per-barrel range and potentially challenging higher levels in Q4.

West Texas Intermediate (WTI) Crude Oil Prices

Source: Bloomberg LP as of October 4, 2023. Past performance is not indicative of future returns. One cannot directly invest in an index.

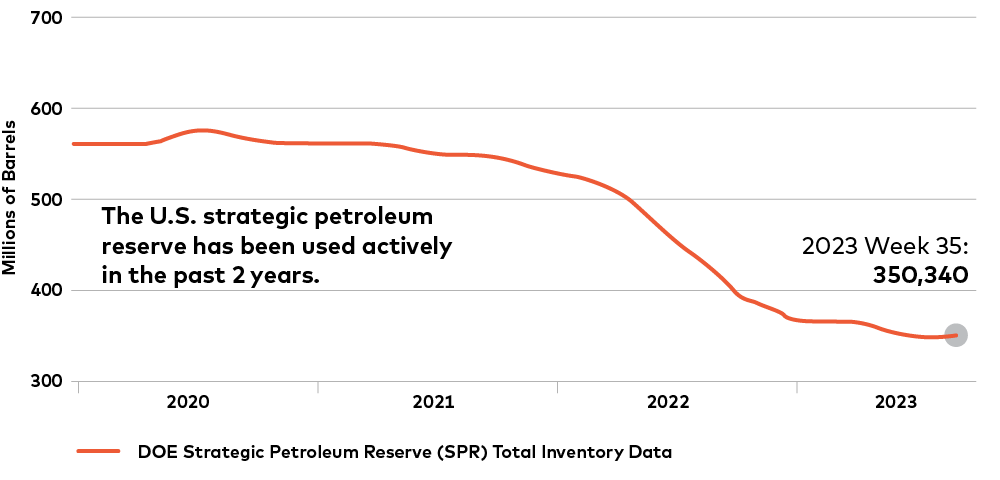

Oil price fundamentals appear to skew very bullish at the moment, while Inventory levels remain extremely low. The U.S. Strategic Petroleum Reserve has been depleted significantly over the past 18 months to combat the effects of the Russia-Ukraine war. OPEC+, the international cartel of oil-producing states, has cut production levels in an effort to move prices higher. All of those factors, combined with resilient global economies, have kept the broader oil market quite tight, and they look set to continue over the next several quarters, potentially pushing oil prices higher over the medium term.

U.S. Department of Energy Strategic Petroleum Reserve Total Inventory

Source: U.S. Department of Energy, September 2023

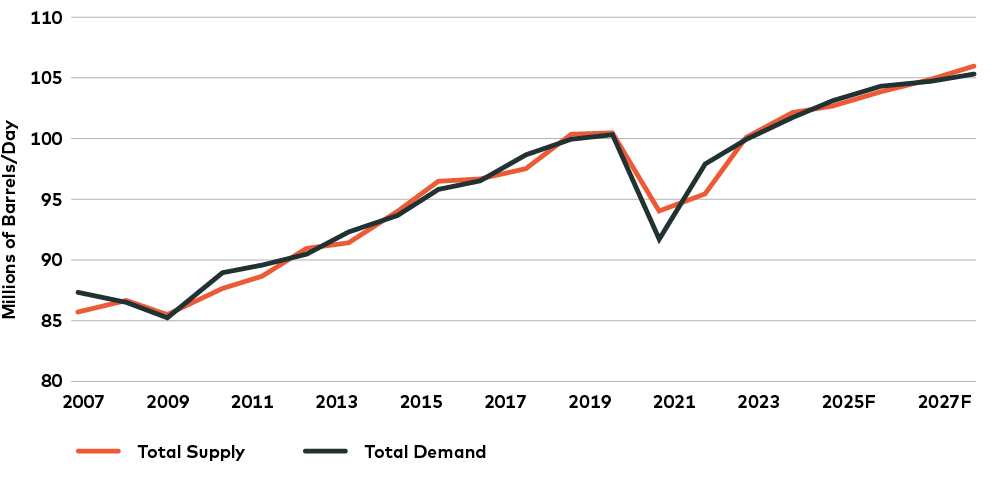

Global Oil Demand and Supply

Source: Bank of America Global Research with data from International Energy Agency, September 2023

It’s noteworthy that despite the bullish fundamental backdrop, the market probabilities for higher energy prices continue to remain quite low. In fact, expectations for oil prices to be above US$90 per barrel in 2024 are only in the 30% range, according to BCA Research. Given the geopolitical uncertainty of the Russia-Ukraine war and the tight inventory situation, the market may not yet be appreciating the opportunity here.

Fundamentals also seem to support energy equities. Energy companies continue to exhibit strong capital discipline, resisting the urge to increase capital spending despite a period of higher prices. Since the onset of COVID-19 in 2020, they have largely chosen to use excess capital to improve their balance sheets and reduce debt. Now that their debt positions have improved, extra cash flow from elevated prices has been returned to shareholders in the form of increased dividends and special dividends. Those factors should continue to support elevated energy equities prices over the near and medium term.

Finally, despite the move in oil prices the past few months, the market’s overall equity positioning continues to be underweighted to the energy sector. The cyclical nature of commodities tends to mean that institutional investors prefer other sectors with less volatility. And it’s true that oil prices can be volatile. An economic slowdown, either globally or in strategically important regions such as China, remains a significant downside risk. Geopolitical developments – for instance, Israel’s recent declaration of war on Hamas, and the ongoing war in Ukraine — could also disrupt the current supply-demand outlook, either positively or negatively.

If, however, oil prices remain resilient at their current elevated levels, the energy sector seems relatively well positioned to with respect to other sectors of the equity market and another “energy resurgence” could be right around the corner.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced from Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of October 4, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.