Real yields in the US are either too high or equity valuations are well above fair value. Investors who can understand which enterprises possess real value and those that do not, will find themselves in an enviable position compared with the broader market.

In brief

- Real yields in the US are either too high or equity valuations are well above fair value.

- But what if equity valuations reflect the promise of AI? History suggests incumbents don’t always win.

- In this new paradigm, the least fit will fail and cede their revenue and profit pools to the fittest.

A great investor once quipped that “all investing is value investing.” He was right, as overpaying has proven to be a high hurdle to overcome. The difficulty is assessing what is true “value” given the massive range of variables involved that can affect the future of any business, new or old, particularly in a changing world.

I rarely write about equity market valuations such as twelve-month trailing or forward price-to-earnings ratios, the primary reason being that they are not measures of value. They are yardsticks only used to compare relative value among groupings of financial assets. They are short-term, mathematical ratios that have become overused by investors who lack the ability or time required to fully understand the deep inner-workings of a business and its enterprise value.

Public or private, equity or debt, all risk assets need to compensate investors for the possibility of capital loss, but also for time. Capitalism only works when savers and investors are compensated for locking up their money. Interest rates represent the price of time, and they’re embedded in the value of every risk asset. This explains why there’s a relationship between interest rates and asset valuations.

That relationship has broken down

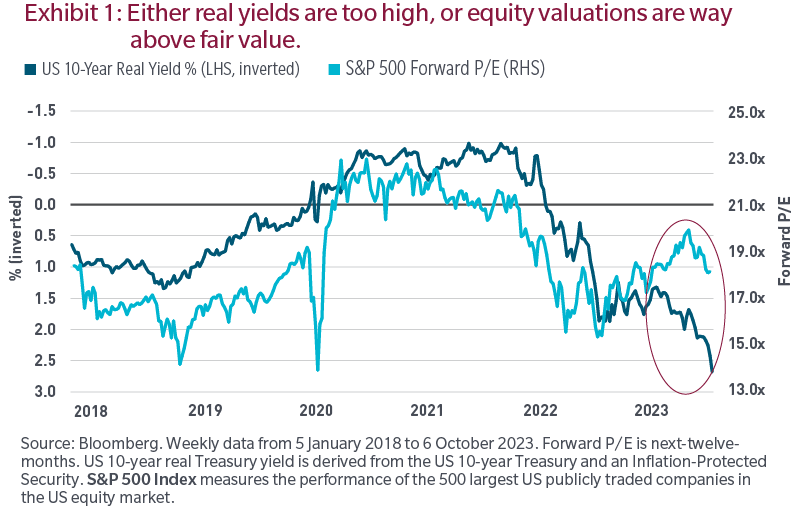

The dark blue line, measured by the left-hand axis is the yield (inverted) on the US 10-year Treasury Inflation Protected Security. We’re using this as a proxy for expected real rates in the United States. The light blue line on the right-hand side is the twelve-month forward price-to-earnings ratio on the S&P 500.

The relationship is simple. When interest rates decline, the value of future cash flows rises and pushes equity valuations higher. This is evident in the chart. The pandemic lockdown gave central banks cover for more financial repression. Real yields fell from pre-pandemic levels of around 1% to something with a minus sign in front of them and risk assets responded positively.

The relationship works in the other direction as well. After the inflation ambush of 2022, stock valuations collapsed to compensate investors for the increasing competitiveness of risk-free yields.

Our circle is highlighting the breakdown in this general relationship. Either real yields are too high at a more historically normal 2% or equity valuations are well-above fair value. In other words, the bond market is signaling something quite different from the equity market.

If the bond market is right, what’s the equity market missing?

The multi-decade paradigm of abundant, cheap capital, inexpensive labor and low capital spending that propelled profit margins to all-time highs has ended. The fallacy of extrapolation may be at play as equity investors are assuming that those profit tailwinds will continue unabated.

However, the unfortunate reality is that they are now profit headwinds. Credit has become scarce and expensive. While corporate net leverage looks fine due to trailing profits, investors should be thinking about leverage on normalized, not peak, profits. Additionally, while a lot of debt was termed out during the pandemic, credit events are rarely about maturity walls and are instead usually linked to unsustainable capital structures. As we head in to 2024, investors will ultimately begin to incorporate what are now materially higher capital costs into their free cash flow models. High debt loads that accumulated over many years was used to gear up existing cash flow streams rather than investment in new income streams. That debt will likely need to be paid back and at much higher costs and with less income.

Labor, too, is now scarce and represents a significant expense that will affect future profits. This year, the US is averaging a bankruptcy filing every one to two business days as companies fail under the weight of their debt or simply because their business models aren’t viable in a capital-constrained world. Labor costs should normalize as equilibrium is restored, but that can be a long process. Until then, labor expenses will be a drag on returns.

What if the bond market is wrong?

Perhaps the valuation gap is an artificial intelligence premium and the bond market is underappreciating its effects?

While that is a possibility, history has shown that productivity gains are ultimately competed away. While companies enjoy an initial profit lift from new technologies and labor is able to produce more with less, new entrants with fresh ideas often change the industry dynamics and those gains get deflated away.

Disruptors and innovators tend to capitalize on new technologies and usurp the value proposition of incumbents. We would argue that while artificial intelligence may bring a step-function change in how society operates, it could allow for the emergence of an entire new group of companies at the peril of some of the existing enterprises that litter the benchmarks. This is why we are unwavering in our conviction about the future value of active management.

Will central bankers, during the next period of financial strain, return to financial repression and socialization of losses?

While everything has a probability, this feels like a low one to us. It’s helpful to consider wants versus constraints. Meaning, policy makers may “want” to repress rates, but can they?

Compared with prior episodes, most advanced economies face all-time high debt-to-GDP ratios and ballooning budget deficits. These introduce a potential new constraint on policymakers as the bond vigilantes clearly are back after years of dormancy. Governments, like risk assets, need to compete for savers’ capital and they too are now at the mercy of the bond market.

Conclusion

For myriad reasons, equity markets are typically late in discounting unwelcome financial outcomes. Frequent readers of these pieces will recall earlier notes on this. While rates, short or long, nominal or real, may fluctuate higher or lower to a degree, the paradigm has shifted, and we find it highly unlikely that rates will return to pre-pandemic lows.

This paradigm will be different from the last. The least-fit businesses were able to survive due to suppressed costs. But costs are no longer suppressed and continue to rise, introducing strain. In this new paradigm, the least fit will fail and cede their share of revenue and profit pools to the most fit.

Investors who can understand which enterprises possess real value and those that do not, will find themselves in an enviable position compared with the broader market.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affi liates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

“Standard & Poor’s®” and S&P “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affi liates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affi liates make any representation regarding the advisability of investing in such products.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.

Copyright © MFS Investment Management