by Vinay Thapar, CFA, Co-Chief Investment Officer and Senior Research Analyst—US Growth Equities; Portfolio Manager—Global Healthcare, AllianceBernstein

Even the best scientists in the world cannot reliably forecast drug-test results, so why should investors gamble? Quality businesses are key for healthcare stocks.

Healthcare stocks often serve as powerful painkillers during market declines. Yet the sector offers much more than just downside mitigation for investors who focus on business potential and resist the urge to predict scientific breakthroughs.

While the MSCI World Index fell by 18.1% in 2022, healthcare stocks fell by only 5.4%. But healthcare’s reputation as a defensive haven understates the sector’s attractions. Pharmaceutical groups, medical device manufacturers and healthcare providers are benefiting from big trends that can help fuel long-term returns for investors who are skilled at deciphering the complex forces shaping the sector.

Three Big Trends

Three forces are stimulating change in healthcare today: innovation, pricing structures and policy. However, these dynamics often clash and complicate the investment outlook for a product or company. Will people pay more for a revolutionary treatment if it isn’t covered by a healthcare system? Is a government likely to provide meaningful subsidies for a new diagnostic technology? Are current prices sustainable over the long term? Questions like these vary from country to country, based on government policies, national economics, and spending or cultural preferences.

Despite these challenges, we believe there are ways to make informed judgments across the industry that can lead investors to solid sources of profitability and investment returns. The first step is to avoid the common fallacy that drug trials can be predicted. During the pandemic, many companies tried to develop COVID-19 vaccines, but only a few succeeded. Even the best scientists in the world cannot reliably forecast drug-test results, so why should investors gamble? Instead, develop a clear picture of how innovation, pricing and policy dynamics could affect a company’s profitability and growth rate.

Medical Innovation

Scientific innovation has underpinned healthcare advances for decades. Yet in many ways, the technological revolution in healthcare is still in its infancy. Investors need to look beyond cutting-edge equipment or biotechnology research to understand how innovation will reshape the industry. For example, although the use of big data and artificial intelligence is still relatively limited in pharmaceutical development, over time they will probably become integral tools in improving the efficacy of drug trials.

New developments will make an impact across many areas. Robotics are already changing surgical procedures. Treatments for Alzheimer’s disease and cardiovascular disorders will help combat the physical and economic costs of demographic change. The development of solutions to age-old problems from the common cold to cancer is just a matter of time.

Pricing Disruption

Still, powerful innovations don’t always make economic sense. Understanding how pricing points are determined for a new product or service is essential to gauge a company’s earnings potential.

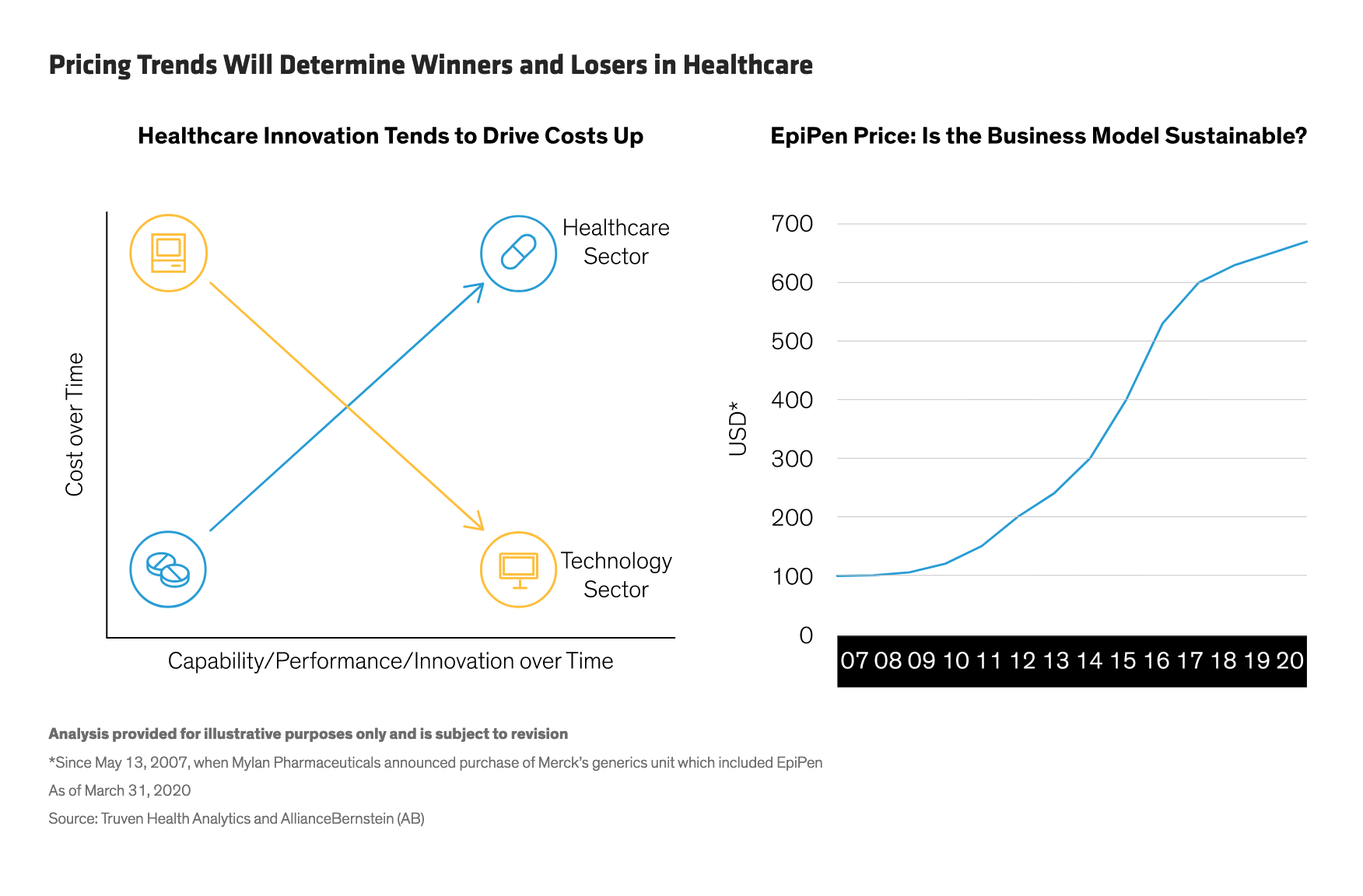

Innovation and pricing have a curious relationship in healthcare. In technology, it’s well known that innovation drives performance improvements and pushes down costs exponentially. The IBM mainframe computers that powered NASA’s Apollo spacecraft in the 1960s and cost millions of dollars each had a fraction of the memory and processing capacity of an iPhone. But in healthcare, the opposite happens: innovation tends to drive prices up (Display, left). For example, 25 years ago, cancer patients paid about $200 a month for chemotherapy, and success was limited. Today, some chemotherapy treatments can cure cancer with fewer side effects, but at a cost of $100,000.

In many cases, investors must ask whether prices are realistic. For example, Mylan’s EpiPen is a popular product that can avert death in cases of extreme allergic reactions. Its price surged more than sixfold since May 2007 (Display above, right), when Mylan bought Merck’s generic-drug unit, which included the EpiPen. Is this sustainable? While high-priced products may flatter a company’s earnings and margins, they could prove to be a weakness if the price is forced down by market dynamics or policy decisions.

Policy Dynamics

Government policies about healthcare are a key determinant of whether a business will succeed or fail. Healthcare spending per capita differs dramatically from country to country, and the quality provided doesn’t always reflect the price paid. For example, the US spends more on healthcare than almost any country in the world, yet its quality of healthcare provided ranks lower than in the UK and Germany, which both spend much less (Display).

Policy decisions can make the difference between life and death by determining which costs and treatments are covered. Around the world, healthcare systems are feeling the strain of rising costs, and workers are responsible for meeting more healthcare expenditures. At the same time, demand from emerging economies is growing, and spending is likely to increase amid efforts to upgrade the quality of healthcare. These trends will reshape price points for treatments, technology and services.

Business Fundamentals

Taking these three forces into consideration, investors can evaluate a healthcare business. In our view, innovative healthcare companies that are positioned for long-term success amid pricing pressures and shifting policy sands should demonstrate the following attributes:

- High or improving returns on invested capital (ROIC)

- Strong reinvestment rates

- Healthy balance sheets

- Businesses with durable competitive advantages

Be wary of companies that pursue earnings growth at the expense of profitability. Highly acquisitive companies should also be scrutinized closely, especially if they have a lot of debt and/or sales concentrated in a small group of products. And companies that rely on a single successful drug test to drive future growth should be handled with extreme care, in our view.

Intuitive Surgical is a good example of a company that scores high on our criteria. The company is a leader in medical robotics, with proven technology in an industry that has high barriers to entry for competitors. Global adoption of robotic surgery is increasing, with more than 1.5 million procedures performed in 2021, a 50% increase since 2018. And Intuitive Surgical’s strong ROIC provides it with the financial means to self-fund its expansion, as well as new opportunities in areas such as natural orifice surgery, which reduces the risk of procedures and doesn’t create scarring.

In contrast, we believe that specialty pharma companies and hospitals are often problematic investments. For many specialty pharma companies, pricing models are unsustainable, as companies take aggressive price increases while little is spent on R&D. Instead, capital is allocated toward acquisitions, which typically drive adjusted earnings growth at the expense of ROIC. Hospitals are also facing pressure on profitability as insurers focus on creating low-cost/high-quality healthcare ecosystems in part aided by new technological advances that pull patients away from hospitals for many types of treatments (e.g., telehealth).

Investing effectively in healthcare stocks requires a unique set of skills. It’s not about scientific insight. By applying a disciplined investment process that integrates the diverse factors that affect healthcare businesses, investors can access sources of strong return potential that can invigorate an equity portfolio for the long term.

About the Author

Vinay Thapar is a Senior Vice President and Co-Chief Investment Officer for US Growth Equities and a Portfolio Manager for the Global Healthcare Strategy. He is also a Senior Research Analyst, responsible for covering global healthcare. Before joining the firm in 2011, Thapar spent three years at American Century Investments as a senior investment analyst responsible for healthcare. Prior to that, he worked for eight years at Bear Stearns in the Biotech Equity Research Group, most recently as an associate director. Thapar holds a BA in biology from New York University and is a CFA charterholder. Location: New York