by Russ Koesterich, JD, CFA, Portfolio Manager, BlackRock

Key takeaways:

- In many ways 2023 continues to be the mirror image of 2022, with the most volatile assets being some of the best performers for much of the year.

- Growing evidence of an economy that is slowing warrants an allocation to low volatility equities with a focus on companies who are able to provide stable and consistent earnings.

Russ Koesterich, Managing Director, discusses why a moderation in economic growth may warrant an increased allocation to lower volatility stocks in portfolios.

In many ways 2023 continues to be the mirror image of 2022. One market dimension where this is most apparent: For much of the year, the most volatile assets have been some of the best performers. Last year the most volatile companies were sold as investors wrestled with a rapid rise in inflation and surging interest rates. In contrast, 2023 has witnessed a surprisingly rapid return to these same companies.

Through the July market peak, the volatility style factor, i.e. companies with more price volatility than their peers, outperformed. Since then, there has been a shift in investor preferences towards stability. As more evidence builds that the economy is slowing, investors are less willing to embrace volatility. Assuming further economic moderation in the coming quarters, investors should consider raising their weight to less volatile, more stable companies.

After underperforming their more volatile peers for most of the year, low volatility stocks and indices have been posting better relative performance since the start of August. While absolute returns have still been nominally negative, low volatility indices have outperformed by roughly 200 bps. The converse is also true. After ripping higher in January and then again in the spring, more volatile securities have come under pressure as the market has turned lower.

Stability Counts When Growth Slows

There are several possible explanations for the recent outperformance in low volatility stocks. After a summer of surprisingly resilient economic data, there is growing evidence the economy is slowing. Both job growth and inflation are moderating and there are signs of stress in pockets of the household sector. As typically happens, as the economy slows investors prefer more stable companies and more predictable earnings.

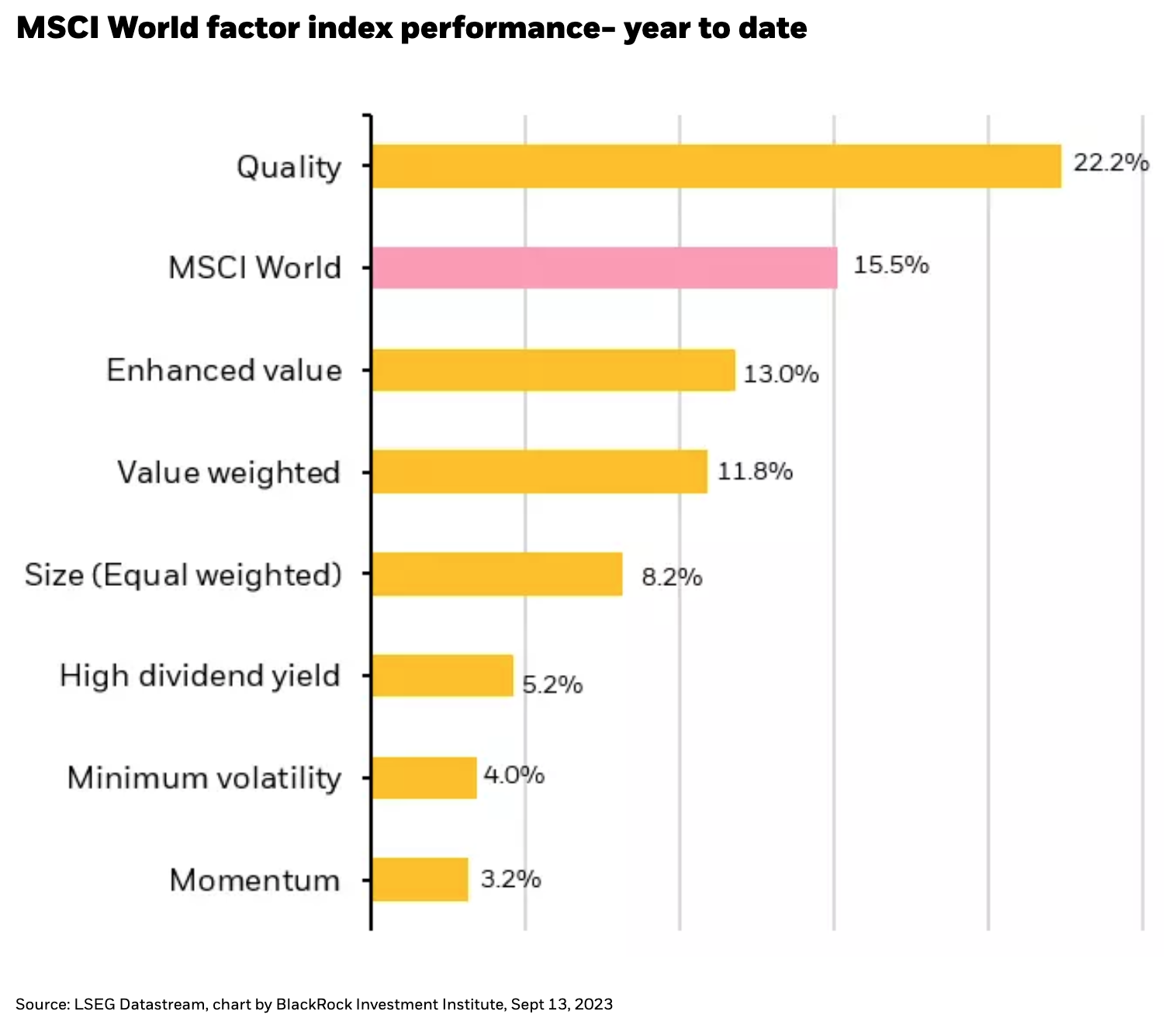

Valuation discrepancies may also be helping. Despite recent relative strength, low volatility stocks have significantly underperformed the market as well as other investment styles (see Chart 1). Prolonged underperformance has left these companies relatively cheap. Looking at the ACWI Low Volatility Index versus the traditional global ACWI Index confirms the relative value discrepancy. Low vol stocks are trading at roughly 17x forward earnings versus nearly 20x for the broader global index. To the extent that investors often pay more for higher quality, the current discount in less volatile companies is worth noting.

Not Just About Price

Not Just About Price

Our base case continues to be no U.S. recession, but even without an official contraction we are likely to see a slowdown. Economic slowdowns typically favor companies in more stable industries, notably staples and utilities. That said, I don’t think investors need limit themselves to the traditional defensive playbook.

Low volatility’s advantage stems from company fundamentals as much as price behavior. This suggests broadening the search to includes companies, regardless of industry, with more stable revenue, earnings, and margins. In addition to staples and utilities, many software, healthcare service and payment companies also display these characteristics. While this year’s rebound has generally favored taking a flier on many of last year’s biggest losers, slower economic growth should shift the investment narrative towards stability and consistency, regardless of the industry.