In a recent Wall Street Journal1 article, James Mackintosh delves into the Federal Reserve's ambitious plans for the U.S. economy. The central bank aims to achieve what Mackintosh describes as "not merely the softest of soft landings for the economy, but the slowest rate-cutting cycle in its history." The Fed's "dot plot" of forecasts reveals its intent to manage inflation effectively while fostering stronger economic growth and lower unemployment rates.

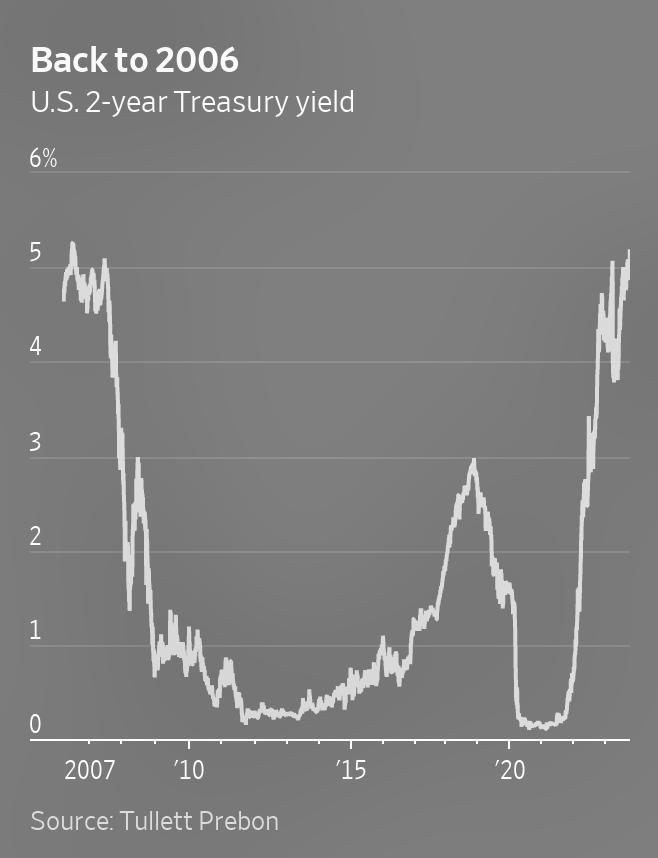

Investors have been particularly attentive to the Fed's prediction that interest rates will decline less than initially anticipated. This has led to an increase in bond yields and a negative impact on Big Tech stocks. Mackintosh notes that the market has accepted the Fed's forecast at "face value," expecting fewer rate cuts next year but a spread of reductions over the subsequent three years.

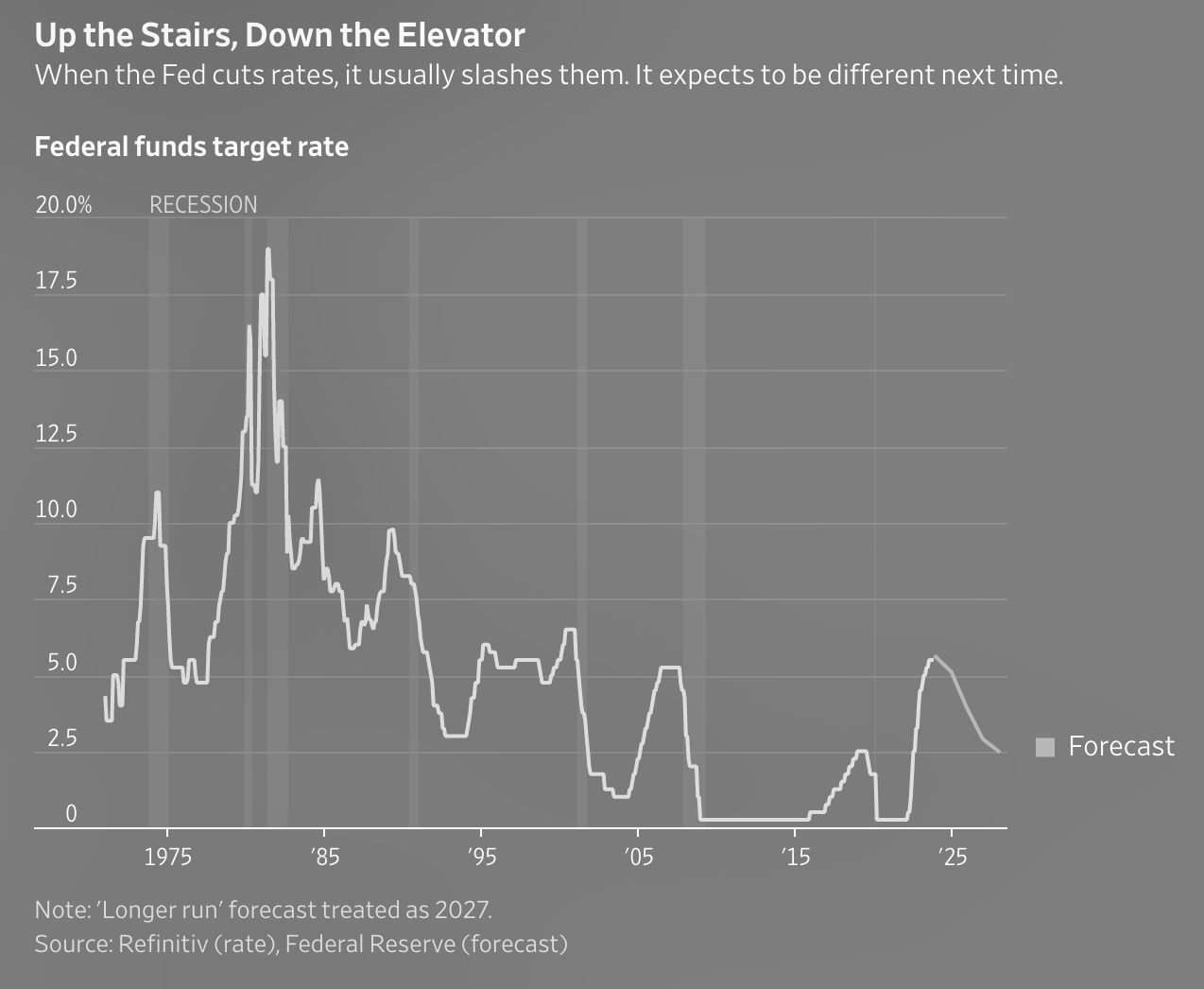

However, Mackintosh casts doubt on the feasibility of the Fed's plans. He states, "It’s the perfect scenario for the central bank, but history suggests it isn’t likely to work out." He highlights two historical lessons that the Fed seems to be overlooking. The first lesson is that interest rates usually rise gradually but are cut rapidly. "They seem to think they can just coast down slowly," says David Kelly, chief global strategist at J.P. Morgan Asset Management, adding, "It never happens that way."

The second lesson pertains to the handling of inflation. Mackintosh cites a study by the International Monetary Fund (IMF) which found that resolving inflation shocks typically requires a tight monetary policy sustained over an average of three years. The study also warned against "premature celebrations" when inflation rates appear to decline, leading to a relaxation of policy. The median Fed policy maker predicts a 5.1% rate by the end of next year, which is double the median inflation forecast. This, according to IMF economists, is the correct approach post an inflation shock, but it comes at the cost of hampering economic growth.

Mackintosh also points out that the Fed's current strategy seems to contradict its usual modus operandi. The central bank is banking on higher-than-expected growth and lower inflation, a scenario that has unfolded over the past year but is not typically expected. The Fed has signaled caution by planning for only two rate cuts next year, as opposed to the four it had previously predicted.

Mackintosh also points out that the Fed's current strategy seems to contradict its usual modus operandi. The central bank is banking on higher-than-expected growth and lower inflation, a scenario that has unfolded over the past year but is not typically expected. The Fed has signaled caution by planning for only two rate cuts next year, as opposed to the four it had previously predicted.

In the long run, Mackintosh argues that the Fed's cautious approach may be the right course of action, as "letting inflation rip is eventually even worse for growth." However, he also notes that the Fed's rate increases have so far had minimal impact on the economy, which does not align with the IMF's criteria for successful central bank action.

From an investment perspective, Mackintosh sees risks in both directions. Rapid rate rises could eventually lead to higher unemployment and quick rate cuts, or a robust economy could result in inflation and force the Fed to raise rates. He concludes that what seems least likely is a steady economic trajectory that would allow the Fed to gradually ease its policies while its forecasts materialize.

Mackintosh's analysis suggests that while the Federal Reserve's plans are optimistic, they may be overly ambitious given historical precedents and the complexities of economic dynamics.

Footnote:

1 Adapted from source: Andrew Harrer/Bloomberg News. "When Rates Drop, They Usually Plunge. The Fed Thinks Different." WSJ, 22 Sept. 2023, www.wsj.com/economy/central-banking/interest-rates-drop-federal-reserve-e71f1892.