by Andrew Ang, PhD, BlackRock

Key takeaways

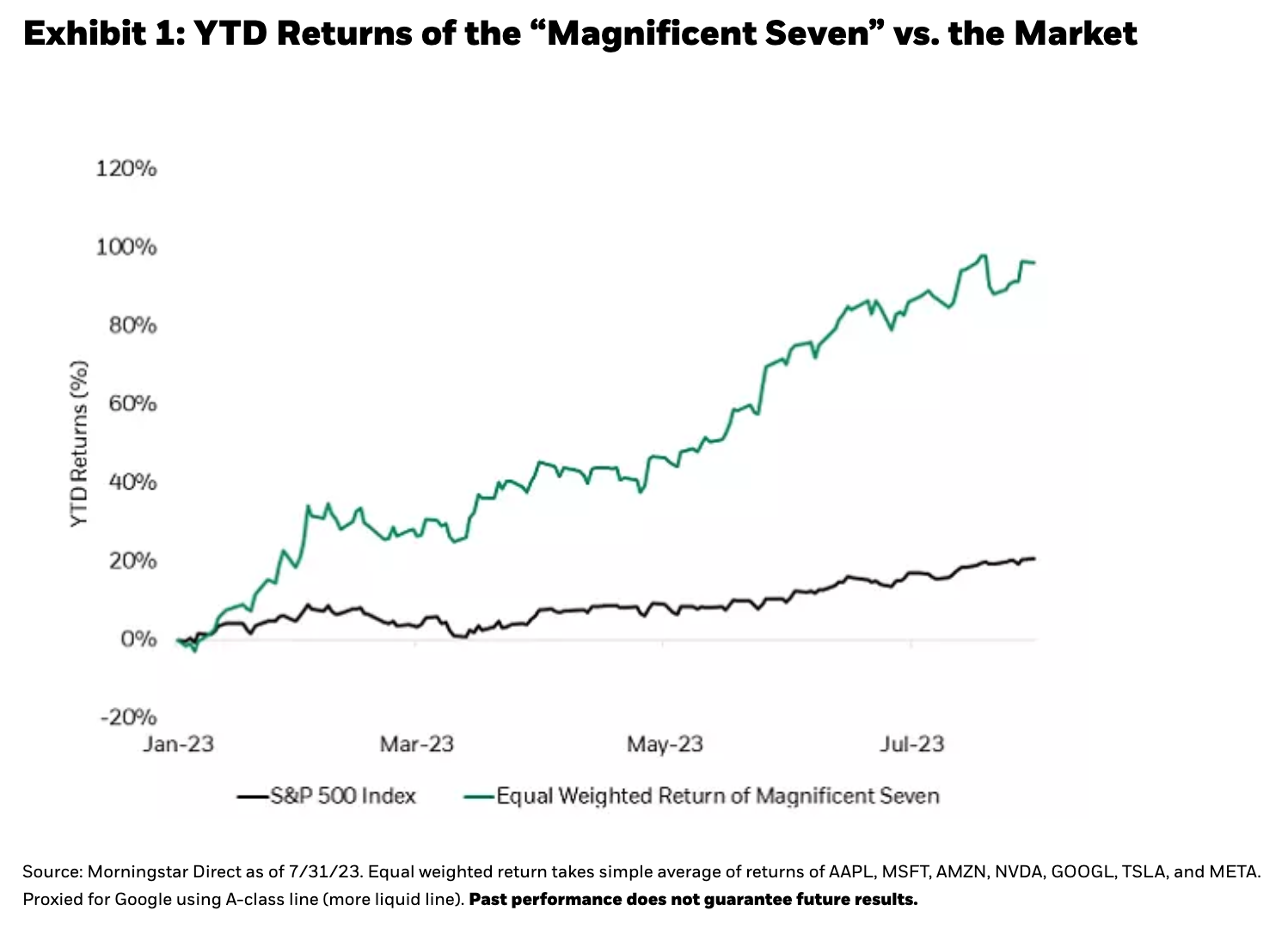

- Narrow leadership by the Magnificent Seven – Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta – has been a challenge for factor investors

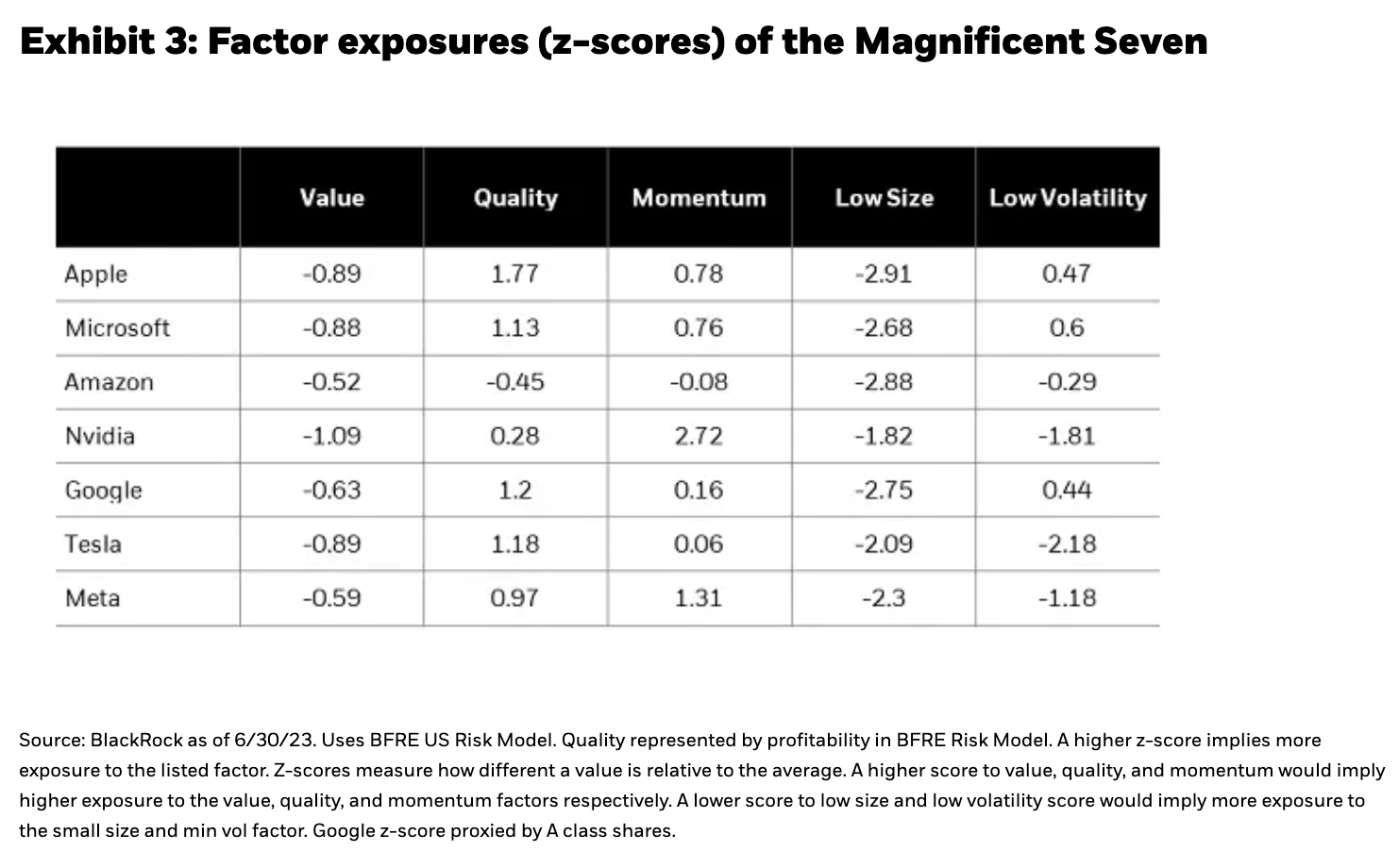

- Factors tend to favor breadth over concentration. Historically, these seven companies have minimal exposure to factors with the exception of quality

- Taking a long-term view and staying disciplined may be prudent to help factor investors capture these long-run premiums

Factors and the Magnificent Seven

Seven mega cap US-based companies – Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta (Facebook) – have stayed top of mind for many investors this year. These companies have been dubbed the “Magnificent Seven” (not to be confused with the 1960s movie or 2016 remake), are the largest U.S. based companies by market cap, and have performed very well so far in 2023 partially due to the latest artificial intelligence boom.

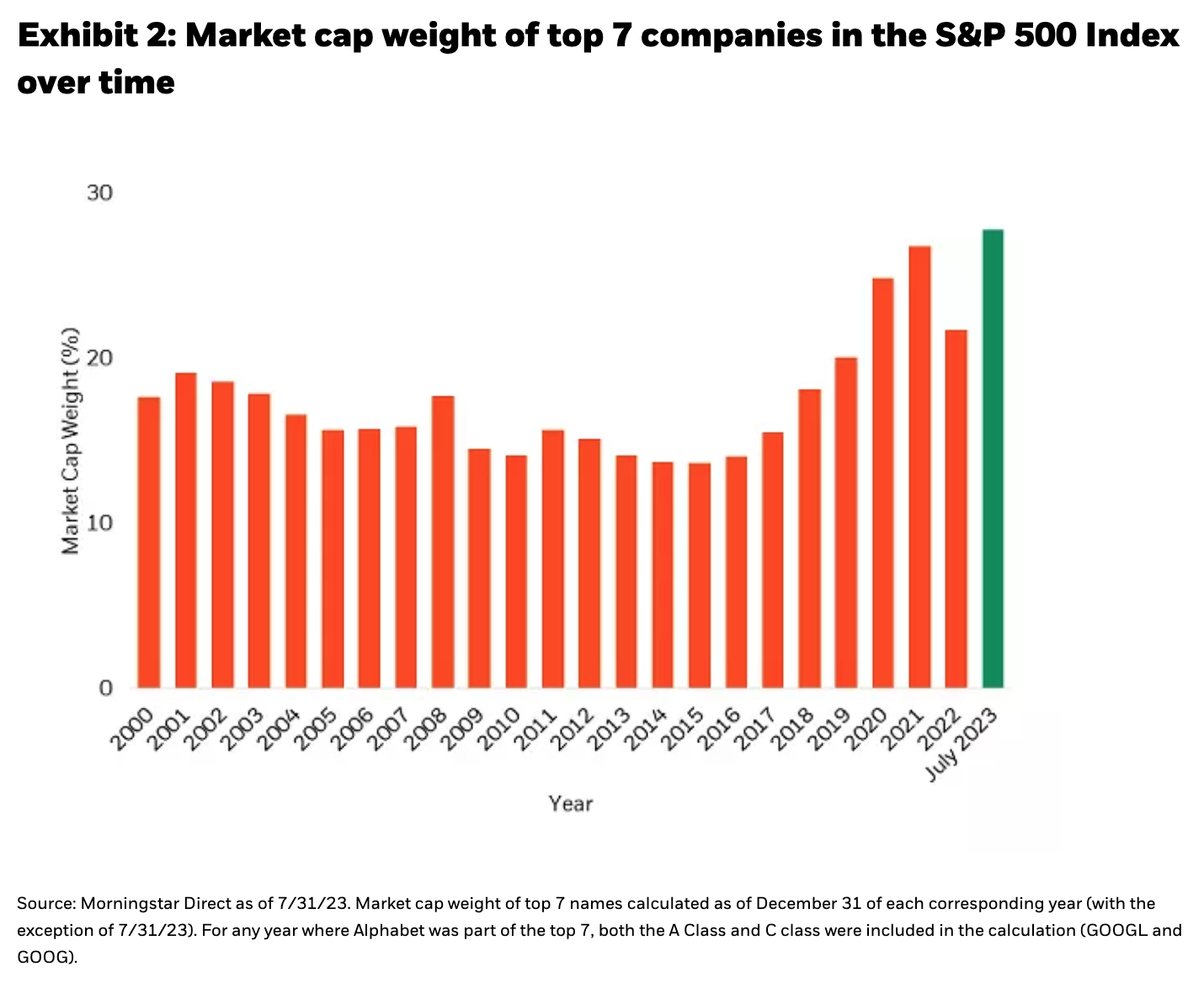

Today’s market concentration

Markets today are very concentrated. Today, the Magnificent Seven make up 28% of the S&P 500 Index and have contributed almost 65% of the S&P 500 Index YTD returns.1 The combined weight of these companies is greater than any combined weight of the top seven companies in the S&P 500 Index since before the turn of the 21st century.2

The current market concentration is not unprecedented—but we have to go back more than 100 years to find a period with even more concentration.3

Market concentration makes stock selection harder

The more concentrated the market, the harder it can be for active managers—both systematic and fundamental—to select securities to outperform the market.

For factors, market concentration in a handful of names can have a material impact. Factors are broad, persistent sources of return. Markets dominated by narrow leadership can be a headwind for factors which favor breadth. In general, factor portfolios have tended to produce better information ratios4 at lower levels of active risk relative to a benchmark. The more concentrated a portfolio (or the market) is, the more portfolio returns are driven by idiosyncratic or stock specific risk – and less by underlying factor exposure.

As an example – if an investor wanted to capture the small size factor in a portfolio, they may look to invest in a small cap index ETF that seeks to track the Russell 2000 Index. If they instead decided to buy just one small cap company in the Russell 2000 Index, their portfolio’s returns would be driven completely by that individual company’s risk-return profile. Thus, they would be subject to the volatility and stock specific risk of that one company. While the individual security does have exposure to the small size factor, the investor would be able to harvest the size premium more efficiently with an ETF that diversifies across approximately 2000 small cap securities.

How do Magnificent Seven look from a factor lens?

Generally, the Magnificent Seven score well on the profitability factor, but less well on the other rewarded factors.

As expected, the Magnificent Seven names have high exposure to large size (mega cap) and negative exposure to value (more expensive). They are mixed on volatility, with companies like Tesla, Nvidia, and Meta having higher volatility than their peers while Apple, Microsoft, and Google have lower volatility (and larger minimum volatility exposure). However, except for Amazon, they all score above average on profitability. Not surprisingly, they generally have strong momentum exposure today (especially Nvidia and Meta) given the run up these firms have seen.

Reflecting these factor scores, the Magnificent Seven has the largest weight in the quality factor, which has increased since December 2022, and they appear in the momentum factor. There is negligible weight of the Magnificent Seven in the minimum volatility, value, and low size factors.

The exposure of the Magnificent Seven only to the quality factor has meant that in 2023, the quality factor is the only factor to outperform the market. But over the long run, buying cheap, higher quality, upward trending securities, and smaller size have rewarded investors with excess returns relative to the market over time (see Exhibit 4). Using data going back to the 1960s, value, quality, momentum, and small size have historically provided positive premiums in excess of the market.

Minimum volatility is another factor that serves a distinct purpose in portfolio. Unlike the other four factors, the minimum volatility factor has historically delivered approximately the same returns as the market over long cycles—but it has done this with reduced risk.5 Historically, minimum volatility has been approximately 20% less volatile6 than the broad market as represented by the S&P 500 Index.7

Taking a long-term view

Factor investors have generally faced a difficult market so far in 2023 as factors have been affected by the narrow leadership of the Magnificent Seven. The Magnificent Seven’s positive quality characteristics has led to the outperformance of the quality factor, but the other well-known factors—value, momentum, small size, and minimum volatility—have been challenged. One economic rationale for factors is they represent compensation for bearing risk that other investors are unwilling to take.8 For investors who have seen challenging factor performance this year, staying disciplined and maintaining strategic allocations may be prudent to ensure they capture the long-run reward.

In fact, in a time of concentration, diversification is even more important!

There is only one company which was in the top seven stocks by market cap at December 1999 and is a member of today’s Magnificent Seven. One of the top seven companies in December 1999, Lucent Technologies, no longer exists. Because the Magnificent Seven have low exposures to value, momentum, small size, and minimum volatility factors, these factors may offer diversification benefits if or when some of the Magnificent Seven experience a reversal.

Copyright © BlackRock