Pre-opening Comments for Tuesday August 29th

U.S. equity index futures were lower this morning. S&P 500 futures were down 8 points at 8:30 AM EDT.

Big Lots jumped $1.04 to $7.32 after reporting a narrower than expected second quarter loss.

JM Smucker advanced $3.65 to $146.54 after reporting higher than consensus fiscal first quarter earnings.

Best Buy added $0.75 to $74.82 after reporting higher than consensus second quarter earnings.

Bank of Nova Scotia (BNS Cdn$62.82 ) is expected to open lower after reporting less than consensus quarterly earnings.

EquityClock’s Daily Comment

Headline reads “The reversal of treasury bond prices last week creates a highly enticing risk-reward to look to accumulate positions, using intermediate-term levels of support below as the stop to any holdings”.

https://equityclock.com/2023/08/28/stock-market-outlook-for-august-29-2023/

Technical Notes

Mastercard $MA an S&P 100 stock moved above $405.19 to an all-time high extending an intermediate uptrend.

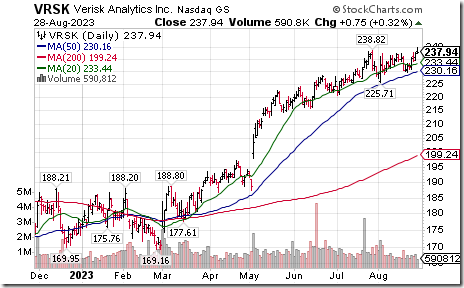

Verisk Analytics $VRSK a NASDAQ 100 stock moved above $238.82 to an all-time high extending an intermediate uptrend.

Trader’s Corner

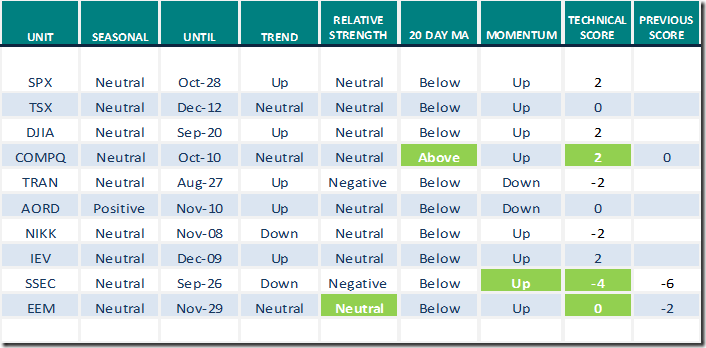

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 28th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

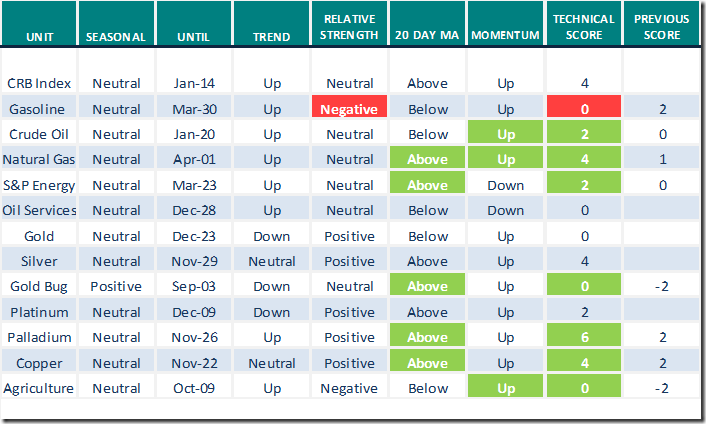

Commodities

Daily Seasonal/Technical Commodities Trends for August 28th 2023

Green: Increase from previous day

Red: Decrease from previous day

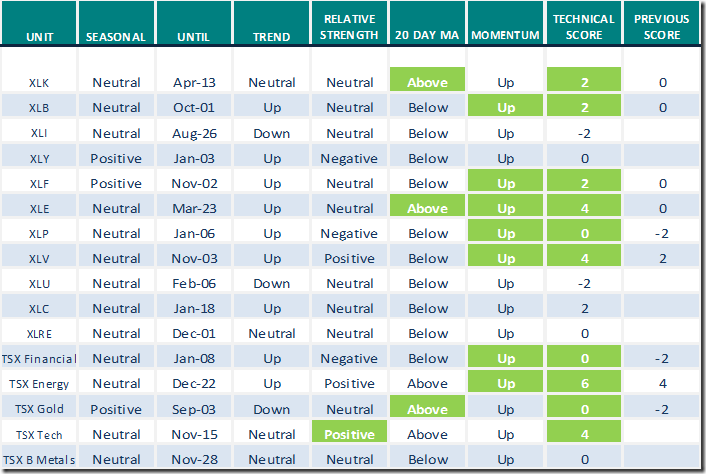

Sectors

Daily Seasonal/Technical Sector Trends for August 28th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Dollar gains may bring stock market pain in September

Dollar Gains May Bring Stock Market Pain In September | Seeking Alpha

The stock market is set up for a relief rally. Don’t chase the bounce, says technician.

Prepare for a stock market crash: Jeffery Huge

StockCharts TV | StockCharts.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.80 to 37.00. It remains Oversold.

The long term Barometer added 1.40 to 53.40. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer advanced 8.37 to 40.34. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer added 3.52 to 51.10. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed