by Larry Adam, Chief Investment Officer, Raymond James

Review the latest Weekly Headings by CIO Larry Adam.

- Bonds perform well after the tightening cycle ends

- Near-term caution on equities is warranted

- Equity rally should broaden into the lagging sectors

The 2023 FIFA Women’s World Cup ‘kicked’ off this week. Women’s soccer has become so popular, with over one million World Cup tickets sold and more than two billion viewers expected to watch the matches! The field of qualifying teams expanded to 32 nations this year, with eight countries making their World Cup debut. The reigning champs, the U.S. Women’s National Team, hope to make history with a third consecutive title win – something no men or women’s team has ever achieved! And just like women’s soccer has reached an inflection point globally, financial markets are approaching one too. With inflation falling and growth slowly grinding lower, time is running out on many global central bank tightening cycles – especially for the Federal Reserve (Fed) that meets next week. With the end of the tightening cycle near, we evaluate four potential ‘plays’ to consider in positioning portfolios as we move forward:

- Fed pause is a ‘game changer’ for fixed income | Aggressive central bank tightening led to historic losses in the bond markets last year. However, with central bank tightening cycles winding down, some emerging market central banks starting to ease, and U.S. yields at their highest level in over a decade, the outlook for fixed income markets is looking much brighter. While there is still some debate about where policy rates will peak (i.e., will the Fed hike one or two more times?), the key point is that most of the rate increases are now behind us. This is good news as history suggests that bonds perform well after the Fed delivers its final rate hike. In fact, in the eight Fed tightening cycles since 1980, the average one-year return after the last rate hike for the U.S. Bloomberg Aggregate Bond Index was ~14%, with returns positive 100% of the time! More importantly, bonds delivered solid gains regardless of whether the economy experienced a recession (like in 2008) or a soft, non-recessionary landing (like in 1994).

- ‘Time’ to revisit your bond game plan | One of the biggest issues confronting investors at this point in the cycle is when to extend duration and move out on the curve? With the yield curve now deeply inverted, it is tempting to remain in cash and earn yields in excess of 5.25%, particularly as recession calls have been pushed back due to better-than-expected economic data and Fed officials touting the ‘higher-for-longer’ narrative. However, holding cash for too long has an opportunity cost, which means that investors run the risk that yields may be lower when it comes time to reinvest. That is why it may be prudent to extend duration and start locking in attractive yields further out on the curve, particularly as longer-term Treasury yields near 4%. One way to minimize the negative carry or income loss on your portfolio is to barbell your fixed income exposure (i.e., allocating to both short and longer duration bonds). This strategy combines the benefit of generating higher income, while also positioning for potential capital appreciation from longer duration bonds that generally occurs after the rate tightening cycle concludes and yields decline.

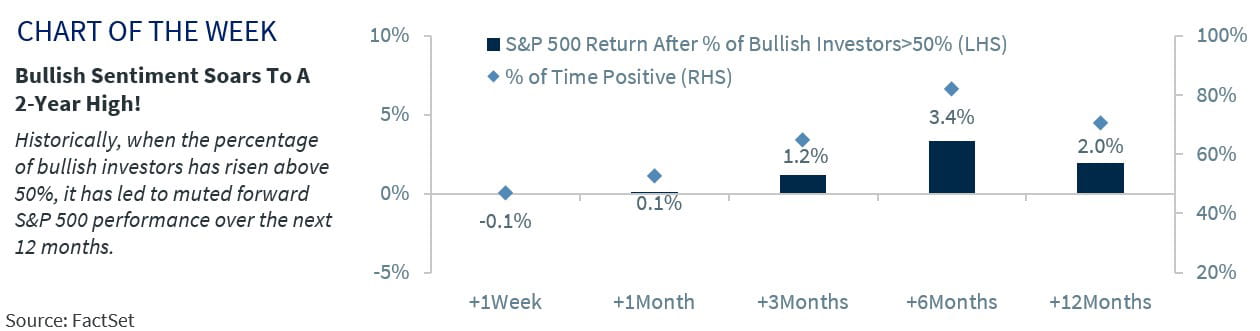

- Play a little ‘defense’ with your equity exposure | Coming into the year, we were optimistic on the equity market as our forecast for decelerating inflation, a stabilization in earnings, and a downshift in Fed tightening would provide a tailwind for the asset class. However, after the best start to a year since 1998 (+19%), the S&P 500 has surpassed our year-end target of 4,400 and is approaching our 12-month target (through June 2024) of 4,600. While we remain optimistic on the equity market longer term, we are cautious near-term and would look to be more selective for a few reasons. First, much of the uber pessimism from investors coming into this year has dissipated. This is evident in the AAII investor sentiment survey that shows that bullishness surged to 51.4% – the highest level in over two years! Historically, when this level rises above 50% it has led to muted performance over the next 12 months (see chart below). Second, there are several potential risks around the corner, such as the potential for reduced government spending as a result of the debt ceiling bill, a threat of a slowdown in consumer spending due to the reinstatement of student loan payments, or any further impacts from the ongoing Russia Ukraine war. Third, as the equity market has risen above what we deem fair value, the risk/return framework of bonds is increasingly becoming more attractive relative to the equity market in the near term.

- Rebalance into ‘offside’ equity sectors | Narrow leadership has been a key theme in the positive performance year-to-date, with mega-cap tech the main driver of the market’s performance. In our 3Q Outlook, we outlined that we did not see a significant decline in the tech sector in 2H23. But we also saw an opportunity for index performance to broaden out to laggard sectors such as financials, health care and energy as their negative performance did not reflect their positive fundamentals. Since the start of earnings season, we got a key look into the financials sector, which suggested that much of the concern surrounding the banking industry after the regional banking turmoil was overblown as capital ratios remain healthy and corporate activity (e.g., M&A/IPOs) is beginning to pick up. As a result, the financials sector is the best performing equity sector (+5.0%) since the start of the third quarter.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.