by Chris Hogbin, Head – Equities, AllianceBernstein

Excitement over AI has driven equities this year. Yet investors should maintain a disciplined, long-term focus amid uncertain market conditions.

Global equities advanced in the second quarter, led by a narrow group of stocks seen as big winners from the artificial intelligence (AI) revolution. Yet beneath the surface, many more companies can be found with resilient earnings potential to help portfolios thrive through challenging conditions ahead.

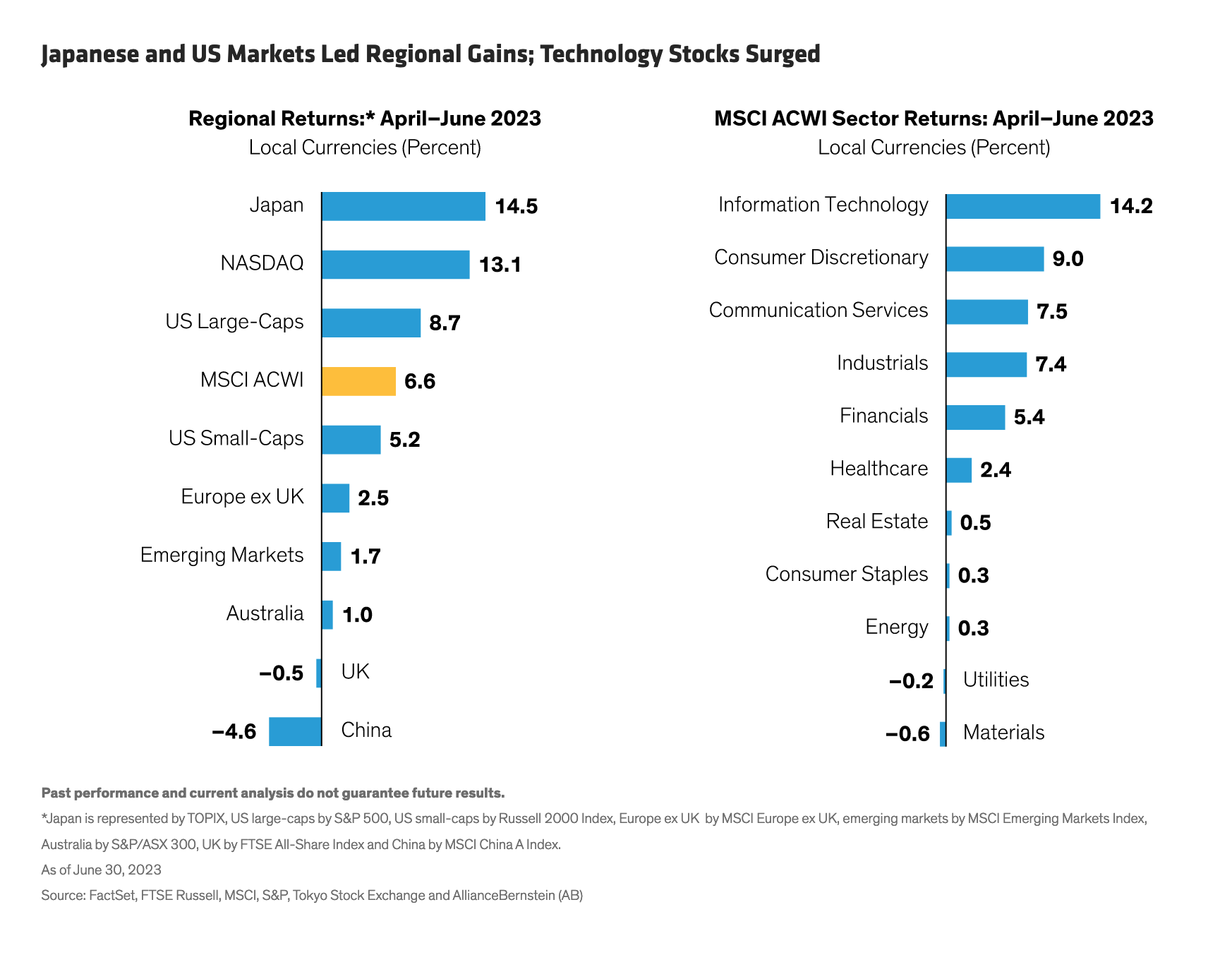

Recent enthusiasm over technology has overshadowed concern about interest rates, inflation and recession. Stocks shrugged off these risks during the second quarter, as the MSCI ACWI Index rose by 6.6% in local-currency terms, taking its year-to-date gains to 14.0%. Regional returns were mixed, with Europe, emerging markets and China underperforming (Display). Japanese stocks rallied on signs of corporate governance reform and an escape from deflation, as well as a weaker yen. US stocks were the center of attention, as optimism about AI breakthroughs fueled the technology-heavy S&P 500 and NASDAQ.

Technology and consumer discretionary stocks led global gains. Materials and utilities stocks were weak, while energy underperformed as oil prices declined. Global growth stocks outperformed value during the quarter, driven by US market trends. Outside the US, style returns were more balanced.

Narrow Group of Stocks Dominated Returns

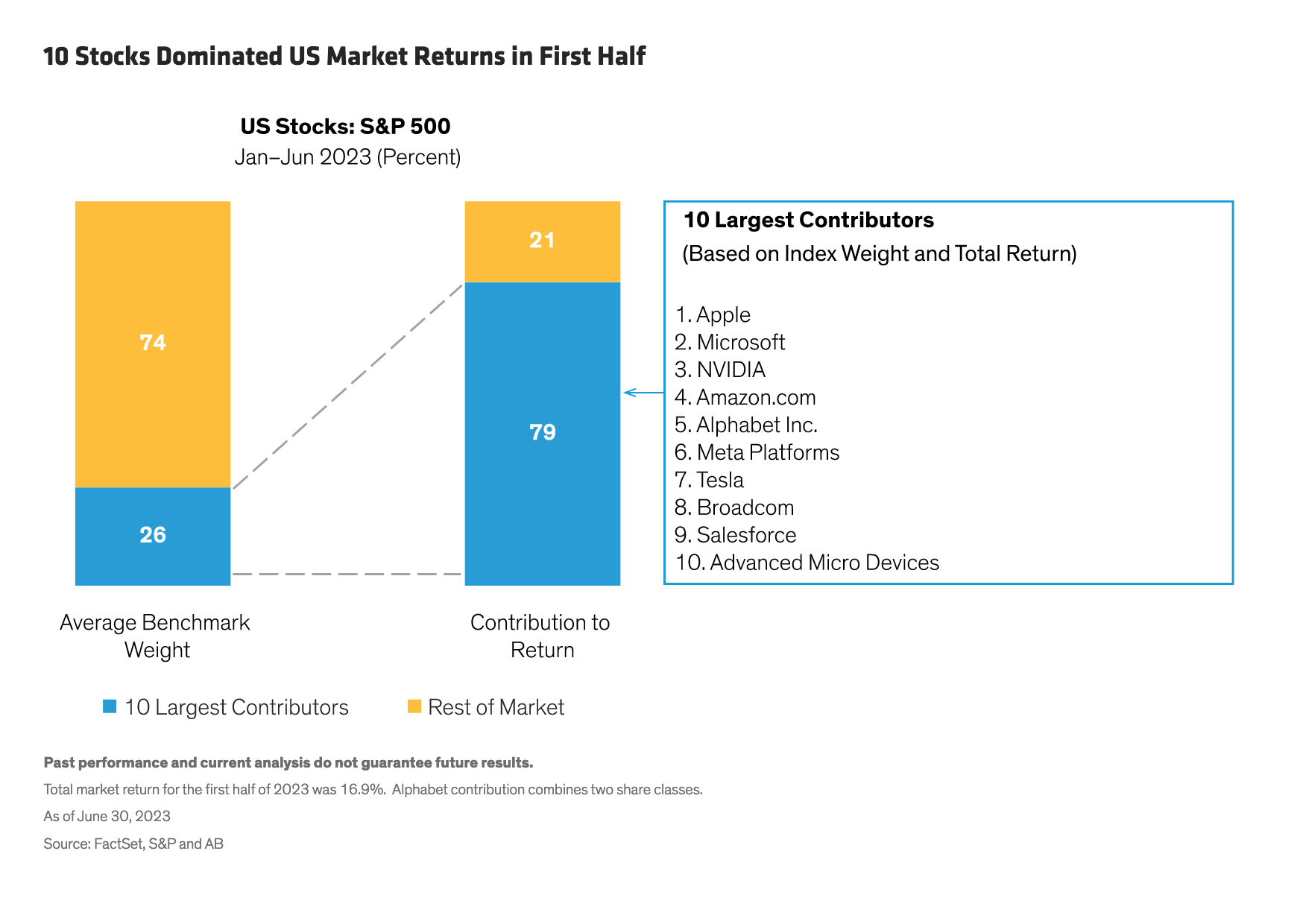

During the first half of 2023, 10 US stocks accounted for 79% of the S&P 500’s gains (Display) and 54% of the MSCI ACWI’s gains. This group, including NVIDIA, Microsoft, Apple and Alphabet Inc. (Google’s parent), is widely seen as a direct beneficiary of generative AI’s potential to transform business productivity. NVIDIA—which posted the strongest total returns in the first half—manufactures powerful graphics processing units (GPUs) that are the backbone of the AI revolution.

Why did these stocks outshine the rest of the market so dramatically? We think the reason is related to investor concerns about the US Federal Reserve’s attempts to slow the economy, which have raised anxiety about the sustainability of earnings. The perceived AI winners are especially popular because they’re seen to have a structural engine for sustained growth that can traverse periods of macroeconomic difficulty with relative ease.

Investors who held all these stocks have benefited from the trend. In contrast, portfolios that lacked exposure to this group suffered disappointing returns relative to the market. However, market concentration also creates risks; investors who pile into a small group of AI-fueled names could get burned if valuations stretch too far, sentiment shifts and returns rapidly reverse. While AI offers real promise, we believe each related company should be evaluated for its broader fundamental strengths and valuation, and positioned appropriately based on a portfolio’s investing philosophy and risk-management framework. Even growth equity portfolios should source earnings growth from diverse stocks in less correlated industries, in our view.

Evaluating Earnings amid Macroeconomic Uncertainty

Beyond the AI darlings, the rest of the market may offer more opportunity than widely perceived, when comparing the bottom-up earnings outlook of individual companies to top-down economic concerns.

At midyear, investor perceptions of corporate prospects are still being tarnished by fears of a recession. This is understandable. In mid-June, the Fed delivered a hawkish surprise, keeping interest rates on hold while indicating that two more rate hikes are likely this year. With a strong US labor market, restabilized banking sector and resilient growth, Fed Chair Jay Powell doesn’t yet think economic conditions are restrictive enough to bring inflation back to target.

In Europe, inflation has also proved tough to tame and interest rates are still rising. As a result, manufacturing indicators have continued to weaken. Meanwhile, China’s recovery from COVID lockdowns has been anemic. Its slowing property market can no longer drive growth, while China’s government is reluctant to deploy stimulus to reignite the economy, as in previous economic slowdowns.

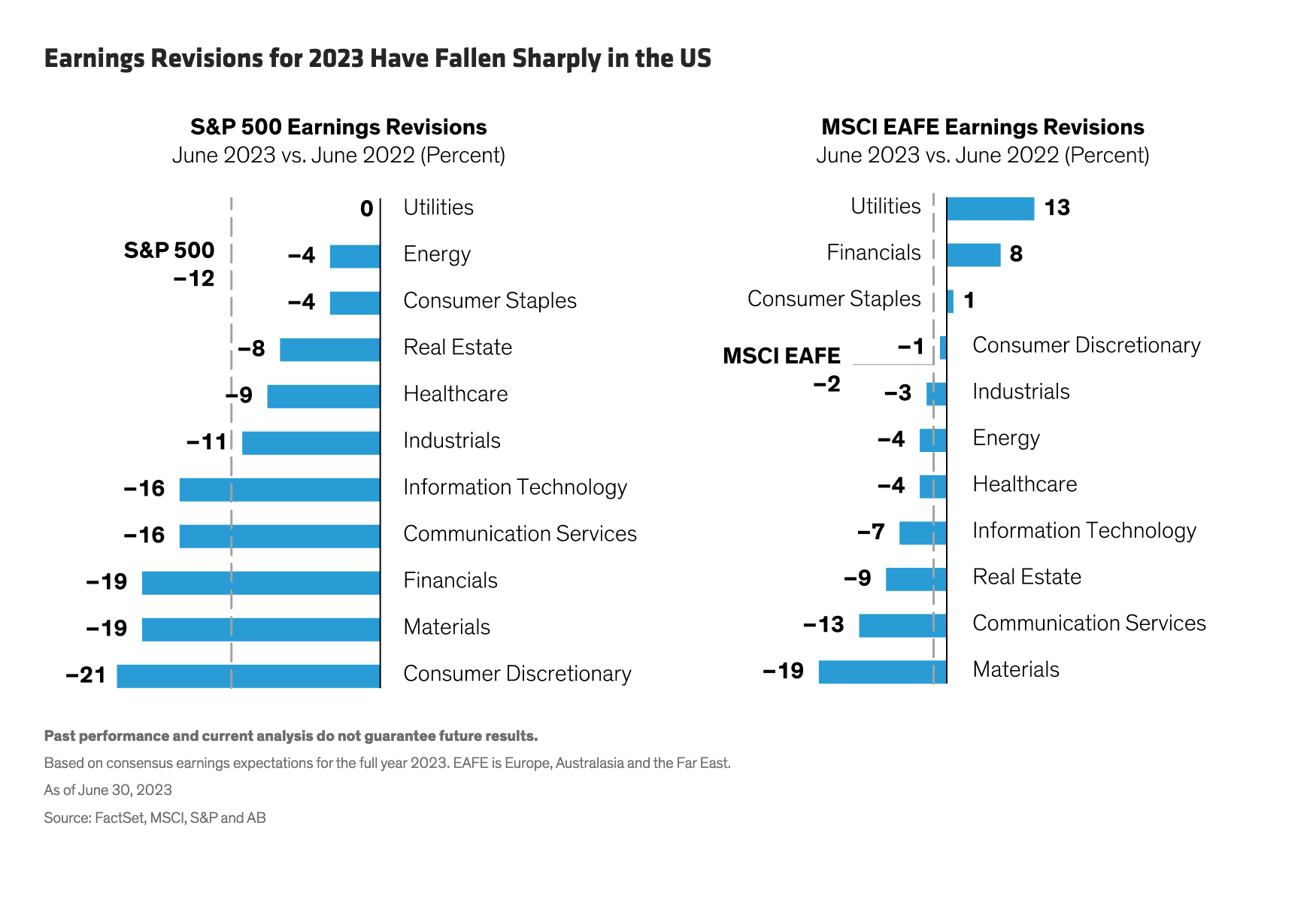

Against this backdrop, the key question for equity investors is: to what extent are earnings forecasts aligned with economic expectations? One year ago, the earnings outlook seemed overly optimistic given widespread expectations of a weakening economy. However, over the last 12 months, earnings expectations for 2023 have fallen sharply across many sectors, particularly in the US (Display). Downward earnings revisions don’t necessarily mean that earnings growth will contract; rather, they indicate the magnitude of declines to expected future growth rates.

Of course, earnings expectations could be revised further. However, there are signs that the US may be close to a bottom. Our research suggests that the declines in US earnings revisions over the last year are consistent with peak-to-trough declines of previous shallow recessions. Outside the US, earnings revisions haven’t fallen as much, but conditions vary by sector (Display above, right); financials could benefit from a higher rate environment, while materials (commodities) are very economically sensitive.

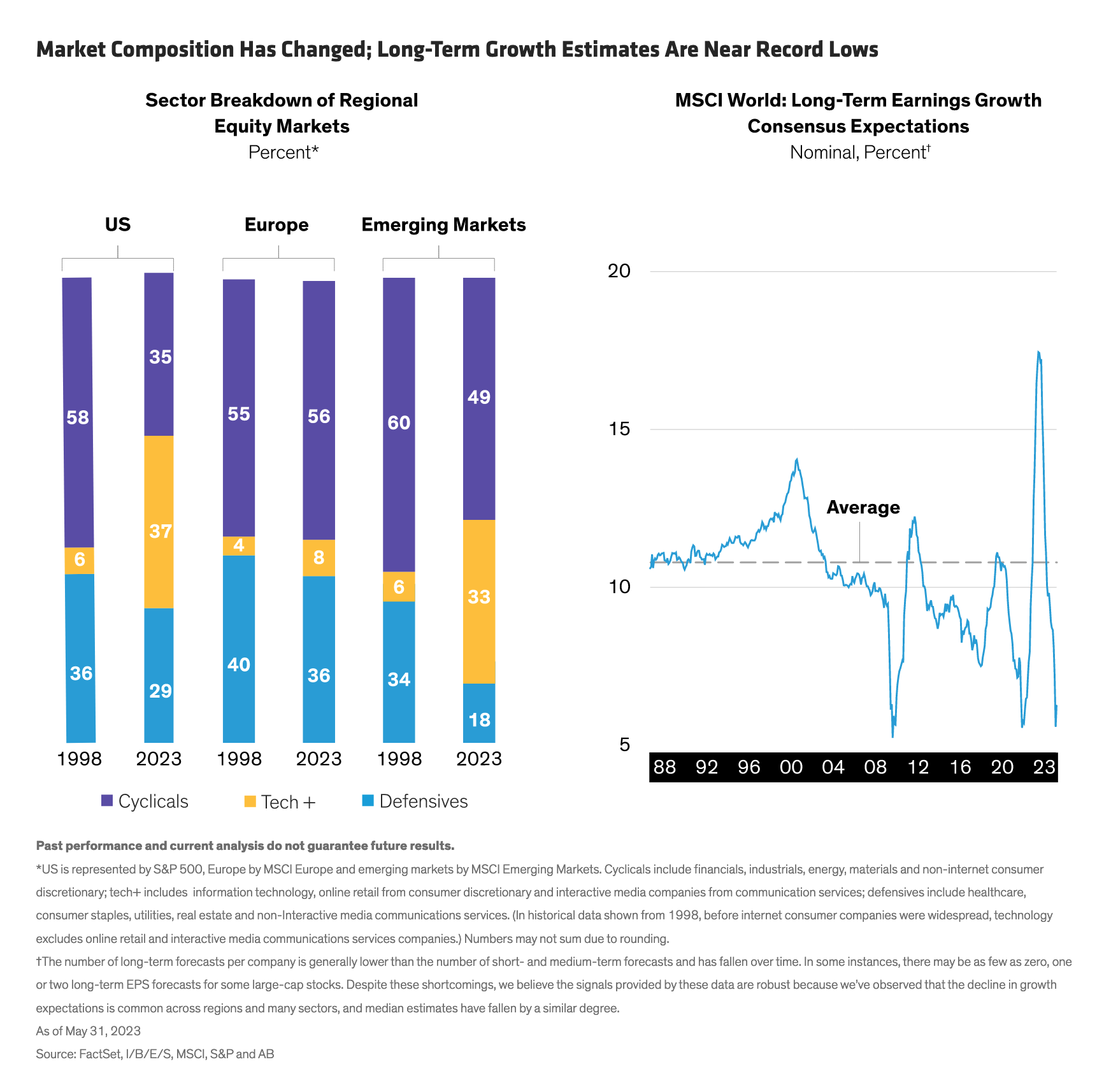

Today’s markets offer ample opportunity to position in stocks that are less sensitive to macroeconomic cycles (Display, left). In the US, for example, only 35% of the S&P 500’s weight is in cyclically sensitive sectors such as financials, industrials, energy and materials. Rewind to 1998, and the S&P 500 had about 58% in cyclical sectors. The sector composition of European markets hasn’t changed much. Yet in emerging markets, the balance has shifted toward technology, too.

Equity markets are still vulnerable to economic cycles and geopolitical risk. As a result, we believe a longer-term approach may be rewarding. Our research suggests that long-term global earnings forecasts—three to five years ahead—are well below their long-term average (Display above, right), which implies there could be an upside for stocks of companies that perform better than expected. In other words, if long-term earnings exceed current forecasts, today’s valuations are attractive, in our view.

Valuations Under the Microscope

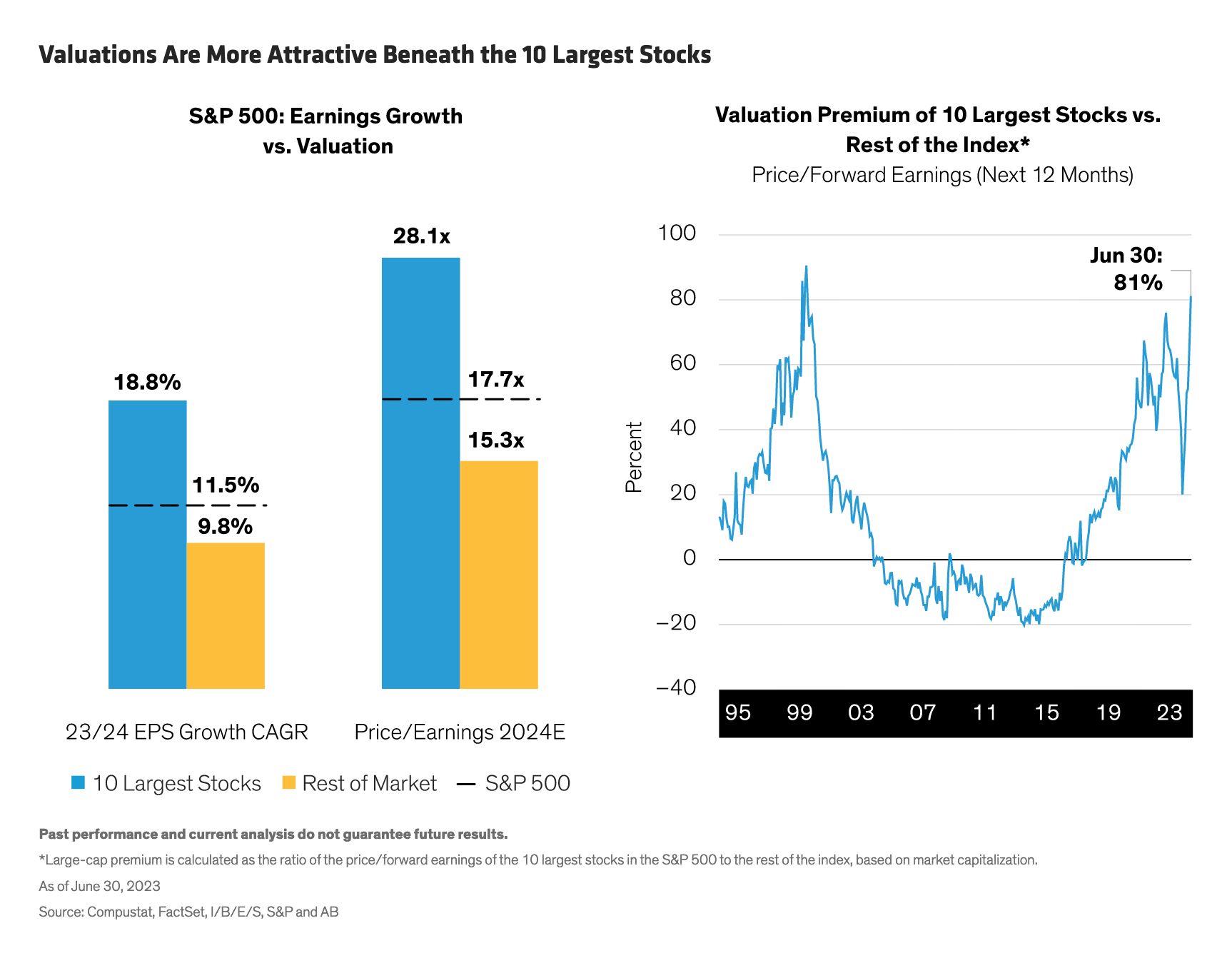

At first glance, after this year’s gains, market valuations look relatively high. At the end of the second quarter, the S&P 500’s price/earnings valuation (2024E) reached 17.7x (Display, left), compared with 14.9x at the beginning of the year. But excluding the 10 best performers, the market’s P/E is a much more reasonable 15.3x and offers estimated earnings growth of 9.9% for 2024. The valuation premium for the 10 biggest US stocks is also relatively high in historical perspective (Display, right). By searching more broadly across equity markets globally, we believe selective investors can find stocks with attractive valuations and solid growth potential.

To be sure, if inflation declines while central banks keep rates higher for longer, real interest rates would turn positive. This may put pressure on stock equity valuations, which are a function of the discount rate used to value future corporate earnings. We believe companies with attractive share valuations today and a robust long-term earnings outlook will provide the best balance of risk and return through this complex transition.

Eye on AI: Hype or Reality?

The AI hype that has driven US market valuations this year reflects the fundamental challenge investors face today.

Many companies are excited about AI. ChatGPT reached an estimated 100 million users just two months after its November 2022 launch. In first-quarter earnings calls, AI, ChatGPT and related terms were mentioned by 317 companies in the MSCI ACWI Index, according to research by our equity data science team, who parsed more than 2,000 earnings call transcripts globally. While AI was most commonly cited by technology companies, it was a hot topic in many sectors from consumer discretionary to industrials.

Clearly, the business world is starting to think seriously about creating efficiencies from generative AI—including in the asset-management industry. But it will take time to know which companies and products have a competitive edge in the race for AI. The early stars of a disruptive revolution are not necessarily the long-term winners.

The dotcom boom provides a cautionary tale. In the early days of the internet, companies such as AOL and Netscape dominated the new landscape, yet quickly faded away. Dotcom start-ups sprouted like mushrooms, fueled by investors’ fear of missing out on the technology gold rush. When the bubble burst, many victims of the irrational exuberance were left nursing big losses.

Yet over time, the internet has indeed been revolutionary. It changed our world beyond recognition, spawning new industries and mega-cap corporate leaders. AI, too, may breathe new life into the technology sector and beyond, and many companies will be talking about how they plan to deploy or deliver AI-powered products. In the first wave, technology enablers—the so-called pick- and shovel-makers—will be popular. Far fewer will actually succeed in generating profitability enhancements from the technology. In some cases, if AI-powered products are commoditized, such as in healthcare research and development, the profitability benefits to individual companies could be eroded. While select enablers of AI technology may deserve high valuations, we think equity investors should tread very cautiously when it comes to predicting the broader business ramifications of generative AI.

Active investors should always focus on the underlying businesses of companies. In hyped-up market environments, when a small group of stocks is skyrocketing, it can be tempting to follow crowded trades. Yet today, as AI excitement unfolds alongside a historic shift in investing conditions, we believe disciplined investing is paramount. Maintaining a strategic focus on how companies across sectors can generate long-term business growth is the key to equity investing success for a dramatically different future.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

* * *

Chris Hogbin is Head of Equities for AB. In this broad leadership role, he is responsible for overseeing AB's portfolio management and research activities relating to all equity investment portfolios. Hogbin is also a member of the firm's Operating Committee. He joined AB's institutional research business in 2005 as a senior analyst covering the European food retail sector. In 2010, Hogbin was named to Institutional Investor's All-Europe Research Team and was ranked as the #1 analyst in his sector in both 2011 and 2012. He became European director of research for Sell Side in 2012 and was given additional responsibility for Asian research in 2016. In 2018, Hogbin was appointed COO of Equities for AB. Prior to joining the firm, he worked as a strategy consultant for the Boston Consulting Group in London, San Francisco and Shanghai, where he was responsible for the execution of critical business-improvement initiatives for clients in the financial-services and consumer sectors. Hogbin holds an MA in economics from the University of Cambridge and an MBA with distinction from Harvard Business School. Location: New York