by Brian Price, CFA®, Managing Principal, Investment Management and Research, Commonwealth Financial Network®

What a year it has been for financial markets. There have been several negative factors in play, including a high-single-digit inflation print, the ongoing war in Ukraine, and several regional bank failures. Nonetheless, the S&P 500 finished the second quarter up 17 percent for the year. Go figure!

Rather than reflecting on what happened, instead I’d like to focus on the potential risks and opportunities as we move into the second half of the year. The executive summary—for those who like to read the punch line first—supports a thoughtful rebalancing approach to trim asset classes that have performed extremely well and to move into areas that haven’t delivered strong returns thus far in 2023. Let’s take a closer look.

What’s Trending

It’s hard to ignore the recent performance disparity under the surface in U.S. equities. It’s a period reminiscent of the 2020–2021 cycle, which saw growth stocks and technology stocks in particular drive the market notably higher in an economic environment that could be politely described as underwhelming.

There is no doubt that many of these dynamic growth companies should command higher multiples, as their future earnings prospects are unquestionably bright. This outlook is especially true when considering how impactful major themes like alternative intelligence (AI) will be on the investing paradigm of the future. Robotics, machine learning, and ChatGPT will likely have a profound impact on the world as we know it. They are powerful, exciting, and slightly terrifying all at the same time.

Indeed, investors with exposure to AI-themed investments have enjoyed triple-digit returns from stocks like Nvidia and Meta so far in 2023. But there is reason for caution against chasing at this point in the cycle. Exposure to growth-oriented investments is still warranted, but valuations may not be as compelling as other global equity asset classes.

Other Areas of Interest

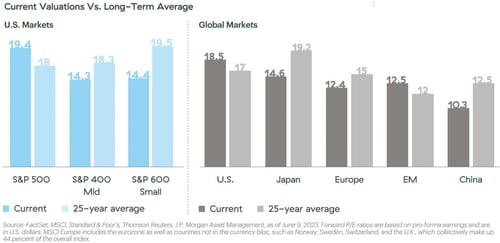

In U.S. equities, large-capitalization stocks have driven the lion’s share of the market’s gains so far this year. But investors should not abandon mid and small caps, as they appear somewhat attractively priced relative to their historical P/E ratios. Small caps tend to be more leveraged to economic growth. As such, investors may want to lean into this trade if they are of the mindset that GDP growth is likely to pick up from current levels.

Another area of potential opportunity is foreign equities. Valuations are compelling across developed international markets and select emerging markets, including China (see chart below). Sentiment is also relatively bearish toward foreign equities, which could represent an opportunity from a contrarian perspective. Now, the old adage that “you make more money when things go from really bad to merely awful than you do when things go from good to great” seems appropriate when thinking about international investing.

The bottom line with equities is that caution is warranted given the impressive rally we have experienced in the first half of the year. Geopolitical risks still abound, and we are not out of the woods when it comes to inflation. Now is a good time for investors to look at their portfolios to ensure that they are well diversified and not overexposed to the areas of the market that may have been working too well (i.e., technology) as of late.

A Favorable Environment for Fixed Income?

If technology and growth stocks have been the belle of the ball, fixed income might best be described as an outright pariah over the past year. On one hand, it is understandable. Bond investors are not accustomed to the double-digit losses that many experienced in 2022. The fear that inflation is still not under control and interest rates may continue to increase is probably keeping some investors on the sideline instead of allocating to bonds.

But the environment for many fixed income asset classes looks much more constructive compared to this time last year. Interest rates have risen to levels that haven’t been seen by fixed income investors in quite some time. This dynamic has created a favorable yield environment for those who rely on their portfolios as a source of income. The short and intermediate portion of the yield curve is especially appealing for investors who do not want to assume a lot of duration risk at this point in the cycle.

A diversified fixed income portfolio makes sense, keeping in mind that there are certain sectors that do not appear as attractive as they have been in the past. Specifically, bank loans and high yield are two credit-sensitive areas that don’t have the most appealing risk/reward profile, so moving “up in quality” is a trade that should be considered. For example, tilting a fixed income allocation of a portfolio more toward Treasuries and mortgages could improve the diversification benefits, as these two sectors tend to have lower correlation to other risk assets.

The Big Picture

So far in 2023, equity and fixed income markets have performed well. A rebalancing approach that results in fading those areas that have performed extremely well while leaning into asset classes that haven’t delivered stellar returns could be a sensible strategy as we enter the second half of the year.

*****

Brian Price, CFA®, is Managing Principal, Investment Management and Research, Commonwealth Financial Network®, the nation's largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth's investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by Brad McMillan.

Forward-looking statements are based on our reasonable expectations and are not guaranteed. Diversification does not assure a profit or protect against loss in declining markets. There is no guarantee that any objective or goal will be achieved. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance is not indicative of future results.

Commonwealth Financial Network is the nation's largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm's corporate blog.