Pre-opening Comments for Wednesday July 5th

U.S. equity index futures were lower this morning. S&P 500 futures were down 23 points at 8:30 AM EDT

United Parcel Services dropped $2.64 to $181.13 after labour negotiations met an impasse.

Netflix added $3.08 to $444.52 after Goldman Sachs upgraded the stock from Sell to Neutral.

Rivian added $1.28 to $20.84 after announcing a triple increase in second quarter production.

EquityClock’s Daily Comment

Headline reads “July is the second strongest month of the year for stocks with the S&P 500 Index averaging a gain of 2.2% and 75% of periods have closed higher”.

http://www.equityclock.com/2023/07/01/stock-market-outlook-for-july-5-2023/

Technical Notes

Retail SPDRs $XRT moved above intermediate resistance at $63.82 and $64.06 resuming an intermediate uptrend. Strength was triggered partially by strength in Walmart $WMT to an all-time high

Steel ETF $SLX moved above $63.97 and $64.67 setting an intermediate uptrend. Steel stocks and related equities and ETFs (e.g. PAVE) are responding to the federal infrastructure bill.

Wells Fargo $WFC an S&P 100 stock moved above $43.34 extending an intermediate uptrend.

United Parcel Services $UPS an S&P 100 stock moved above $180.27 extending an intermediate uptrend.

American Tower $AMT an S&P 100 stock moved above $194.95 setting an intermediate uptrend.

Trader’s Corner

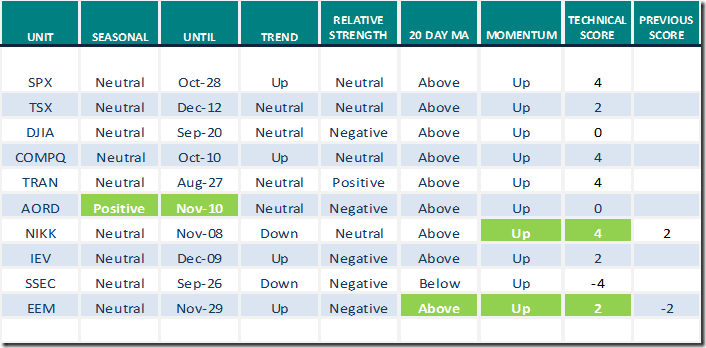

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

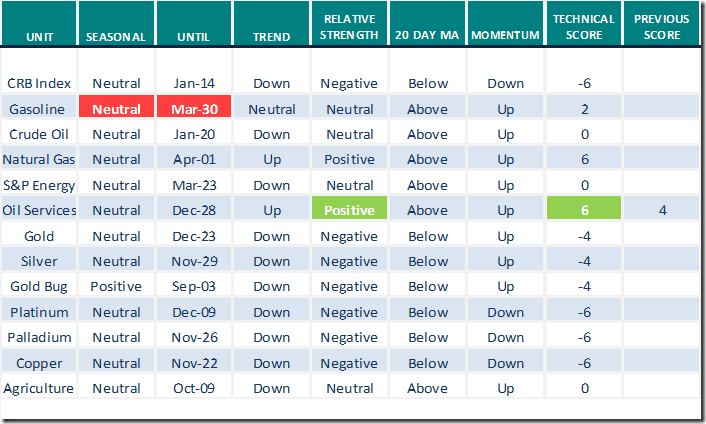

Commodities

Daily Seasonal/Technical Commodities Trends for July 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

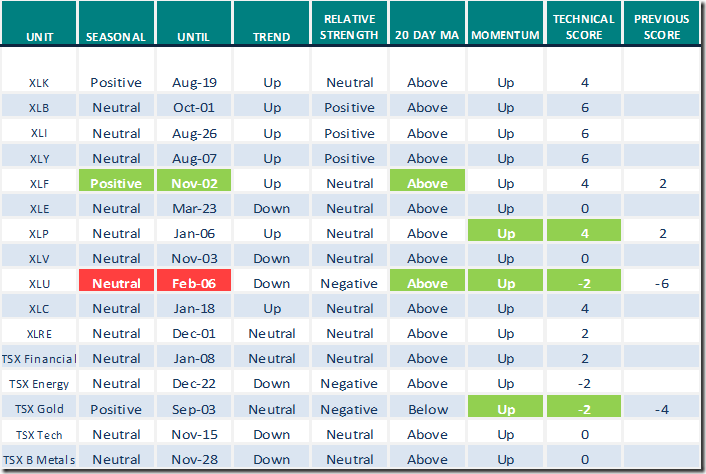

Sectors

Daily Seasonal/Technical Sector Trends for July 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Top 10 Stocks to Watch July 2023, Part 1 | David Keller, CMT | The Final Bar (07.03.23)

Top 10 Stocks to Watch July 2023, Part 1 | David Keller, CMT | The Final Bar (07.03.23) – YouTube

Two Sectors Hitting New All-Time Closing High | Julius de Kempenaer | Sector Spotlight (07.03.23)

Three Key Signals That This Market Will Go Higher | Mary Ellen McGonagle | The MEM Edge (06.30.23)

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.20 to 78.20. It remains Overbought. Daily trend remains up.

The long term Barometer added 2.20 to 68.40. It remains Overbought. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 2.63 to 50.44. It remains Neutral. Daily trend remains up.

The long term Barometer added 1.32 to 55.70. It remains Neutral. Daily trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed