by Michael Contopoulos, Director of Fixed Income, Richard Bernstein Advisors

A quick PSA from RBA: Beware of the coming credit crunch. The key goal of tightening monetary policy is to reduce the flow of credit. It is also important to note that the weakest links always default first. This cycle is so far no different. Small, private, and flawed companies lead defaults of large, public, and seemingly financially sound companies.

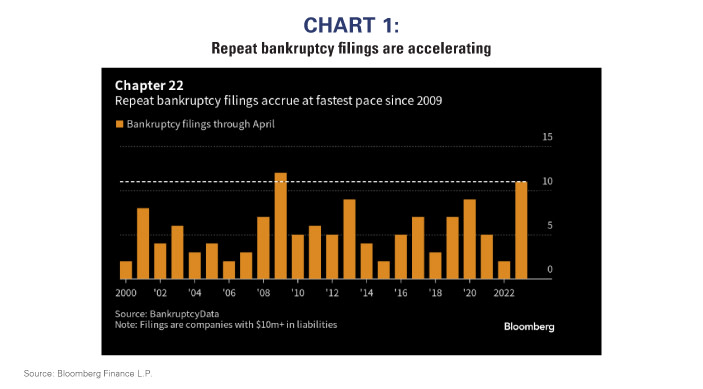

Charts 1 and 2 highlight how the weakest companies are feeling the heat of tighter lending standards and higher interest rates. The first chart clearly shows that repeat bankruptcies – those companies that have defaulted before and have now defaulted a second time – are nearly at all-time highs. An underlying poor business takes precedent over restructuring debt and wiping out equity holders. The second chart should concern private credit managers. Note that small private companies (the types of companies found in private credit portfolios) are defaulting at an alarming rate compared to larger public companies. Small companies are typically the canaries in the credit mine.

Right on cue, earlier this month (May 13/14) 7 large companies defaulted. And if RBA’s proprietary default model is any guide, bankruptcy filings should get worse.

One looming concern overhanging the corporate bond market is the structure of the Collateralized Loan Obligation (CLO) market. CLOs have historically been the biggest buyer of leveraged loans, owning upwards of 2/3 of the entire loan market. As reinvestment periods end and CLO new issuance falls, the CLO’s demand for bank debt is scaling back. The combination of decreasing demand and higher rates on floating rate debt and a profit recession imply conditions couldn’t be worse for the lowest-rated corporate debt.

The environment remains precarious for corporate debt investors. Beware the coming credit crunch.