by Mark Casey, Cheryl Frank, Martin Jacobs & Martin Romo, Capital Group

Big Tech is making a comeback. Many of the names that led the last great bull market — Alphabet, Apple, Microsoft, Meta and Nvidia among them — are leading a nascent recovery this year.

Whether the powerful advance will continue remains an open question, but the tech-heavy CRSP U.S. Mega Cap Growth Index has gained more than 26% on a year-to-date basis, as of May 18, nearly triple the return of the S&P 500 Index in U.S. dollar terms.

What’s driving the rally? That’s open to interpretation.

“This is the area of the market that fell the farthest in 2022, so there’s a bounce-back effect that I think is certainly part of the explanation,” says portfolio manager Mark Casey. “You could argue some of these companies were punished more than they should have been as entire sectors fell out of favour and the selloff became indiscriminate at times.”

Big Tech has enjoyed a big bounce this year

Sources: Capital Group, Center for Research in Security Prices (CRSP), Refinitiv Datastream, Standard & Poor’s. As of May 18, 2023. Past results are not predictive of results in future periods. Returns are in USD.

The changing interest rate outlook also is providing a helpful tailwind, Casey notes, as the U.S. Federal Reserve has indicated it might not raise rates as much as previously expected. That’s provided a boost to long-duration assets, including many tech stocks where investors are speculating on the companies’ long-term prospects, and basing valuation assumptions partly on long-term rate expectations.

The rise of artificial intelligence (AI) systems, such as the popular ChatGPT, is another factor driving enthusiasm for the tech sector. Earlier this year, ChatGPT, co-owned by Microsoft and OpenAI, became the fastest growing consumer app in history.

“Beyond that, you have to look at these companies one by one,” Casey added. “Many of them are cutting costs. Profit margins are improving. In some cases, strategic objectives are changing. And so then, the key question becomes: Will they be able to earn their way back to success?”

Last year’s laggards are this year’s leaders

Sources: Capital Group, FactSet, RIMES, Standard & Poor’s. Sector returns reflect total returns in USD. As of May 18, 2023. Past results are not predictive of results in future periods.

Tech stocks power through a tough quarter

Recent corporate earnings reports have provided a glimpse into the tech turnaround. Despite worries about a global recession, the largest tech giants found ways to rise above the fray by focusing on profitable growth, rather than growth at any cost. Meanwhile, S&P 500 earnings fell by 2% in the first quarter.

Apple reported quarterly earnings on May 4 that beat consensus expectations by a wide margin, driven primarily by higher iPhone sales. Amid a challenging macroeconomic environment, iPhone revenue rose 1.5% on a year-over-year basis, sending Apple shares soaring to their highest level in more than a year. The company also initiated several cost-cutting measures, including hiring freezes for some divisions, reduced travel budgets and delays in new product launches.

Microsoft shares moved sharply higher after the software giant reported better-than-expected top-line revenue growth, boosted by a 31% gain in its Azure cloud-computing division. The software giant has also eliminated 10,000 jobs in a recent round of cost reductions, amounting to about 5% of its workforce.

Nvidia reported a sharp decline in quarterly profit, but its shares skyrocketed anyway based on the chipmaker’s forecast for rapid growth in demand for AI-related chips. Nvidia is the world’s dominant provider of specialized graphics chips used to power AI applications such as ChatGPT. The company has also made big strides reducing its manufacturing costs over the past year.

It’s no surprise then that those three technology companies are the top contributors to the rise of the S&P 500 Index this year, as of May 18. In fact, the combined weighting of Apple and Microsoft alone now accounts for 13.3% of the index, the highest level on record.

Focusing on profits and efficiency

The resurgence of Big Tech is an investment theme that resonates with portfolio manager Martin Jacobs. “Quite a few of the mega-cap technology and media companies look interesting today for different reasons,” explains Jacobs, one of the portfolio managers for Capital Group U.S. Equity Fund™ (Canada). “Obviously, they were down a lot last year, so their valuations are more reasonable today. But many of them also had to recalibrate their growth ambitions. As a result, they're taking actions to operate more thoughtfully and more efficiently.”

Meta Platforms, formerly Facebook, is a high-profile example. The social media giant went through three rounds of layoffs in recent months and revamped its digital advertising business using AI tools designed to improve its ad-targeting systems. These and other aggressive moves contributed to Meta reporting a 3% increase in year-over-year revenue on April 26, ending a three-quarter losing streak.

Netflix provides another example of this new-found cost-consciousness. In recent months, the streaming giant has taken several major steps to make its business more efficient, including the addition of an ad-supported tier of service, a crackdown on password sharing and the planned elimination of its DVD rental business.

Can the tech rally continue?

Although profitability may be improving at some tech-related companies, one area of concern is that there are few signs of robust top-line revenue growth, says portfolio manager Cheryl Frank. “We’re seeing profit margins beating expectations as companies all of a sudden get more cost discipline,” Frank explains. “Investors are reacting positively to companies that are saving their way to profitability, which is a sensible strategy in a high-interest rate environment. But the stocks are not rising because there’s a lot of organic sales growth.”

That leaves Frank concerned about tech valuations, which are still high relative to history. It’s also possible the economic backdrop could deteriorate in the months ahead if the U.S. falls into recession or if the impasse over the U.S. debt ceiling gets worse and potentially leads to a catastrophic default.

“We need a soft landing for this rally to be sustainable,” Frank says.

Investment implications: Broadening opportunities

Whether the Big Tech run continues or eventually fizzles out, the movement is clearly part of a larger trend of broadening opportunities since the start of the bear market in early 2022. While U.S. large-cap tech stocks are now leading the rebound, they aren’t the only game in town, as they were for much of the previous decade.

Over the past year and half, as inflation has moved sharply higher and interest rates have followed, various other sectors and regions have started to bloom. They include the energy, health care and industrial sectors, as well as European stocks — which are outpacing U.S. stocks for the first time in years. At various times over the past 18 months, traditional value-oriented and dividend-paying stocks have surged ahead of growth-oriented stocks.

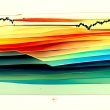

The investment opportunity set has widened significantly

Sources: Capital Group, Refinitiv Datastream, Standard & Poor's. As of 5/16/23. Indexed to 100 as of January 1, 2005. The S&P 500 Index is weighted by market capitalization, meaning the largest companies have the biggest impact on the path of the index. The S&P 500 Equal-Weighted Index gives each stock equal weight, thereby removing the outsize impact of large-cap stocks. The ratio between the two indexes reflects time periods when market breadth is increasing or decreasing. Past results are not predictive of results in future periods.

That’s good news for active investors, says Martin Romo, a portfolio manager for Capital Group U.S. Equity Fund (Canada).

“We have moved from a market that was either/or to a market that is now more balanced,” Romo explains. “We’re no longer going in just one direction. The opportunity set has grown to include U.S. companies and international companies, growth stocks and value stocks, the technology sector and industrials.

“We’re living in a world where there are both cyclical and secular opportunities,” he adds. “For investors willing to do their homework, it’s a much more compelling, target-rich environment.”

Mark Casey is an equity portfolio manager with 22 years of investment experience (as of 12/31/2022). He holds an MBA from Harvard and a bachelor's degree from Yale.

Cheryl Frank is an equity portfolio manager with 24 years of investment experience (as of 12/31/2022). She holds an MBA from Stanford and a bachelor’s degree from Harvard.

Martin Jacobs is an equity investment analyst, with research responsibility for U.S. industrials, machinery and electrical equipment companies. He has 34 years of investment experience (as of 12/31/2022). He holds an MBA from Wharton and a bachelor's degree from the University of Southern California.

Martin Romo is an equity portfolio manager with 31 years of investment experience (as of 12/31/2022). He is president of Capital Research Company and serves on the Capital Group Management Committee. He holds an MBA from Stanford and a bachelor's degree from the University of California, Berkeley.

Copyright © Capital Group