by Robert M. Almeida, Global Investment Strategist, Portfolio Manager, MFS Investment Management

Rob Almeida warns that headlines are often distractions. It's not that they're not important, it's just that they're a small part of a larger mosaic.

In brief

- Economics and finance fail as sciences because they prompt people to confuse cause and effect.

- Whether we’re near or at peak rates is not as relevant for markets as many think. It’s a distraction.

- Headlines are often distractions. I’m not suggesting they aren’t important or valuable data points, but they’re small parts of a much larger mosaic.

Finance isn’t a science

Finance and economics are considered soft sciences. They’re soft because unlike physical sciences, they lack immutable laws. Water freezes at zero degrees centigrade and boils at 100. That’s a law of physics and it’s absolute.

Economies and financial markets are comprised of people making decisions. Sometimes those decisions are rational, often times not. The absence of rules and laws often leads to narrative fallacy and attribution error as people rely on observations and patterns to ascribe cause and effect, sometimes confusing correlation with coincidence. The consequence of this is often, and unfortunately, financial loss. Then people look for someone or something to blame.

The Devil’s tricks

A tremendous amount of effort and ink has been spent on determining the timing of peak central bank policy rates. The current consensus is we’re near the peak.

While whether policy is or isn’t near peak seems relevant, it’s not. It’s a distraction.

The market is akin to a demonic beast that works hard to trick investors into making mistakes. It distracts investors from what really matters. And it’s been successful for centuries in this regard, separating people from their savings.

If the US Federal Reserve hikes another 25 or 50 basis points or cuts 50 or 75 basis points later this year as the short-term Treasury market implies, the damage to the economy and company fundamentals has been done. The jump in capital costs over the last year was the fastest in four decades. Given the bulk of the US economy is fixed rate, now we wait to learn the effects.

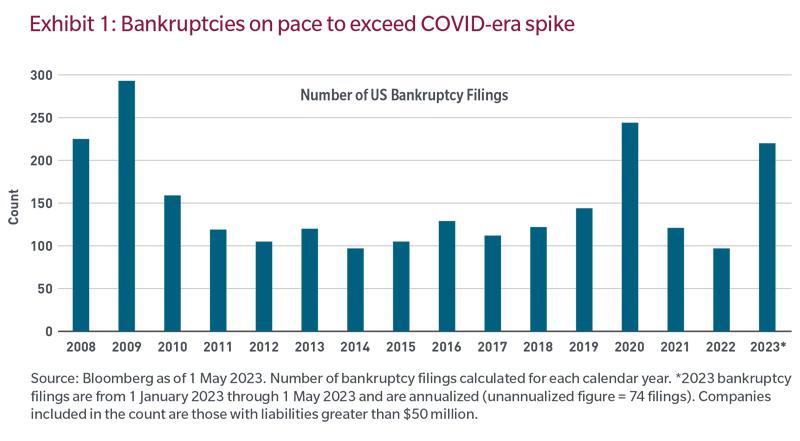

One measure is bankruptcy filings. There have been 74 filings so far in 2023 from companies with liabilities greater than $50 million. When annualized, as I did in the chart below, its surpassed the COVID lockdown year of 2020 when US gross domestic product collapsed by nearly one-fifth.

Most companies incur debt for a variety of reasons, including for tax purposes, to compound profits and to diversify capital sources. The key is how much. The just-passed era of artificially suppressed capital costs induced companies to assume historic debt loads. Today, those costs are dramatically higher than before and will be a material drag on future profitability for many enterprises and we’ve already seen its negative effects in some companies that have reported this earnings cycle.

The bigger picture

The market has discounted a lower Fed funds rate later this year. But that won’t change the trajectory of bankruptcy filings and lower returns on capital. Never mind that most companies’ largest cost item is labor, which remains in short supply and doesn’t show any signs of changing given the multi-decade low unemployment readings in the United States and eurozone.

Peak policy rates and other positive or negative headlines are often distractions. I am not suggesting they aren’t important or valuable data points, but that they are small parts of a much larger mosaic. What is most relevant to financial assets is future cash flows — i.e., profits. And I think the market is set up for disappointment, at least for the stocks and bonds of companies who were able to inflate margins on the back of low rates and cheap labor, which I think will catalyze a multi-year revolution for actively managed portfolios as a more difficult future operating environment separates the winners from the losers.

*****

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.

Copyright © MFS Investment Management