by Robert Waldner, Chief Strategist and Head of Macro Research, Invesco Fixed Income, Invesco

Key takeaways

The best of times?In the U.S., recent growth has been positive, the labour market has been resilient, and inflation appears to have peaked. |

The worst of times?Despite current rosy macro data, many forecasters see two clouds on the horizon: recession and inflation. |

A pragmatic approach.Acknowledging the good news of the current data, while keeping an eye out for clouds, may be the way to go for now. |

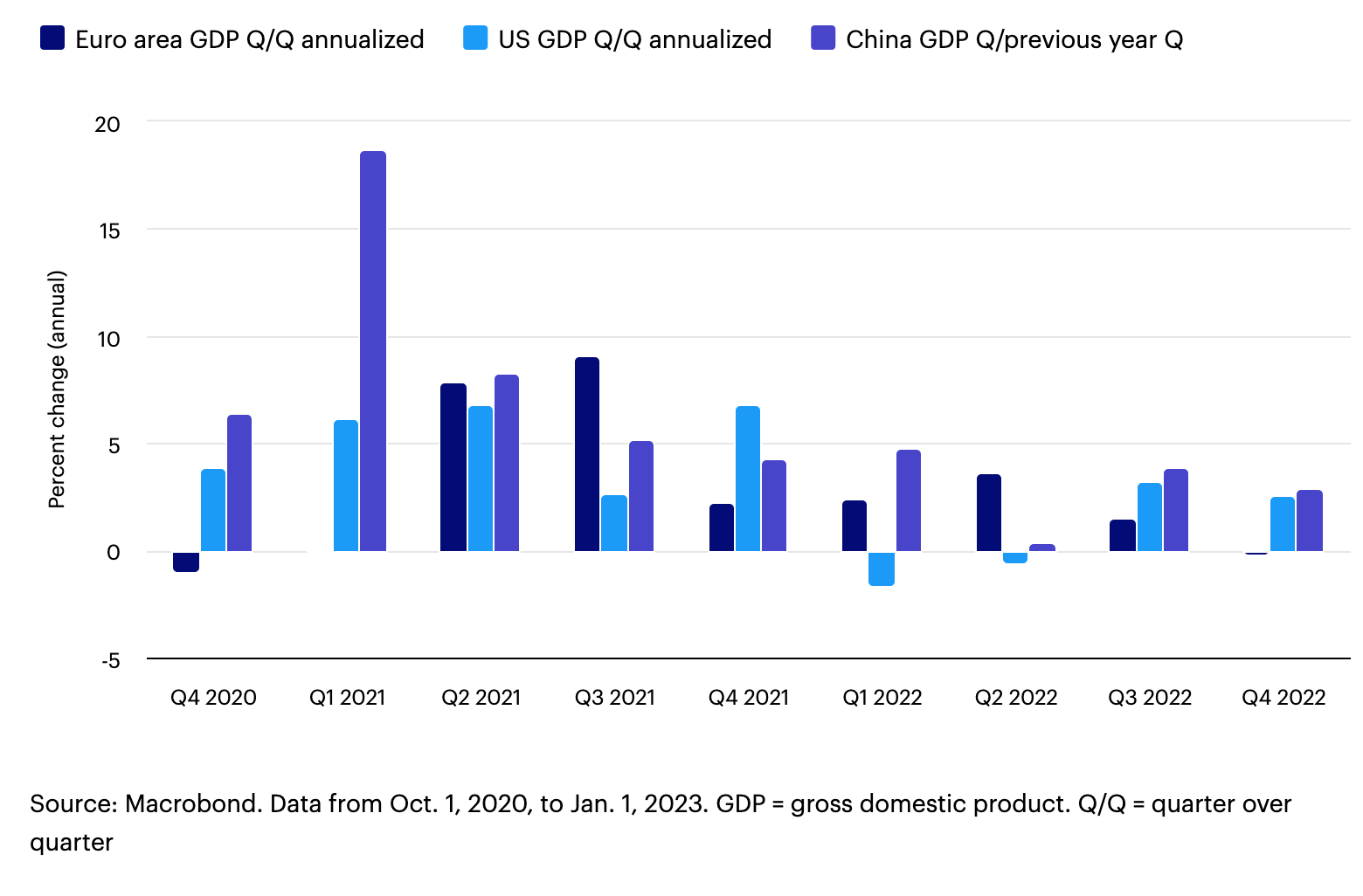

Figure 1: Purchasing Managers’ Indexes (PMI) have reached expansion levels (50+)

The best of times?

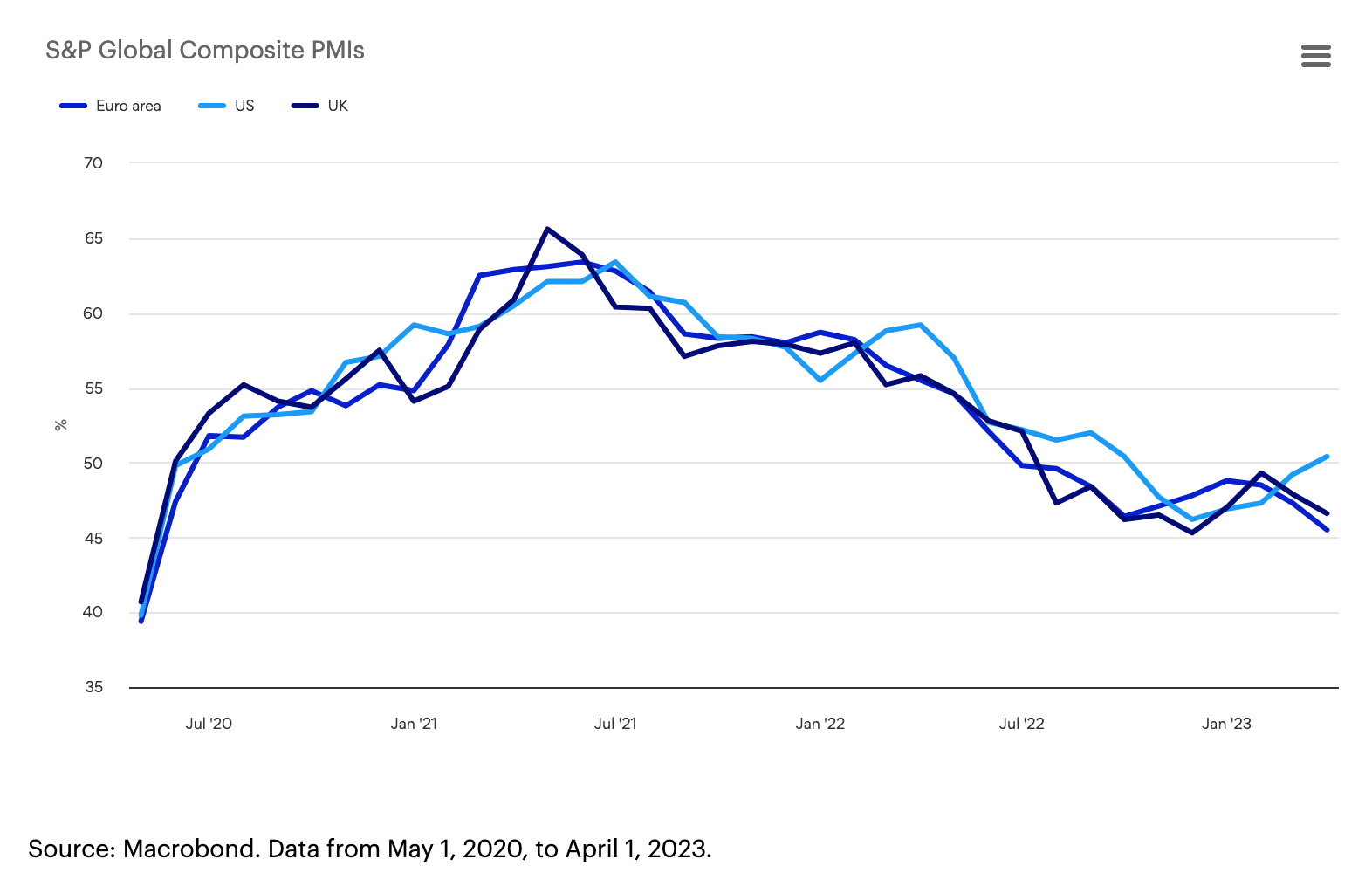

Recent growth has been stronger than many expected, and the U.S. labour market has been more resilient to rising rates. Worries about energy availability have also eased, allowing better economic performance in Europe and across the global economy.

While not booming, global economic momentum has remained solidly in positive territory, and, so far, the major economies have skirted a recession. There certainly have been pockets of weakness, housing in the U.S. being a clear example, but the U.S. economy has been resilient and able to continue to generate solid, if unexciting, growth.

Figure 2: Growth is weak, but still positive

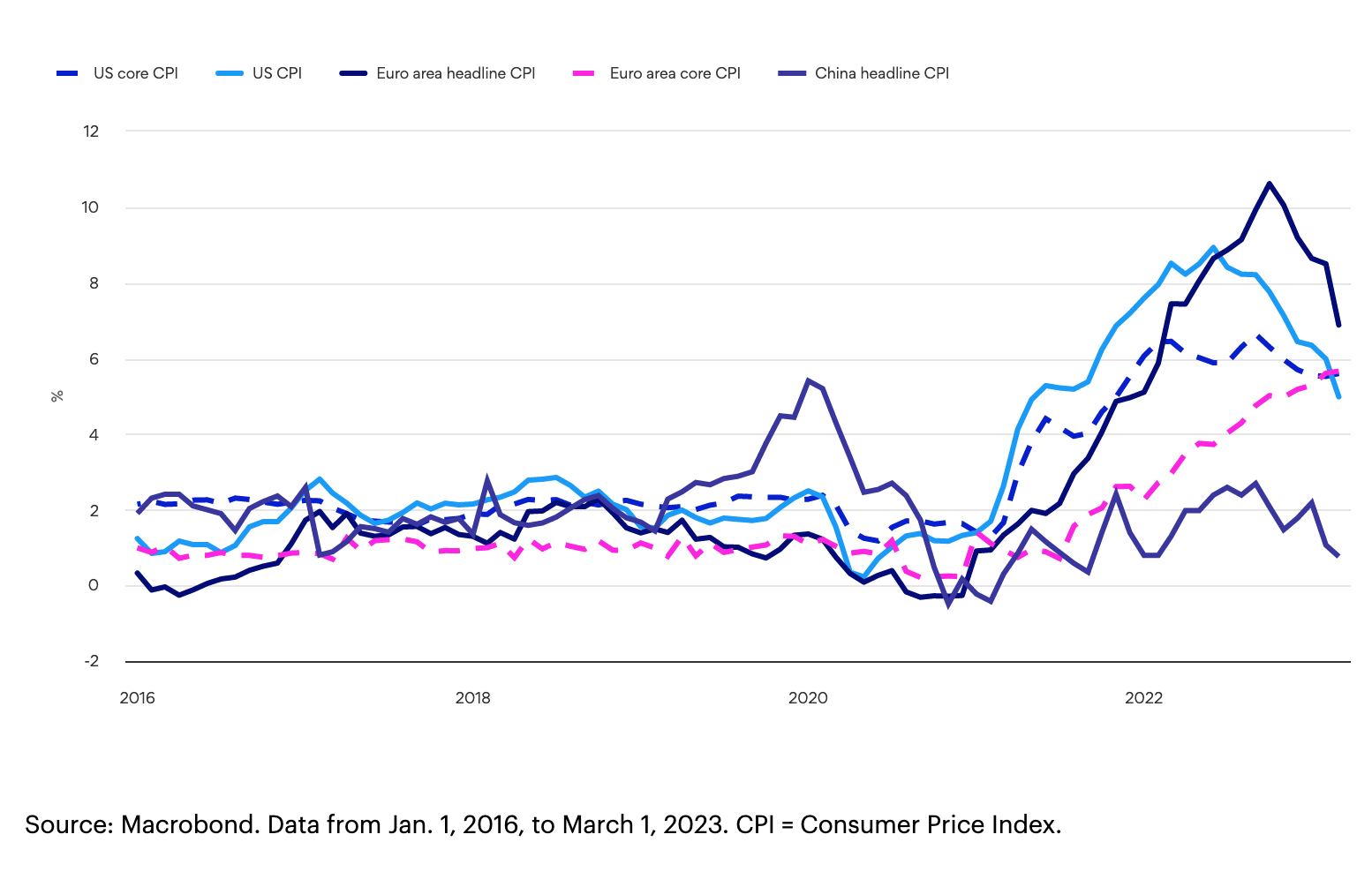

European inflation has been rising until recently but is likely to follow the path of U.S. inflation with a lag, in our view.

Figure 3: Inflation high, but declining

Currently countering all this good news for markets is the fact that central banks are still tightening financial conditions. Indeed, the U.S. Federal Reserve (Fed) raised rates at its last meeting in an environment where the yield curve is already steeply inverted, and some banks are showing signs of stress. This tightening of financial conditions is keeping interest rates and spreads higher than where they would otherwise be. In the best of times, when the Fed pauses or cuts, it should be a good environment across all financial assets. A disinflationary growth environment should be positive for markets across the board.

The worst of times?

Despite current rosy macro data, many forecasters see clouds on the horizon that could precipitate negative market outcomes. These two clouds are recession and inflation:

- Recession: Historical patterns suggest that an inverted yield curve and large amounts of rate hikes should translate into a recession. Recent recessions, particularly the global financial crisis and the pandemic recession, have come with major market dislocations across rates and credit markets. A drop in growth typically stresses credit across the economy and drives spreads wider and risky assets lower. Market observers can also point to current banking stress and declining deposits as signs of tightening credit growth — the early signs of recessionary activity. Whether the U.S. actually gets a recession in the coming quarters remains a question for now. Current data show remarkable stability, and there are no obvious imbalances in the economy outside of the labour market, which looks to need the type of correction a recession facilitates. So, while a recession remains a possibility for the U.S., it is far from a certainty, and less than a 50% probability, in our view.

- Inflation: The surprising rise in inflation across Western economies in the post-pandemic recovery has left markets deeply concerned about the possibility of continued inflation pressure. The fact that inflation has begun to come down should ease some of this concern, but many market observers continue to be concerned that tight labour markets will exert renewed upward pressure on inflation going forward. If inflation renews an upward push in the coming months, while growth remains anemic, we may move to a stagflation environment, which would be quite negative for financial assets across the board. While it is certainly possible that inflation could renew its upward push, every month that goes by with prices and wages looking contained makes this stagflation scenario appear less likely. Inflation remains a risk for markets, but that risk is fading as benign data continue to come in.

Invesco Fixed Income’s view: A pragmatic approach

Recent data are supportive of the disinflationary growth view, and at the most recent FOMC meeting, the Fed appears to have opened the door to a pause in rate hikes. Any additional acknowledgement of disinflationary forces in the economy by central banks will likely clear the path for good asset market performance going forward. While negative scenarios of recession or higher inflation would likely be negative for markets, these remain forecasts that are not consistent with current data. Acknowledging the good news of the current data, while keeping an eye out for signs of our negative scenarios, would seem to be the way to go for now.