April 21, 2023

The first quarter earnings season for the S&P 500 has started stronger than the last two quarters, though both the number of positive EPS surprises and the magnitude of these surprises are below their 5-year averages, according to John Butters, Senior Earnings Analyst at FactSet. Despite reporting higher earnings for Q1, the index is experiencing the largest year-over-year decline in earnings since Q2 2020.

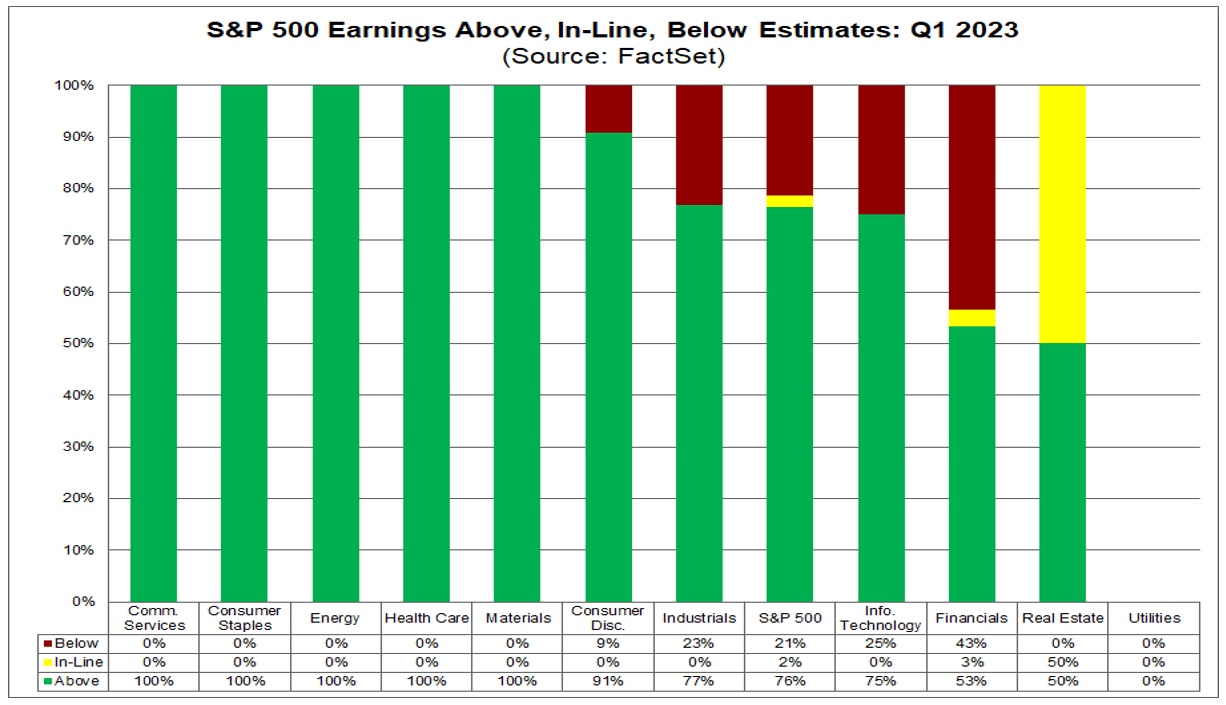

So far, 18% of S&P 500 companies have reported Q1 2023 results. Among them, 76% reported actual EPS above estimates, which is below the 5-year average of 77% but above the 10-year average of 73%. Companies are reporting earnings 5.8% above estimates, lower than the 5-year average of 8.4% and the 10-year average of 6.4%.

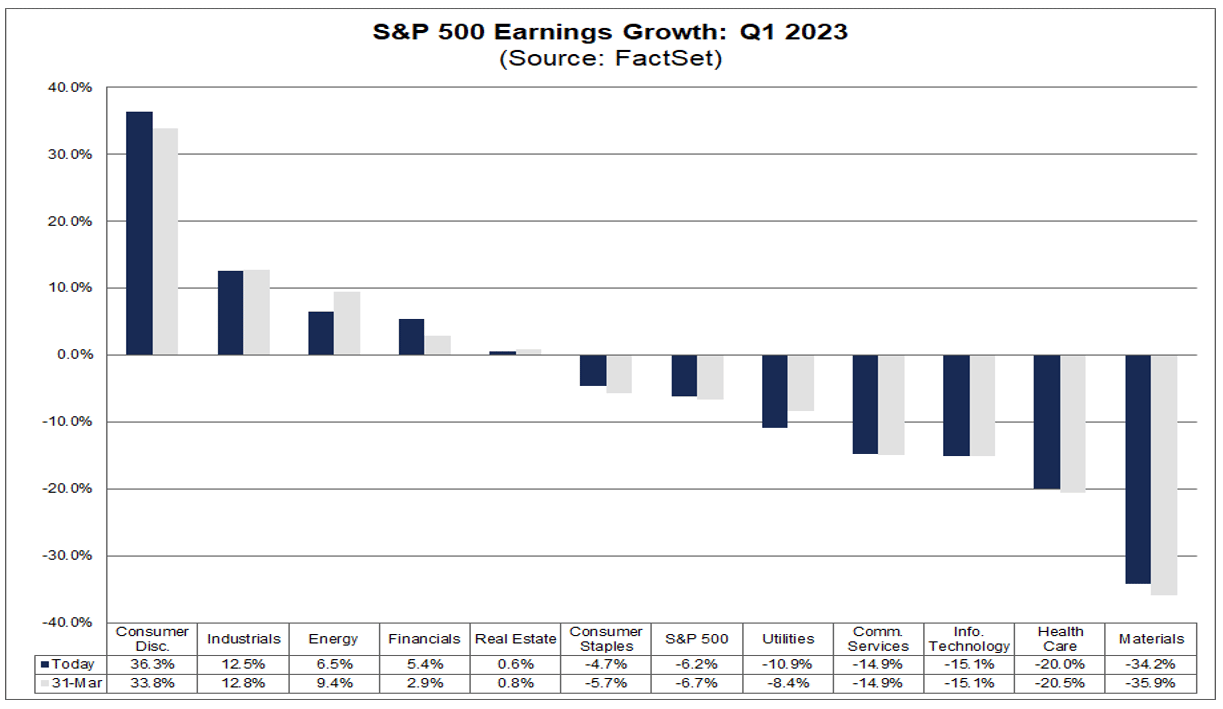

The blended earnings decline for Q1 is -6.2%, compared to -6.7% at the end of Q1 and last week. Multiple sectors, led by Health Care, have contributed to the decrease in overall earnings decline. Positive surprises from the Financials sector and downward revisions for the Energy sector have also impacted the index since March 31.

If the -6.2% decline holds, it will be the largest earnings decline since Q2 2020 (-31.6%) and the second consecutive quarter with a decrease in earnings. Five sectors report year-over-year earnings growth, led by Consumer Discretionary and Industrials. In contrast, six sectors report (or are expected to report) a year-over-year decline in earnings, led by Materials, Health Care, Information Technology, and Communication Services.

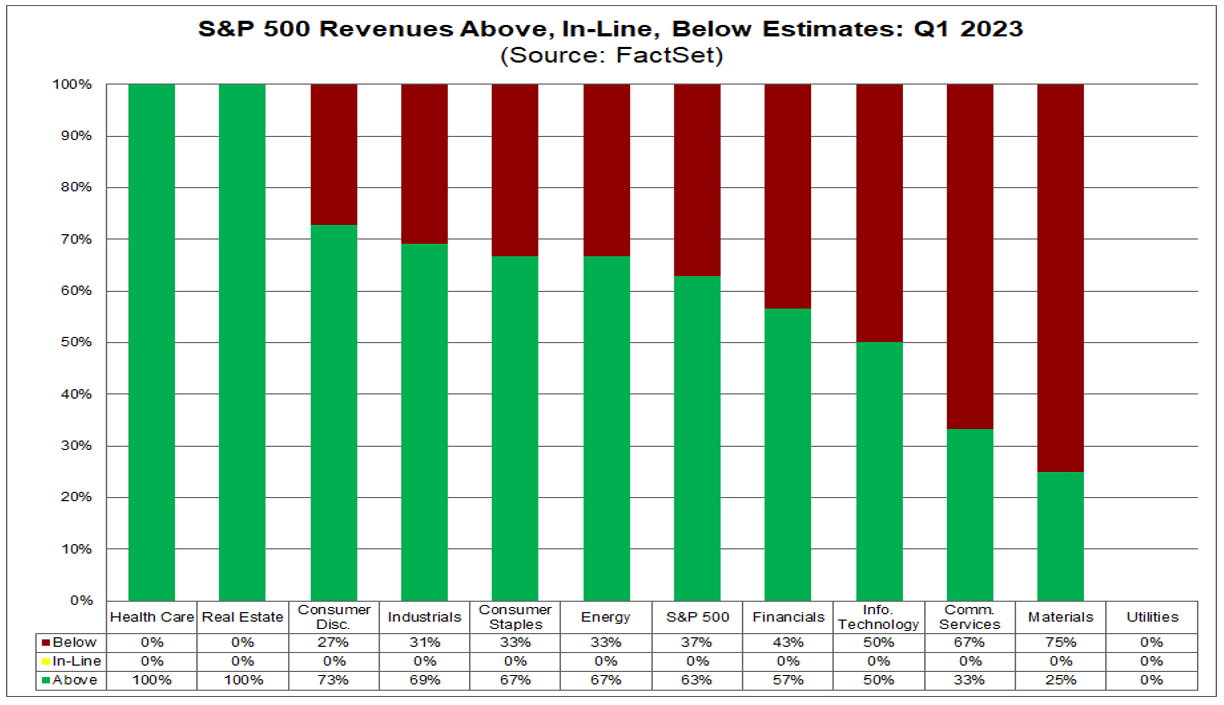

Regarding revenues, 63% of companies have reported actual revenues above estimates, says Butters, which is below the 5-year average of 69% but equal to the 10-year average of 63%. Companies report revenues 1.8% above estimates, below the 5-year average of 2.0% but above the 10-year average of 1.3%.

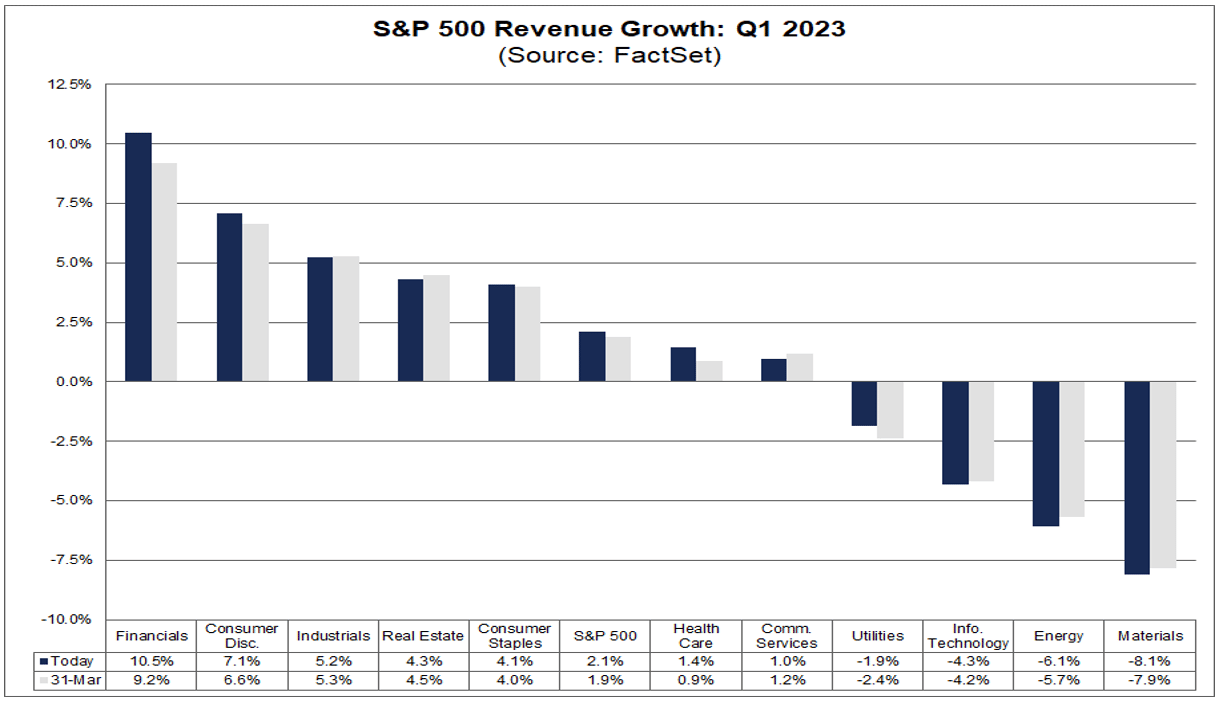

The blended revenue growth rate for Q1 is 2.1%, compared to 1.9% at the end of Q1 and last week. Positive revenue surprises from multiple sectors, led by Health Care, Consumer Discretionary, and Financials, have contributed to the decrease in overall revenue decline. The Financials and Health Care sectors have contributed the most to the decrease in overall revenue decline since March 31.

If the 2.1% growth rate holds, it will be the lowest revenue growth rate since Q3 2020 (-1.1%). Seven sectors report year-over-year growth in revenues, led by the Financials sector, while four sectors report (or are expected to report) a year-over-year decline in revenues, led by the Materials sector.

Analysts anticipate earnings growth for the second half of 2023. They project an earnings decline of -5.0% for Q2 2023 and earnings growth of 1.6% and 8.5% for Q3 2023 and Q4 2023, respectively. For CY 2023, analysts predict earnings growth of 0.8%.

The forward 12-month P/E ratio is 18.2, below the 5-year average (18.5) but above the 10-year average (17.3). It is also slightly above the forward P/E ratio of 18.1 recorded at the end of Q1.

In the upcoming week, 180 S&P 500 companies, including 14 Dow 30 components, are scheduled to report Q1 results.

Q1 2023: Scorecard

Q1 2023: Growth

Footnotes:

1 Adapted from source: Butters, John. "S&P 500 Earnings Season Update: April 21, 2023." 21 Apr. 2023, insight.factset.com/sp-500-earnings-season-update-april-21-2023.