In his article, "The De-Dollarization Fairytale," Alfonso Peccatiello explores the global financial system's reliance on the US Dollar and the challenges that come with attempting to move away from it. Peccatiello provides a comprehensive overview of the reasons for the US Dollar's dominance and why it's difficult to replace.

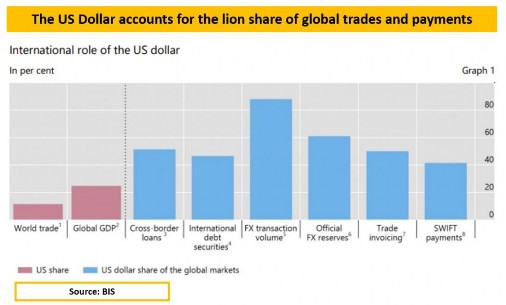

Brazilian President Lula's recent speech questioned the need for countries to be tied to the US Dollar for trade and proposed the idea of a BRICS Central Bank currency. However, Peccatiello argues that the US Dollar's role as the Global (Reserve) Currency of choice, accounting for over 80% of global FX transactions and more than 50% of global trades and payments, makes it difficult to replace.

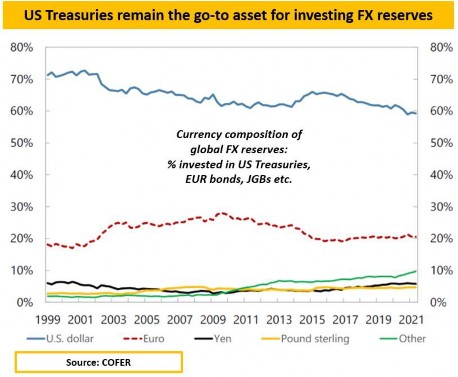

According to Peccatiello, the US Dollar's dominance is largely due to its "safe and liquid" nature, which allows countries to trade seamlessly with multiple partners. When countries export goods and accumulate US Dollars, their central banks are responsible for managing these foreign exchange reserves. The US Treasury market, with its 20+ trillion size, liquidity, and deep repo ecosystem, is the preferred choice for storing these reserves. Factors like the absence of capital controls, democratic roots, and the rule of law reinforce the attractiveness of US Treasuries.

Peccatiello also examines potential alternatives to the US Dollar, highlighting their shortcomings. Japan's government bond market is 60%+ absorbed by the BoJ, making it illiquid. Europe's fragile monetary but non-fiscal union and limited supply of safe collateral (German Bunds) make it unappealing. Finally, China, Brazil, and Russia present various risks, such as capital controls, lack of democracy/rule of law, corruption, and inflation, which make them unsuitable for storing foreign exchange reserves.

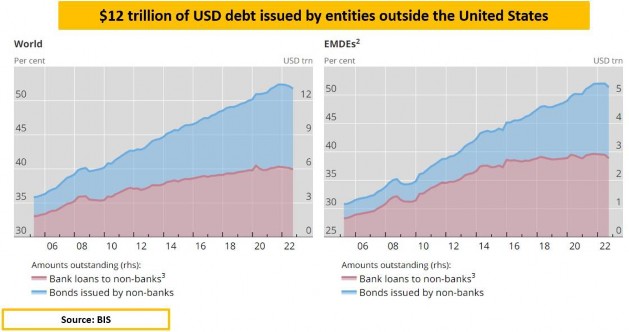

In addition to the issue of reserves, Peccatiello discusses the sizeable USD-denominated foreign debt, which stands at $12 trillion. This debt is necessary to finance global businesses that sell products in US Dollars, and any attempts to "de-dollarize" would require deleveraging this massive debt system. Peccatiello emphasizes the importance of understanding this concept, as countries like Brazil that attempt to move away from USD-denominated trades would face challenges, such as hampering their organic inflows of US Dollars and choking their corporations under USD scarcity when repaying and refinancing their debt.

Peccatiello concludes that an orderly unwind of the US Dollar is a fairytale, as there is no valid alternative for a smooth transition, and deleveraging the global USD debt-based system would be an extremely painful process. This is why the idea of de-dollarization continues to be discussed but never materializes.

In summary, Alfonso Peccatiello's article "The De-Dollarization Fairytale" argues that despite ongoing discussions about de-dollarization, the US Dollar's dominant position as the Global (Reserve) Currency and the challenges associated with finding a suitable alternative make it difficult to replace. Furthermore, the massive USD-denominated foreign debt creates additional barriers to a smooth transition away from the US Dollar, making de-dollarization more of a fairytale than a realistic possibility.

Footnotes:

1 Adapted from source: (Alf), Alfonso Peccatiello. "The De-Dollarization Fairytale." The Macro Compass, 20 Apr. 2023, themacrocompass.substack.com/p/the-de-dollarization-fairytale.