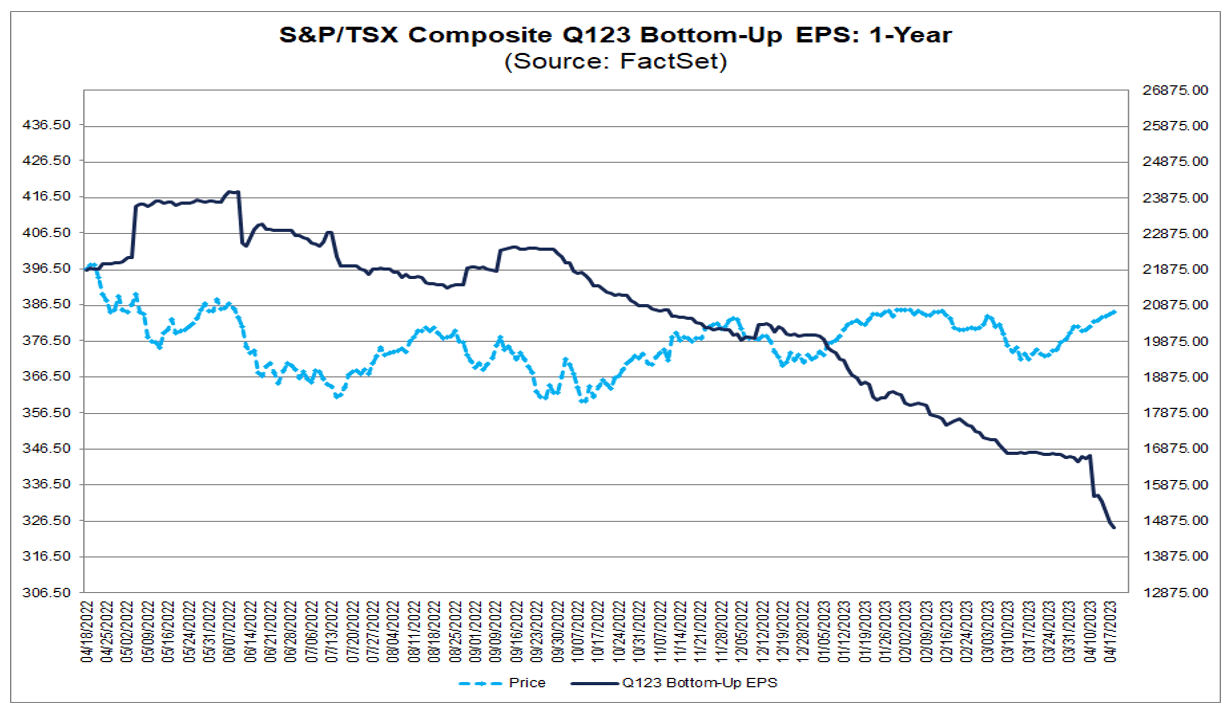

According to John Butters, Vice President and Senior Earnings Analyst at FactSet, analysts have lowered their earnings estimates for the first quarter of 2023 more than the average for companies in the S&P/TSX Composite. On a per-share basis, estimated earnings for Q1 2023 decreased by 8.9% from December 31 to March 31. Butters notes that this decline was larger than the 5-year average (-1.6%), the 10-year average (-3.1%), the 15-year average (-4.6%), and the 20-year average (-3.6%) for a quarter. Furthermore, the first quarter marked the largest decline in the quarterly EPS estimate since Q2 2020, which saw a decrease of 36.7%.

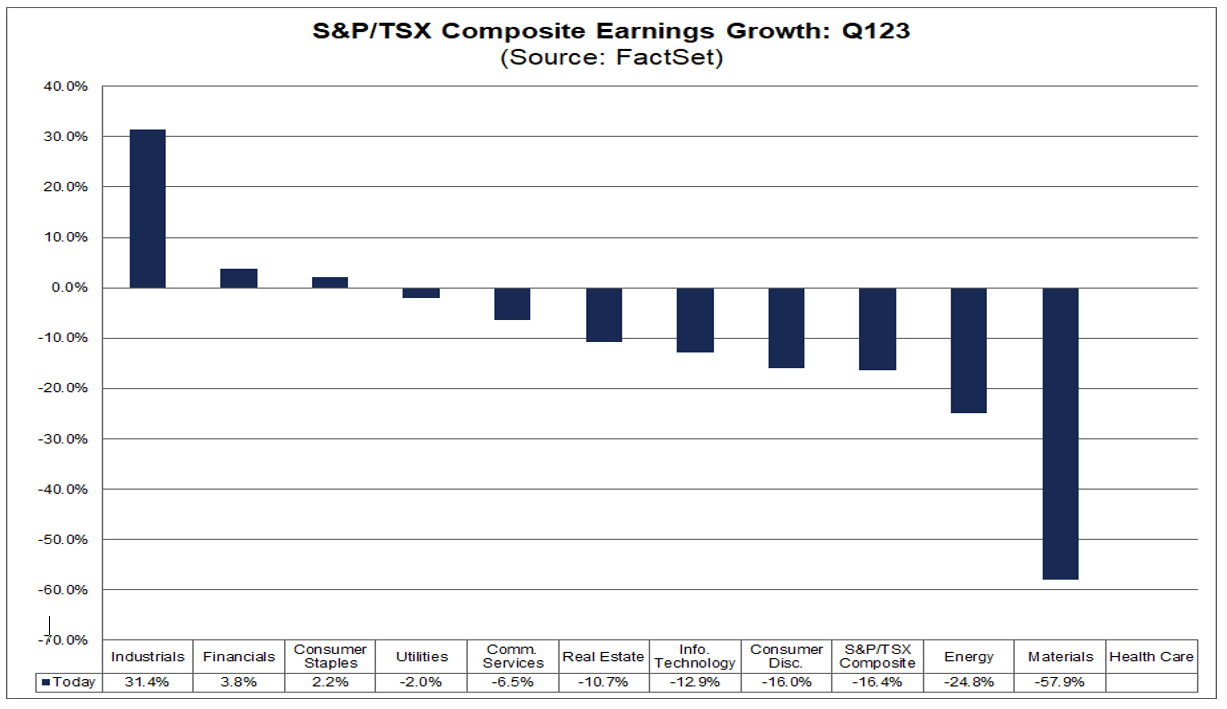

At the sector level, Butters highlights that 10 of the 11 sectors recorded a decline in estimated earnings during the quarter. The Energy (-20.9%), Materials (-17.6%), and Consumer Discretionary (-16.2%) sectors led the downward trend.

Butters states that due to the net downward revisions to earnings estimates, the estimated year-over-year earnings decline for Q1 2023 is larger now relative to the start of the first quarter. As of today, the S&P/TSX Composite is expected to report a year-over-year earnings decline of -16.4%, compared to the estimated year-over-year earnings decline of -11.7% on March 31 and the estimated year-over-year earnings decline of -4.0% on December 31.

If the actual decline for the quarter is -16.4%, Butters points out that it will mark the largest earnings decline reported by the index since Q3 2020. It will also mark the second straight quarter in which the index has reported a year-over-year decline in earnings. Three of the eleven sectors are projected to report year-over-year earnings growth, led by the Industrials sector. Conversely, seven sectors are predicted to report a year-over-year decline in earnings, led by the Materials and Energy sectors. A growth rate is not being calculated for the Health Care sector due to the loss reported by the sector in Q1 2022.

Looking ahead, Butters mentions that analysts expect declines in earnings of -10.2% and -2.9% for Q2 2023 and Q3 2023, respectively. However, analysts expect the index to report earnings growth of 7.6% for Q4 2023. For the entirety of CY 2023, analysts are predicting a decline in earnings of -5.3%.

Regarding valuation, Butters reports that the forward 12-month P/E ratio is 13.6, which is below the 5-year average (14.8) and below the 10-year average (15.2).

Lastly, Butters notes that the peak weeks of the Q1 2023 earnings season for the S&P/TSX Composite begin next week. Over the next four weeks, around 200 companies in the index are expected to report results for the first quarter.

Disclaimer: This article is for informational purposes only. The information contained in this article is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

Footnotes:

1 Adapted from source: Butters, John. "Canada Earnings Season Preview: Q1 2023." 20 Apr. 2023, insight.factset.com/canada-earnings-season-preview-q1-2023.