by Jared Dillian, The 10th Man

Yesterday’s CPI report showed that inflation continues to slow to 5% on an annualized basis. That is a lot better than it was last year. We should be happy about this.

The bad news? Inflation won’t go down much more before it finds support.

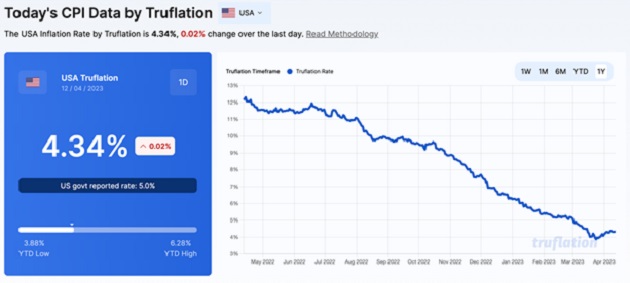

There is a website called Truflation that computes inflation on a mostly real-time basis. Go to their website and check out the chart:

Source: Truflation

Truflation currently measures inflation as 4.34%, and you can see from the chart that it is bouncing and heading higher.

I always thought it would be difficult to get inflation below 4%. It’s a matter of psychology—people expect price increases, so they act in such a way as to perpetuate price increases. We have discussed this phenomenon in The 10th Man a bunch of times before.

How do you eliminate inflationary psychology? You raise interest rates to the point where you cause a very serious recession.

Volcker gets credit for ending the inflation of the 1970s, but not many people remember how difficult things were when inflation was at its peak. GDP was down 6% in that recession. It was one of the worst recessions in history. It was relatively short-lived, though, and set us up for an expansion that would last almost 20 years. But we had to take a lot of pain in the short term.

Have we taken enough pain yet? Well, contrary to what New York Fed President John Williams says, the Fed hiked interest rates enough that banks began to fail. Was that enough pain? Did we kill the inflationary psychology? I don’t think we did—they are going to have to hit it harder.

But I don’t spend a great deal of time thinking about what the Fed should do; I think about what the Fed will do. And the Silicon Valley Bank incident looms large in the minds of the Fed. Could the Fed destabilize the financial system through further rate hikes? Absolutely.

And while financial stability is not one of the Fed’s official mandates, it is one of its unspoken mandates. If the Fed nukes 500 banks, there won’t be much left to save from inflation.

The Path of Least Embarrassment

Long-time readers know that I frequently say that the Fed follows the path of least embarrassment. The Fed doesn’t try to make money—it is incidental to what it does—but it does care about politics, optics, and public opinion.

The Fed was slow to act when inflation began to ramp. Why? There were two scenarios: The Fed hikes rates and fights inflation, bringing it down earlier than expected. Or it hikes rates erroneously and causes a recession when it isn’t absolutely necessary. Which path would have caused the Fed the most embarrassment? Clearly, the latter.

Today, the Fed has two possibilities: keep hiking rates and fight inflation or pause and watch inflation go higher. Which of those possibilities will cause the most embarrassment for the Fed? The latter.

Public opinion has shifted. People care about inflation to the exclusion of everything else. This Fed will be humiliated if it pauses interest rate hikes and watches helplessly as CPI climbs over 10%. It would have failed in its mission. Financial historians will be comparing Powell to Arthur Burns. So, the Fed will wait until it is absolutely clear that inflation has returned to normal.

What is normal? The Fed’s official inflation target remains at 2%. Will it wait for inflation to get back to 2%? Maybe. But one thing that the Fed has said all along is that it wants to see progress on inflation, and after yesterday’s CPI report, it is obvious that we are making substantial progress on inflation.

People are very focused on what the Fed will do at the next meeting. It seems as though it will raise another 25 basis points. But there are rate cuts priced in toward the end of the year, which will probably only happen if it becomes clear that the economy is entering a recession.

Predicting the Stock Market

It is true that you can forecast the direction of the stock market if you can forecast the direction of the Fed. I have done pretty well doing this over the years. The next meeting of the FOMC is on May 3. I expect the Fed to hike 25 basis points and pause while still performing quantitative tightening. That will place the lower bound on Fed funds at 5%—a nice round number.

I have always said that the Fed needs visibility as to the end of rate hikes. If we get that visibility at the May meeting, stocks could rally significantly. We have been seeing some reports that short positions in S&P 500 futures are the highest since 2011. You have been duly warned.

Those Bastards and SIC

Just a reminder, my book, Those Bastards: 69 essays on life, creativity, and meaning, was released last week and is available for sale on Amazon! I would be honored if you would pick up a copy. The reviews have been terrific.

Lastly, I hope you’ll join all the other speakers and me at this year’s Strategic Investment Conference (SIC). It’s just around the corner. You can grab all the details and order your 2023 SIC virtual pass here before things kick off on May 1.

See you there!

Jared Dillian