by Vaibhav Tandon, Senior Economist, Northern Trust

Housing stress may spread to other sectors.

Buying a house is a major life moment, but can also produce major stress. Various studies and my recent first-hand experience attest to it. There are countless details to be sorted to make the space livable. The fact that our investment has been growing steadily in value from the time we closed the deal last year has been pleasing. But our satisfaction has been tempered by the hit from rising mortgage rates.

While the housing market remains resilient in India, that’s not been the case in several advanced economies. After years of steady gains, the global property market has pulled back sharply since mid-2022. Housing starts, permits, sales and prices have been trending downward in most G10 economies, with little sign of bottoming out yet.

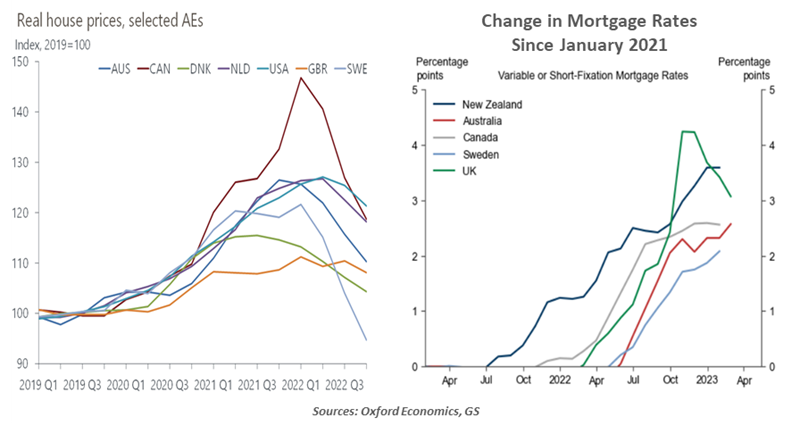

Real home prices in Canada fell for nine straight months last year, with a peak-to-trough loss of 19% since the first quarter of 2022. Over the same interval, large corrections are evident in Sweden (-22%), New Zealand (-21%), Australia (-12%) and the U.S. (-4%). In the U.K., property prices are down by about 5% after peaking last August.

Tighter monetary policy and the accompanying sharp rise in mortgage rates have pushed many housing markets into steep downturns. Policy rates have increased an average of four percentage points across major economies, to levels last seen prior to the 2008 global financial crisis. The average 30-year fixed rate mortgage in the U.S. rose to a two-decade high of 7.1% late last year. Though down from the highs of October 2022, mortgage rates in the U.K. are still well above the levels seen before the pandemic.

Higher mortgage payments are compounding a broader cost of living crisis in some countries, denting consumer spending. Falling home values also affect households via the “wealth effect,” with housing the largest single source of wealth in most economies. In Australia, for example, homes account for 65% of total wealth.

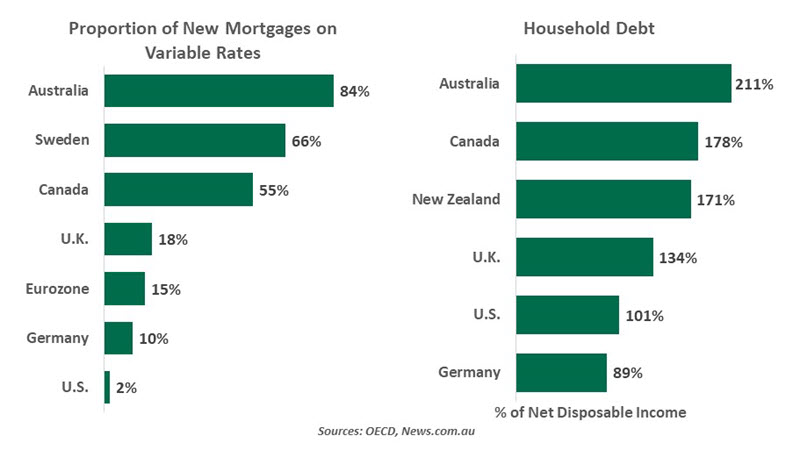

Property markets are highly sensitive to interest rates. Monetary policy affects housing first: Past cycles have shown that every 1 percentage point increase in real interest rates slows house price growth by about two percentage points in most nations. The timing of the pass-through varies, owing to differences in mortgage markets. Economies with higher shares of fixed-rate mortgages tend to see a delayed impact from changes in interest rates.

Overheated housing markets are cooling rapidly, raising the risk of a crash.

But rates are not the only determinant of house prices. Fundamentals like demographics, income and labor market conditions will affect demand for homes, while supply factors like availability, input costs and regulations are also important drivers of home values. Limited housing supply was one of the factors that pushed prices up in the U.S. when COVID was highly disruptive.

A slump in home values after a period of overheating has historically triggered housing crises. Australia and Canada are at greatest risk at the moment: households in these markets are highly indebted and bearing the brunt of higher mortgage rates. European countries like Sweden and the Netherlands are not far behind. The impact of higher borrowing costs is already evident on the British economy. According to the Bank of England’s credit conditions survey, the share of lenders reporting more defaults on mortgages rose in early 2023 to the highest level since the GFC, excluding the pandemic phase.

On the other hand, American households are better placed given that a sizeable share of homeowners locked in cheap fixed-rate loans. More than half of U.S. mortgages originated or were refinanced in 2020 or 2021, when the borrowing costs were at historic lows. Adjustable-rate debt in the U.S. accounts for only about 5% of total mortgages.

Falling home values can trigger a negative feedback loop in which tightening credit supply adds to the slump, thus eroding households’ confidence and creditworthiness. The Reserve Bank of Australia’s Financial Stability Report estimates that about 15% of borrowers will likely see their mortgage payments and essential living outlays exceed their disposable income by the end of 2023. The potential spillovers to the banking sector cannot be ignored.

Housing market crashes raise the risk of systemic banking crises. According to Oxford Economics, the risk of a banking crisis triggered by a property market downturn is much higher today than in the past in countries with weakening housing markets and existing banking sector challenges.

Although banking systems in the most advanced economies are well capitalized and have sound underwriting standards, some are suffering from deficient liquidity and weak profitability. Worryingly, some of the markets which are at risk of facing a major housing downturn are also among the ones where banks have relatively weak balance sheets.

The risk of a spillover from housing to the banking sector cannot be ignored.

The U.S. banking system has strong liquidity and capital positions. However, the American mortgage market is now dominated by non-banks which face fewer capital requirements and are more reliant on short-term funding. If the crisis hits, capital for new mortgage originations may be scarce, further slowing the housing market.

Many central banks have either halted or are close to concluding their tightening cycles. The end of this phase will bring greater stability to house prices. But with mortgage rates likely to remain higher for longer, the downward pressure on prices and investment will likely persist until rates decline. Personally, I can’t wait for a little relief on my monthly payments…the money will come in handy for fixing the many problems we have discovered since moving in.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.