Pre-opening Comments for Wednesday April 12th

U.S. equity index futures were higher this morning. S&P 500 futures were up 31 points in pre-opening trade.

S&P 500 futures advance 27 points following release of the March Consumer Price Index at 8:30 AM EDT. March CPI was expected to increase 0.2% versus a gain of 0.4% in February. Actual was an increase of 0.1% . On a year-over-year basis March CPI was expected to increase 5.1% versus a gain of 6.0% in February. Actual was an increase of 5.0%. Excluding food and energy, March Consumer Price Index was expected to increase 0.4% versus a gain of 0.5% in February. Actual was an increase of 0.4%. On a year over year basis, core CPI was expected to increase 5.6% versus a gain of 5.5% in February. Actual was an increase of 5.6%.

Bank of Canada updates monetary policy at 10:00 AM EDT on Wednesday. The Bank of Canada’s lending rate to Canada’s major bank is expected to remain unchanged from February at 4.50%.

Procter & Gamble added $0.73 to $151.39 after raising its quarterly dividend from $0.91 to $0.94.

Triton International advanced $19.23 to $82.24 after Brookfield Infrastructure announced its acquisition in a stock and cash deal valued at $4.7 billion.

Shopify gained $1.07 to US$45.85 after JMP Securities upgraded the stock from Market Perform to Outperform. Target

EquityClock’s Daily Comment

Headline reads “Wholesaler inventories are in decline through the first two months of this year, reminiscent of recessionary downturns in the economy over the past 25 years”.

http://www.equityclock.com/2023/04/11/stock-market-outlook-for-april-12-2023/

Technical Note

O’Reilly Automotive $ORLY a NASDAQ 100 stock moved above $873.94 to an all-time high extending an intermediate uptrend.

Trader’s Corner

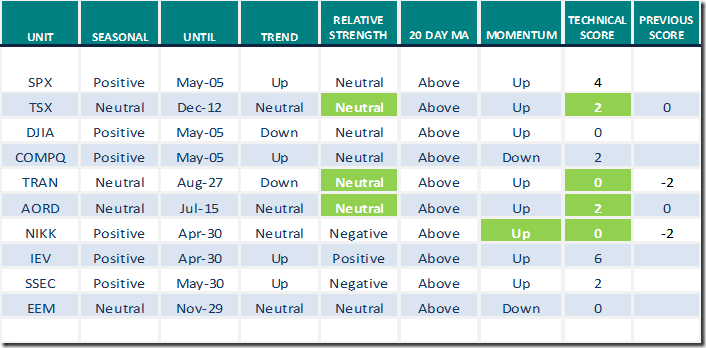

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 11th 2023

Green: Increase from previous day

Red: Decrease from previous day

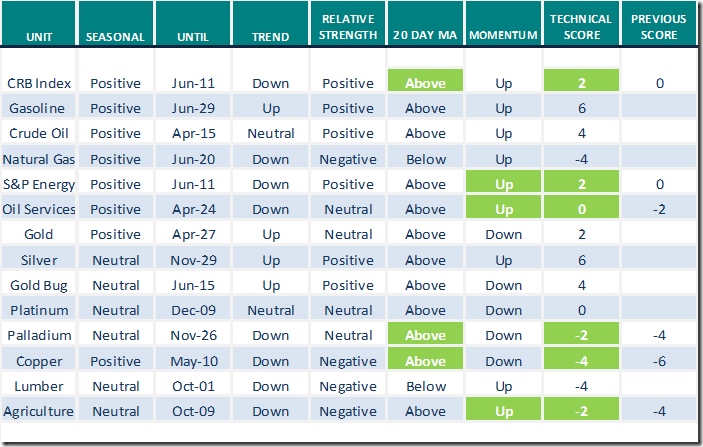

Commodities

Daily Seasonal/Technical Commodities Trends for April 11th 2023

Green: Increase from previous day

Red: Decrease from previous day

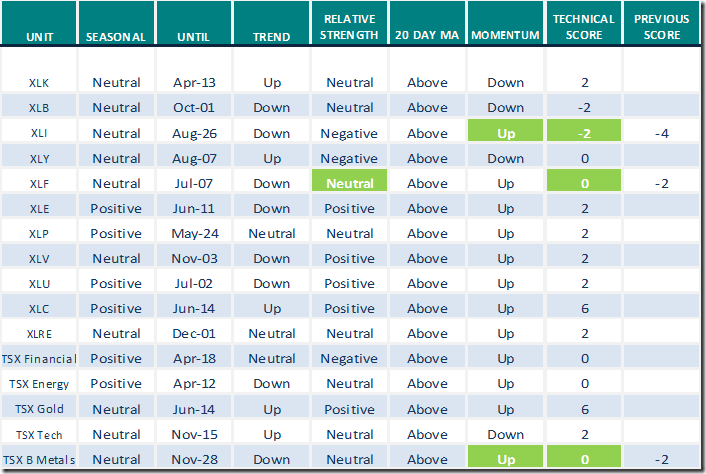

Sectors

Daily Seasonal/Technical Sector Trends for April 11th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Equities Storm Back Again! | Tom Bowley | Trading Places (04.11.23)

Equities Storm Back Again! | Tom Bowley | Trading Places (04.11.23) – YouTube

Surge in Oil Revives Rotation to Energy Stocks | Julius de Kempenaer (04.11.23)

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.80 to 52.80. It remains Neutral.

The long term Barometer added 4.40 to 62.00. It changed from Neutral to Overbought on a move above 60.00. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 5.58 to 57.08. It remains Neutral. Daily trend is up.

The long term Barometer added 3.86 to 67.81. It remains Overbought. Daily trend is up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed