The yield curve is a crucial macro variable that informs us about borrowing conditions and market expectations for growth and inflation. Rapid changes in the yield curve at different stages of the economic cycle are essential to understanding and incorporating into your portfolio allocation process.

Alfonso Peccatiello, Macro Strategist at The Macro Compass, guides us through different yield curve regimes, analyzes over 50 years of asset class returns, assesses the current situation and labor market, and provides an actionable investment strategy.

There are four primary yield curve regimes:

- Bull Flattening: Characterized by lower front-end yields and flatter curves. Peccatiello cites 2016 as an example when "Fed Funds were already basically at 0% and weak global growth."

- Bull Steepening: Lower front-end yields and steeper curves. Late 2020 and early 2021 is an example when "the Fed was keeping rates pinned at 0% and stimulating via QE but the economy was flooded with fiscal stimulus and ready for reopening."

- Bear Flattening: Higher front-end yields and flatter curves. Peccatiello notes that 2022 was a bear flattening year as "Powell raised rates aggressively to fight inflation, but he ended up choking the economy off."

- Bear Steepening: Higher front-end yields and steeper curves. The 2009 example highlights "the worst of the GFC was behind us and investors were afraid that QE would lead to runaway inflation and the Fed would be forced to start acting on it."

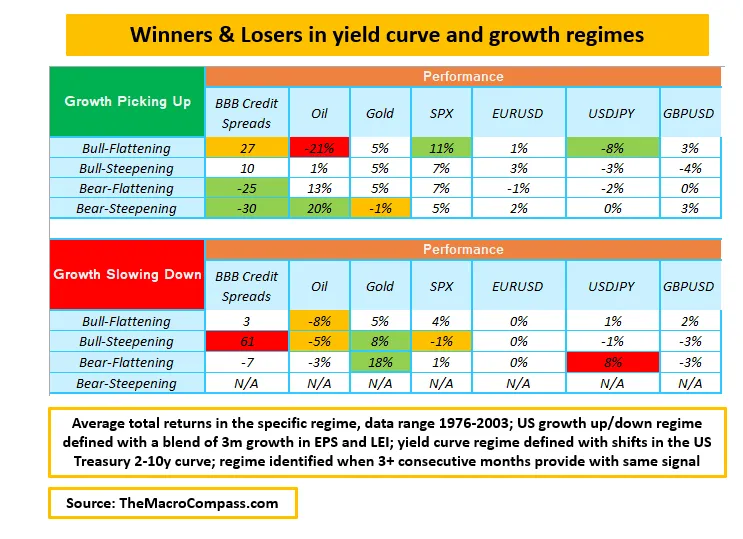

Peccatiello emphasizes that rapid changes in the yield curve shape during growth turning points are key variables to consider for successful asset allocation. After analyzing 50+ years of cross-asset returns through different growth and yield curve regimes, he suggests that the implications from this data are crucial for portfolio allocations.

In conclusion, understanding and adapting to different yield curve regimes is vital for optimizing portfolio allocation. Being aware of the historical context, the current state of the economy, and the labor market can inform investors' decision-making processes and help create a successful investment strategy.

Footnotes:

1 Adapted from source: (Alf), Alfonso Peccatiello. "The Big Yield Curve Shift." The Macro Compass, 10 Apr. 2023, themacrocompass.substack.com/p/the-big-yield-curve-shift?utm_source=substack&utm_medium=email.

2 Photo by Piret Ilver on Unsplash