Pre-opening Comments for Tuesday April 11th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged at 8:30 AM EDT.

Brookdale Senior Living gained $$0.26 to $3.24 after the company raised guidance.

Tilray dropped 0.12 to Cdn$2.62 after reporting a third quarter loss of $1.90 per share. The company also announced purchase of Hexo for Cdn$56 million.

CarMax gained $5.17 to $71.03 after reporting higher than consensus fourth quarter results.

Devon Energy added $.08 to $53.47 after Truist raised its target price from $70 to $87.

EquityClock’s Daily Comment

Headline reads “Evidence suggests that the trends of employment are normalizing following the abnormally mild winter that helped to support activity in January and February”.

http://www.equityclock.com/2023/04/10/stock-market-outlook-for-april-11-2023/

Canadian Association for Technical Analysis Event

Next CATA presentation is offered tonight at 8:00 PM EDT. Speaker is Tom Bowley from www.StockCharts.com . Everyone is welcome. Not a member of CATA? More information is available at Home – Canadian Association for Technical Analysis (canadianata.ca)

Technical Notes

Lockheed Martin $LMT an S&P 100 stock moved above $495.83 to an all-time high extending an intermediate uptrend.

Trader’s Corner

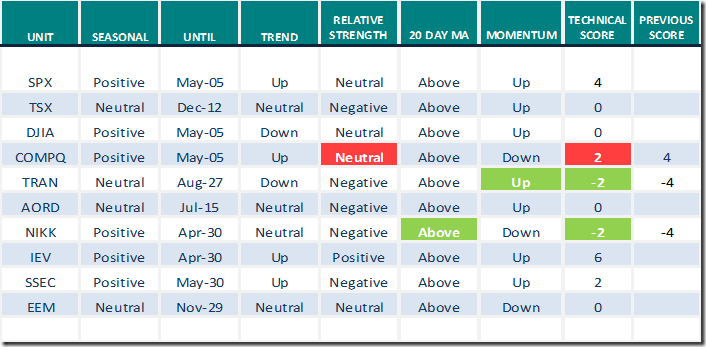

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 10th 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for April 10th 2023

Green: Increase from previous day

Red: Decrease from previous day

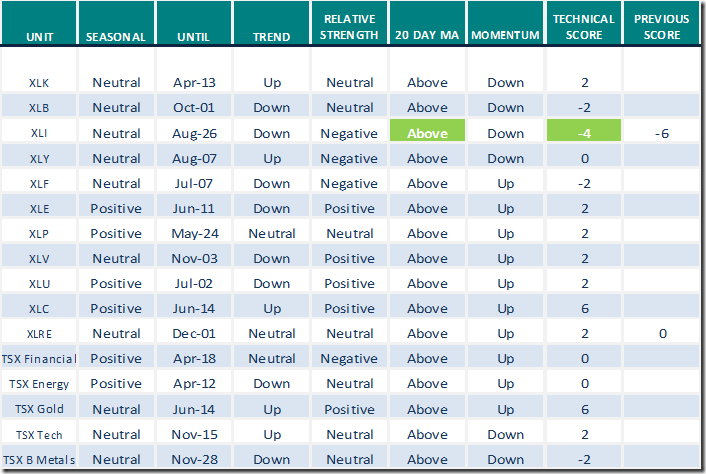

Sectors

Daily Seasonal/Technical Sector Trends for April 10th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Link offered by a valued provider

Return Of The Mega Caps Follow Up | Greg Harmon, CMT | Your Daily Five (04.10.23)

Return Of The Mega Caps Follow Up | Greg Harmon, CMT | Your Daily Five (04.10.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 5.00 to 49.00. It remains Neutral.

The long term Barometer added 0.80 to 57.60 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 1.72 to 51.50 yesterday. It remains Neutral.

The long term Barometer added 0.86 to 63.95 yesterday. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed