In the realm of investment services, Wall Street jargon is pervasive, and a single term can carry different meanings based on an investor's perspective and inherent biases. As a consulting organization with a long history, Meketa strives to reduce and simplify this jargon, using terminology that is more likely to resonate with the marketplace and educate investors on complex subjects.

This educational whitepaper, authored by Ryan Lobdell, CFA, CAIA, Jason Josephiac, CFA, CAIA & Brian Dana, CAIA at Meketa Investment Group, aims to provide clarity by avoiding terms such as "hedge funds," which Meketa acknowledges can be ambiguous. They liken investing in hedge funds to playing "sports" without specifying which sport, pointing out that this broad term encompasses various activities such as basketball, football, skiing, field hockey, lacrosse, and racing. In the context of racing, there are multiple subcategories like NASCAR, Indy, Motocross, and Rally. Meketa commits to identifying specific investment strategies that can help investors build an effective and efficient "all-around athlete" to complement the other players in their strategic asset allocation team.

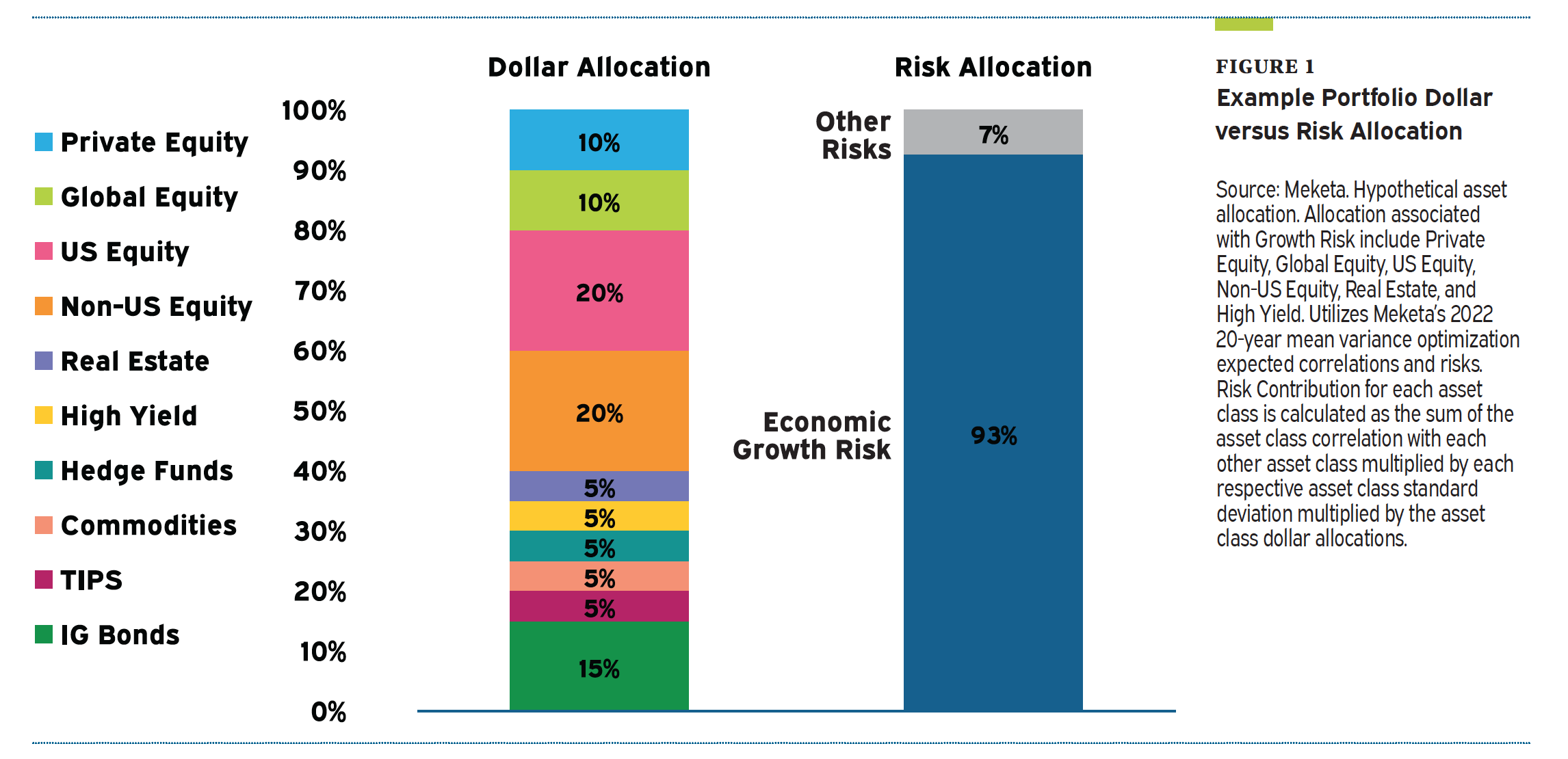

Meketa notes that championship teams usually possess both a strong offense and defense. Most strategic asset allocations have a well-built offensive roster that moves with changes in economic growth risk. This risk, also referred to as equity risk, appears in almost all investment strategies, from public and private equity to real estate and high yield bonds. They warn that investors' portfolios might have a higher risk exposure to economic growth risk than they realize due to label diversification. Figure 1 illustrates the potential masking caused by label diversification in a strategic asset allocation when viewed through a risk lens, revealing a high dependence on economic growth.

According to Meketa, the lack of diversification in the strategic asset allocation might not be as balanced as desired, which could reduce the chances of the portfolio consistently competing at the highest level. This doesn't imply that the portfolio cannot be a championship team, but it may be overly reliant on offense or on offensive players without enough defense. As a result, investors might look for defensive tools to increase the likelihood of building a team or portfolio that consistently competes at a championship level.

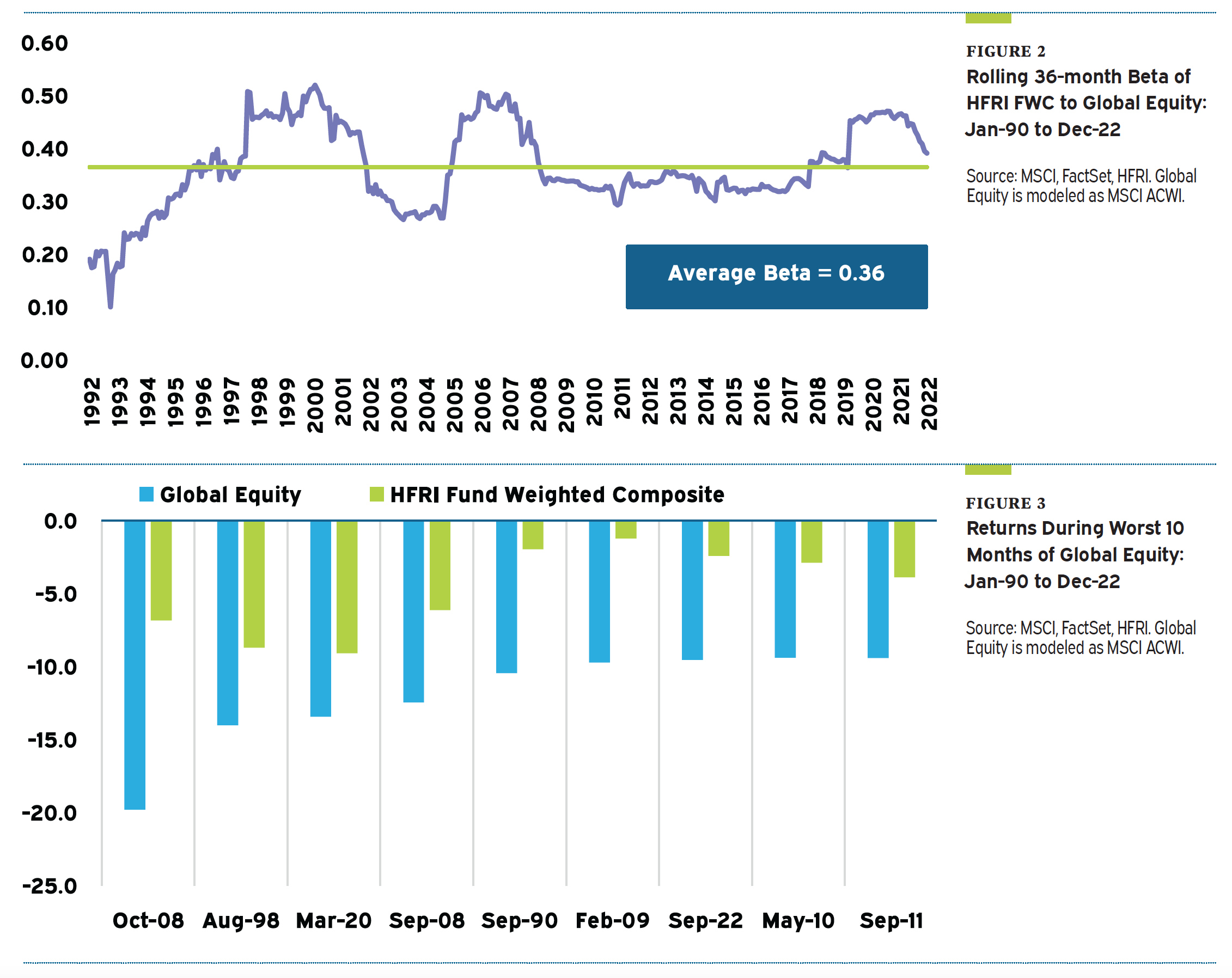

Meketa draws attention to another issue: like the strategic asset allocation issue where label diversification may conceal the underlying risk concentration, hedge fund programs often exhibit a similar pattern. Some hedge fund programs, which they liken to playing zone defense, do not genuinely hedge, at least not sufficiently from the perspective of the historical embedded beta1 and drawdowns exhibited by industry standard benchmarks. Figures 2 and 3 demonstrate that many hedge fund programs might be a low equity beta implementation of risks an investor already has elsewhere in their strategic asset allocation.

In summary, Meketa's whitepaper emphasizes the importance of understanding and reducing Wall Street jargon to facilitate better investment decisions. They use sports analogies to illustrate the need for a balanced approach to strategic asset allocation and draw attention to the potential pitfalls of label diversification and its impact on risk management. By shedding light on these issues, Meketa aims to guide investors towards constructing portfolios that can consistently compete at the highest level.

Footnotes:

1 adapted from source: "Risk Mitigating Strategies - Meketa Investment Group." Meketa Investment Group, 20 Mar. 2023, meketa.com/leadership/risk-mitigating-strategies.

2 Photo by Adrian Dascal on Unsplash