Technical Notes

ETFs moving below intermediate support included PIN, XLB, XLI, FCG, URA, USO, UGA, ECH, MDY, FM, PHO, UGA, USO, XLE, EEM

XBM.TO, XEG.TO, XFN.TO

S&P 100 stocks moving below intermediate support included BRK.B, HON, ALL, JPM

TSX 60 stocks moving below intermediate support included TD, POW, CNQ, TRP, ENB, NTR, FM, SU.

Base Metal stocks extending an intermediate downtrend included RIO, BHP, HBM.TO

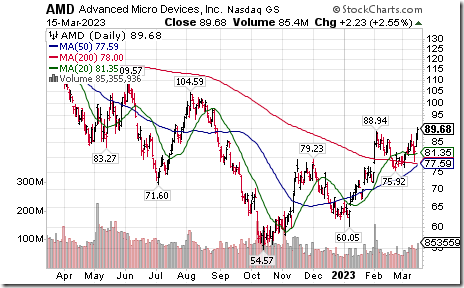

Advanced Micro Devices $AMD a NASDAQ 100 stock moved above $99.94 extending an intermediate uptrend.

Meta Platform META an S&P 100 stock moved above $197.16 extending an intermediate uptrend.

Fortis $FTS.TO a TSX 60 stock moved above $56.11 extending an intermediate uptrend.

Trader’s Corner

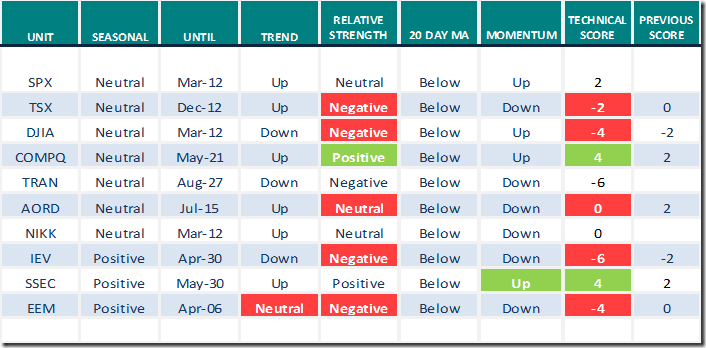

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 15th 2023

Green: Increase from previous day

Red: Decrease from previous day

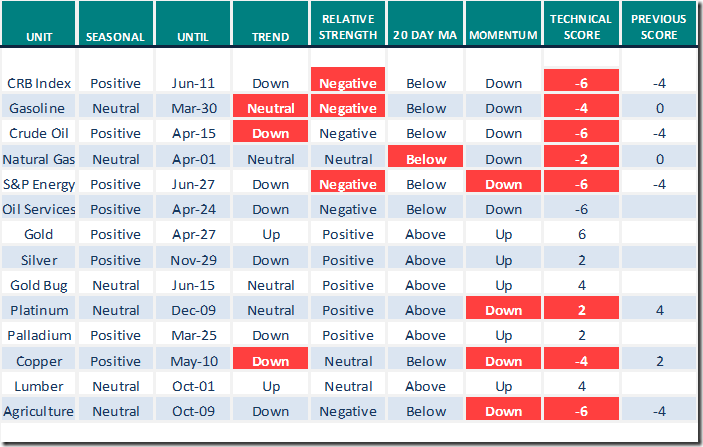

Commodities

Daily Seasonal/Technical Commodities Trends for March 15th 2023

Green: Increase from previous day

Red: Decrease from previous day

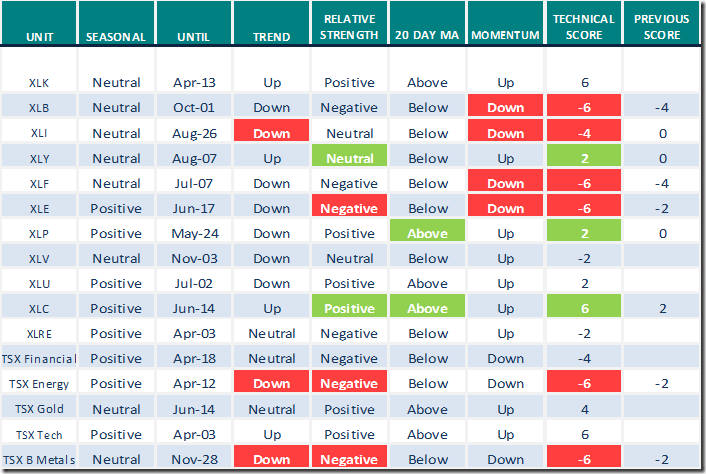

Sectors

Daily Seasonal/Technical Sector Trends for March 15th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Are Commercial REITS Next? | Greg Schnell, CMT | Market Buzz (03.15.23)

Are Commercial REITS Next? | Greg Schnell, CMT | Market Buzz (03.15.23) – YouTube

Every Bank, Everywhere, All at Once | Julius de Kempenaer | Your Daily Five (03.15.23)

https://www.youtube.com/watch?v=nR-x_vqjy_k

Investors Digest

Don Vialoux was asked to offer the “Top Pick” this week. Choice was the Shanghai Composite Index. The Investor’s Digest is available by subscription.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 5.00 to 19.20. It remains Oversold.

The long term Barometer dropped 4.80 to 40.60. It remains Neutral. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer dropped 7.23 to 26.81. It remains Oversold. Trend is down.

The long term Barometer dropped 6.38 to 48.09. It remains Neutral. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed