Technical Notes

Dow Jones Industrial Average SPDRs $DIA moved below $324.84 completing a double top pattern.

Weakness was notable in the financial sector. U.S. Regional Bank SPDRs $KRE moved below $56.33 and $55.36 extending an intermediate downtrend. U.S. Bank SPDRs $KBE moved below $43.38 extending an intermediate downtrend.

Notable U.S. banks moving below intermediate support setting intermediate downtrends included Citigroup, Bank of America, JP Morgan and Morgan Stanley. Citigroup $C moved below $49.15 completing a double top pattern.

Bank of America $BAC an S&P 100 stock moved below $31.15 extending an intermediate downtrend.

JP Morgan $JPM a Dow Jones Industrial Average stock moved below support at $133.55.

Morgan Stanley $MS moved below intermediate support at $92.20.

U.S. Insurance iShares $IAK moved below $89.80 and $89.45 extending setting an intermediate downtrend.

Travelers $TRV a Dow Jones Industrial Average stock moved below $56.33 extending an intermediate downtrend

Dow Jones Industrial Average stocks that broke intermediate support included JP Morgan, Walgreens Boots and UnitedHealth Group. Walgreens Boots $WBA moved below $33.85 extending an intermediate downtrend. UnitedHealth Group $UNH moved below $463.89 extending an intermediate downtrend.

Other S&P 100 stocks breaking intermediate support included Colgate Palmolive and Dow.

Colgate Palmolive $CL moved below $70.94 extending an intermediate downtrend. Dow $DOW moved below $55.38 and $55.15 completing a short term Head & Shoulders pattern.

Canadian “gassy” stocks responded to higher natural gas prices. ARX Resources moved above $16.15. Advantage moved above $8.68 and $8.69.

Base metal stocks responded to strength in the U.S. dollar. Teck Corp $TECK a TSX 60 stock moved below US$37.96 extending an intermediate downtrend. Lundin Mining $LUN.TO moved below Cdn$8.03 extending an intermediate downtrend.

Restaurant Brands International $QSR.TO a TSX 60 stock moved below Cdn$85.56 completing a double top pattern.

Trader’s Corner

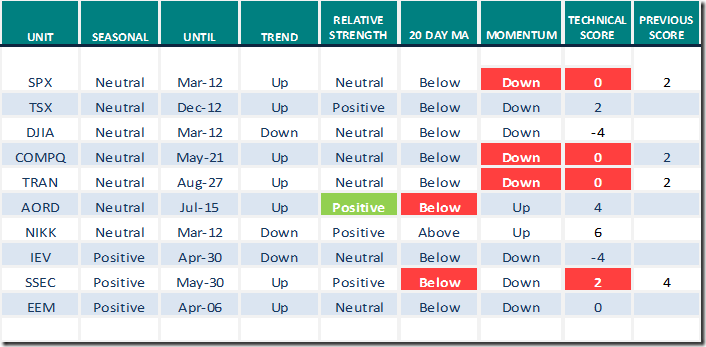

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 9th 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for March 9th 2023

Green: Increase from previous day

Red: Decrease from previous day

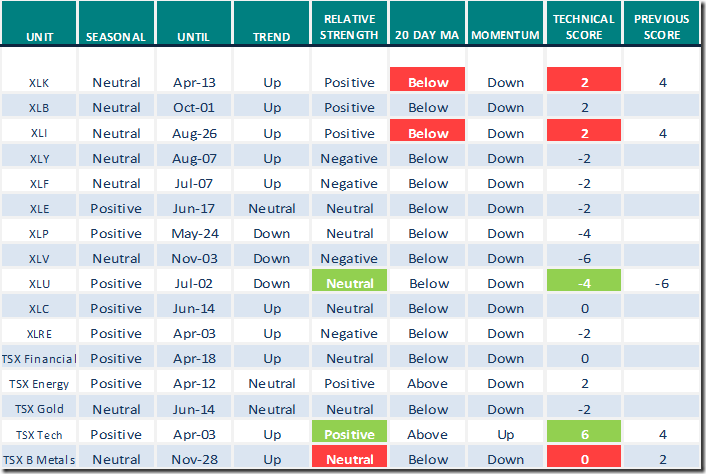

Sectors

Daily Seasonal/Technical Sector Trends for March 9th 2023

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 11.40 to 30.00. It changed from Neutral to Oversold on a move below 40.00. Trend remains down.

The long term Barometer dropped 7.80 to 49.80. It remains Neutral. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer dropped 8.09 to 40.00. It remains Neutral. Trend is down.

The long term Barometer dropped 5.11 to 57.45. It changed from Overbought to Neutral on a drop below 60.00. Downtrend has resumed.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed