Listen to this article (2:42)"

"Money creation is king," says Alfonso Peccatiello, Founder and Macro Strategist at The Macro Compass. "It leads economic activity and therefore financial markets performance."

Market practitioners pay close attention to indicators tracking ‘’money printing’’ because it can predict economic activity and financial markets performance. But how do we measure money creation correctly? Peccatiello explains how to do this and what it means for growth and markets.

Peccatiello uses his flagship Global Credit Impulse index to measure real-economy money creation. He says "The TMC Global Credit Impulse index (orange, left-hand side) accurately predicted the direction of travel for S&P500 earnings per share growth (blue, RHS) with a few quarters of lead time."

Back in late summer 2022, analysts were expecting EPS to grow healthily in 2023. But Peccatiello’s indicator suggested 2023 EPS would contract and perhaps turn negative already by March 2023, and it turned out to be right.

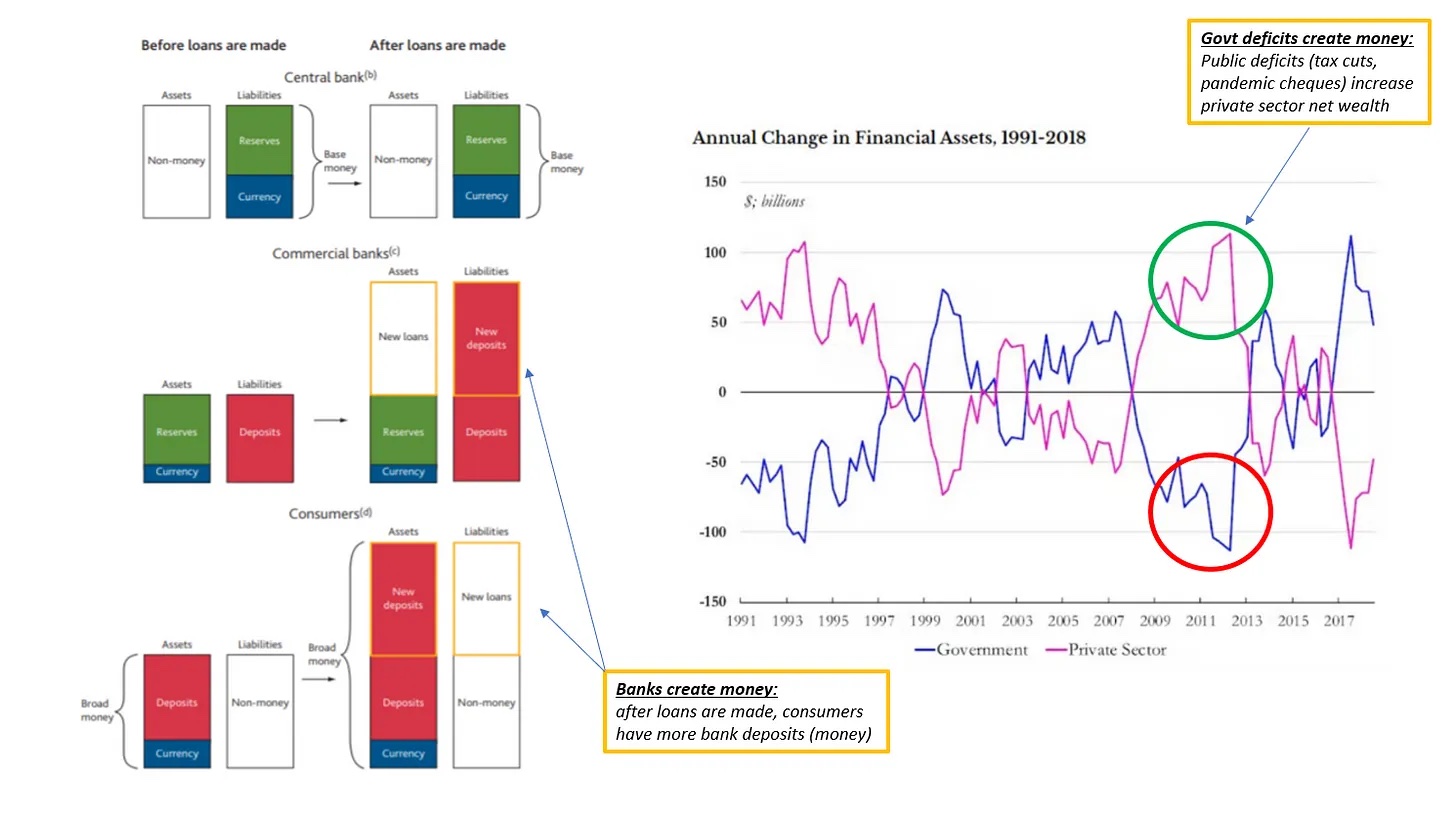

Commercial banks and governments print money we can use, not Central Banks. When the banking system extends a loan or a mortgage, it creates a new liability for the consumer but also a new asset. That newly created credit is money that didn’t exist before (left-hand side), and it is used to purchase such things as new cars and houses. Bank credit creation is real-economy money printing. When the government spends more money than it taxes us for (deficit), it throws net wealth at the private sector (right-hand side). Lower taxes or stimulus cheques increase the real-economy money available for the private sector. Government deficit spending is also real-economy money printing.

Peccatiello believes that the more real-economy money sloshing around the largest economies in the world, the more economic growth ahead and vice versa. Bank credit creation and government deficits are key pieces of the puzzle to track real-economy money creation. Peccatiello uses the TMC Global Credit Impulse index to build a proper money printing indicator. The latest data update shows that the index has changed, and this could have implications for growth and markets ahead.

In summary, money creation is critical to the economy and financial markets. Peccatiello’s Global Credit Impulse index is a useful tool to measure real-economy money creation, and it has accurately predicted the direction of travel for S&P500 earnings per share growth. Bank credit creation and government deficits are key pieces of the puzzle to track real-economy money creation. The latest data update could have implications for growth and markets ahead.

For the full scope, go to The Macro Compass:

The Macro Compass: "Money"Footnote:

1 (Alf), Alfonso Peccatiello. "Money." The Macro Compass, 6 Mar. 2023, themacrocompass.substack.com/p/money.