by Richard Bernstein, Richard Bernstein Advisors

The stock market rally so far this year seems based largely on speculation rather than fundamentals. Investors appear hopeful the Federal Reserve will soon return to a policy of cheap and abundant liquidity while ignoring the Fed’s repeated warnings to the contrary.

Speculation and bubbles require significant liquidity. Economic fundamentals do not point to the Fed soon changing course and easing credit conditions or lowering interest rates and have more recently argued the exact opposite: the Fed could stay tighter for longer than investors currently expect.

Accordingly, we continue to be defensively positioned within our portfolios, rather than loading up on those assets most likely to fizzle out.

Liquidity is a cornerstone of bubbles

We have repeatedly highlighted our five characteristics of a financial bubble. The cryptocurrency and tech/innovation/disruption outperformance during 2020-21 fit all five of these characteristics (see our earlier report, Bubble? 5 for 5. (rbadvisors.com)).

The recent bubble in technology/innovation/disruption/cryptocurrencies was undoubtedly fueled at least in part by the Fed’s immense liquidity injection into the economy in response to the pandemic (See Chart 1). M2 growth peaked at 27%, which was the highest in modern history and put US monetary growth on par with Peru’s. Fiscal stimulus provided additional liquidity via emergency payments.

Because businesses were slow to utilize the capital and consumers were not using services, the extreme amounts of liquidity basically had nowhere to go except into savings. That huge pool of excess savings quickly spurred a financial bubble.

Liquidity is now being drained

However, the Fed and other central banks have begun a concerted effort to withdraw liquidity from the global economy. Chart 1 shows US M2 growth has recently turned negative for the first time in modern history. Chart 2 highlights that 44% of global yield curves are now inverted, which is slightly below the recent 30-year record.

Inverted yield curves tend to reasonably forecast tighter monetary conditions because yield curves are a proxy for lending margins. Most financial institutions take in deposits and pay short-term interest rates on those deposits and lend receiving longer-term interest rates. When yield curves are positively sloped it suggests lending is profitable, i.e., longer-term lending rates are higher than the shorter-term cost of funds.

Inverted yield curves suggest lending is unprofitable because the cost of funding is higher than the interest rate received from lending. Accordingly, lending begins to shut down and liquidity begins to contract.

Today’s global liquidity withdrawal is considerably larger than was 2000’s that ended the Technology Bubble and 2008’s which ended the housing bubble. It appears to be a bad time to speculate based on central banks’ efforts.

The “Fed Put” is dead.

Our recent opinion column in the Financial Times outlined our view that the so-called “Fed Put” is dead (End the Fed Put (rbadvisors.com)).

The Fed could easily rush to the rescue when financial market volatility spiked because expanding globalization and secular disinflation gave them confidence that injecting liquidity into the economy would not cause inflation. Investors’ behavior adapted to the Fed’s repeated safety net, and systematically increased their risk taking.

However, with inflation well above the Fed’s 2% target and the labor markets historically tight, the Fed no longer has the flexibility to save the day for financial market participants. We believe The Fed Put is dead.

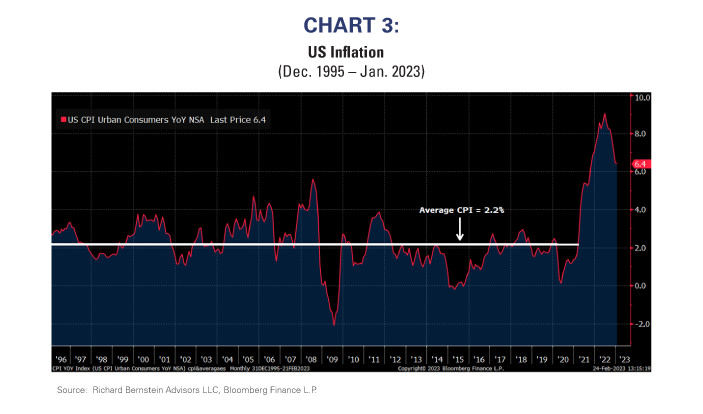

Chart 3 shows how the Fed’s flexibility is now constrained. From 1995 until the pandemic, CPI-based inflation averaged 2.2% remarkably close to the Fed’s 2% target. Since the pandemic’s massive monetary and fiscal stimulus, however, inflation has been well-above their target.

It would appear that either significant deflation or an extended period of low inflation is necessary to return to the 2% average inflation rate. Neither suggests speculation would be profitable.

If 2% average inflation is achieved through a period of actual deflation that implies a broad range of companies would go bankrupt, which would undoubtedly include more speculative companies with weaker balance sheets. Absent some period of significantly improved productivity or trade cooperation breaking out, an extended period of low inflation implies tighter monetary policy and higher interest rates for considerably longer than is currently anticipated.

Corporate cash flows coming under pressure

It has historically been more profitable to speculate when corporate cash flows were improving than when they were deteriorating, and cash flows are increasingly under pressure.

Chart 4 shows the S&P 500® profits cycle and RBA’s forecast for earnings growth over the next four quarters. We are not currently forecasting a deep profits recession, but we do think earnings and cash flows could suffer during 2023.

How do we know the rally isn’t fundamentally based? Look at Cryptos.

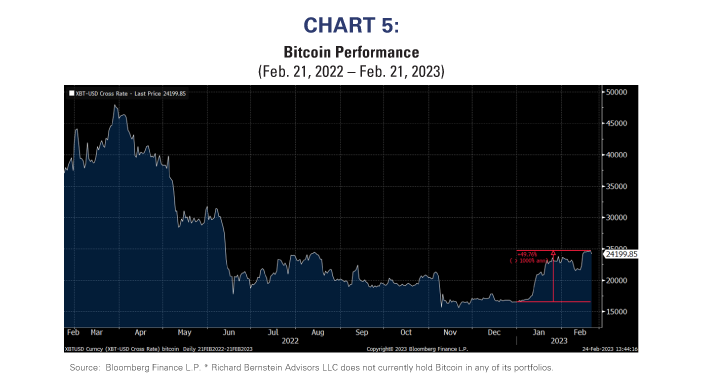

Some have argued that the year-to-date rally in more speculative issues is a fundamental shift from value to growth. The near-50% year-to-date rally in Bitcoin and other cryptocurrencies leads us to strongly doubt that is the case.

Cryptocurrencies seem a bellwether of speculation. There is absolutely nothing fundamentally based about cryptocurrencies’ performance. Cryptocurrencies appreciate solely on the notion that other speculators will buy them in the future at higher prices. (See our earlier report on the cryptocurrency markets Cryptocurrencies: It's just candy crush (rbadvisors.com)).

The rally in cryptocurrencies, as well as in meme stocks and profitless companies, suggests speculation rather than true economic or profit fundamentals have been driving performance. See Chart 5.

Volatility signals leadership change but investors rarely embrace that change.

Equity market volatility generally signals a change in leadership. Equity market leadership is comprised of the stocks best-suited for a particular economic environment, i.e., they perform the best. Volatility occurs when those stocks start to underperform as the economy changes. A new leadership group begins to appear that is better suited for the new environment.

Despite this recurring “changing of the guard”, investors rarely embrace the changes that volatility signals. Instead, they cling to the old leadership hoping for a return to form. The speculative rally so far this year seems a perfect example of investors’ denial of a changing economy.

Our portfolios remain defensively positioned away from more speculative sectors like Technology, Communications, and Consumer Discretionary. We view the opportunities outside the US to be quite broad because most countries are far less concentrated in these three sectors. Technology, Communications, and Consumer Discretionary still comprise about 45% of the US market. Among developed markets only the Netherlands is more concentrated in these sectors.

Longer-term we continue to see a shift from “cute wiener dogs in the metaverse” to real productive assets, and we remain more positive on cyclical sectors such as Energy, Materials, and Industrials than we normally might be at this point in the cycle.