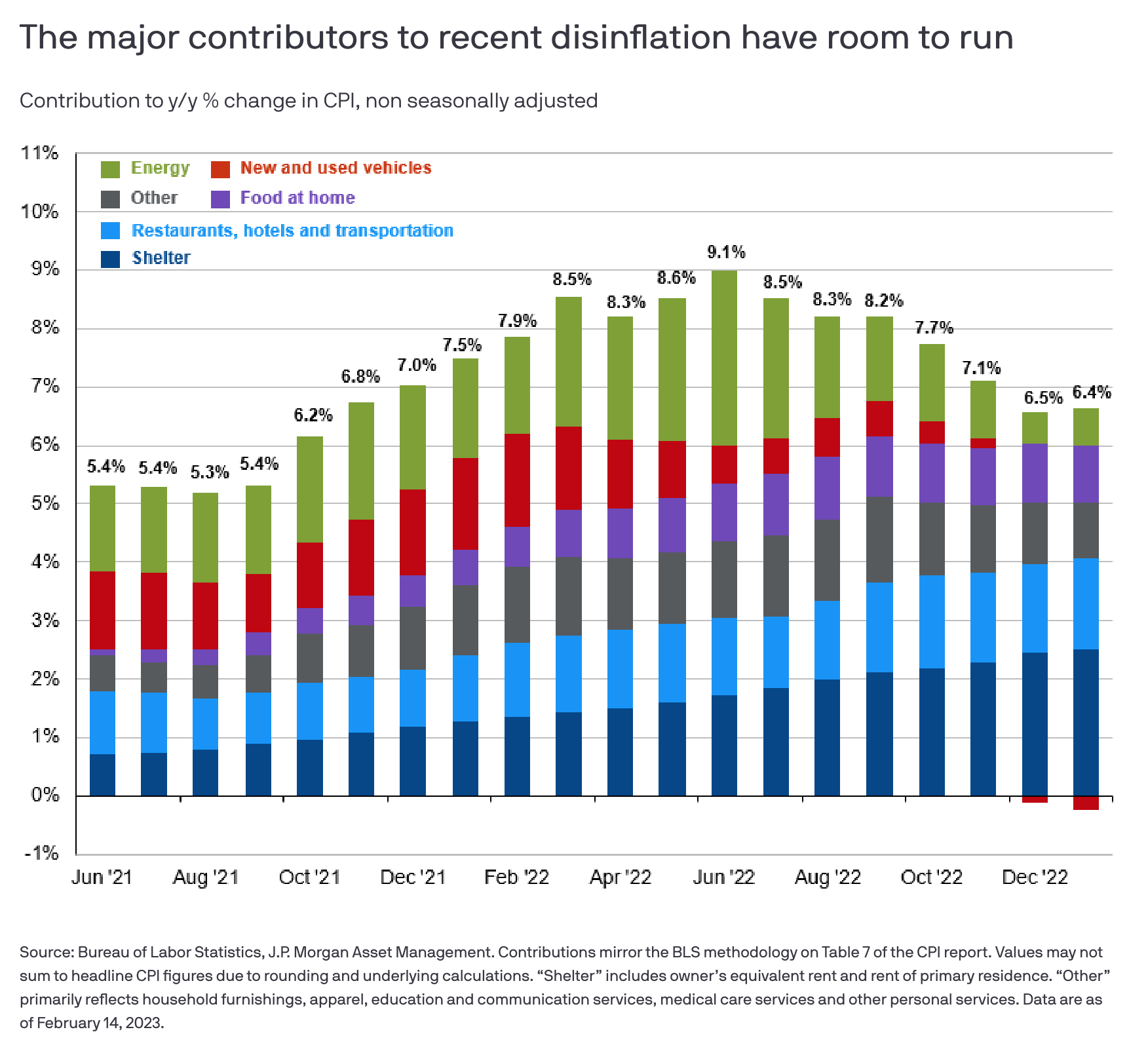

Inflation has been and continues to be a hot topic among investors for the last two years. The recent January Consumer Price Index (CPI) report has shown a bounce in headline inflation of 0.5% month-on-month (m/m) and 0.4% m/m excluding food and energy. However, JP Morgan believes that disinflation, or the falling inflation rate, is in its early stages and will gradually bring inflation back down to 2-3% over the next couple of years. They break down the major components of CPI that contribute to disinflation:

- Energy: Energy inflation has been declining and should come down further, which will also impact food inflation.

- Core goods: Supply chains and the shift from goods consumption to services have brought core goods inflation down, and used car prices have been a major contributor to the slowdown. Further price declines are expected, but it may be a bumpy road.

- Rent: Shelter inflation makes up a large portion of CPI, and while there is a significant lag, owner’s equivalent rent (OER) should soon begin to reflect the rollover in Zillow market rents. This will have a significant impact on core inflation.

- Core services ex-housing: The Federal Reserve’s focus measure on inflation remains elevated but is showing early signs of moderation. Real-time data on services prices point to further declines.

Despite these factors, JP Morgan acknowledges that the road to disinflation won’t be entirely smooth due to factors like China’s reopening, the recent uptick in used car prices, and elevated wage growth. However, a slowing economy with improved supply chains and moderating wage growth cannot sustain a +6% annual inflation rate, which highlights the disinflationary wave with plenty of room to run.

The Federal Reserve is focused on bringing inflation down to its 2% target, but JP Morgan warns that their efforts could lead to a hard landing. Fed tightening expectations have risen, and the peak terminal rate is now at 5.28% with just one rate cut priced in by the end of the year. However, stocks continue to perform well year-to-date. JP Morgan recommends that investors be wary of complacency and consider defensive positioning, with an emphasis on international diversification and a greater allocation to high-quality fixed income assets, as we await further clarity on the timing of a Fed pivot and the impact of monetary tightening on growth and inflation.

In summary, JP Morgan believes that disinflation is in its early stages and will gradually bring inflation back down to 2-3% over the next couple of years. The major components of CPI, including energy, core goods, rent, and core services ex-housing, all have room to run in terms of contributing to disinflation. However, investors should be cautious and consider defensive positioning, as the Federal Reserve’s efforts to bring down inflation could lead to a hard landing.

Footnote:

Adapted from source: "Will disinflation be transitory?" 15 Feb. 2020, am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/will-disinflation-be-transitory.