by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

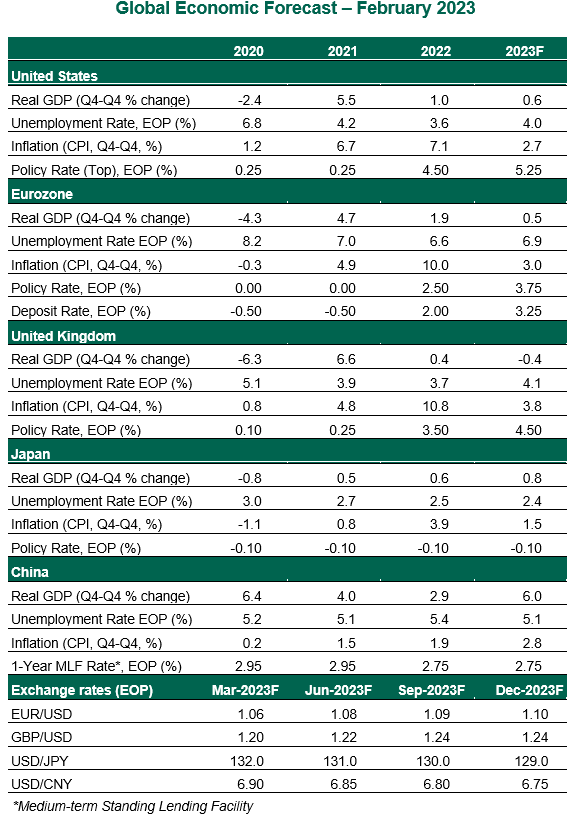

Positive economic developments, ranging from lower European gas prices to healing supply chains along with continued strength in labor markets, have pushed prospects of a recession down. And in regions where recession is still expected, it is likely to be short and shallow.

However, improved economic performance will also make underlying inflation more persistent. While lower commodity prices will help ease headline price increases, steady unemployment could lead to sticky core inflation. Central banks may be forced to become more restrictive for longer.

Monetary persistence by central banks could lead to instability in the financial markets. Enduring issues like U.S.-China tensions and the Ukraine war will also remain sources of uncertainty.

Here are our up-to-date perspectives on how major economies are poised to perform during the balance of this year.

United States

- In the fourth quarter of 2022, U.S. gross domestic product (GDP) grew at an annualized rate of 2.9%. The economy grew 2.1% for the full year, representing a remarkable turnaround from a negative first half. However, coming quarters are likely to slow down as savings deplete and the labor market gives up some steam. Erratic inventories and trade dynamics will complicate the quarterly path of GDP.

- The Federal Reserve continued its rate-hiking program, raising the Fed Funds rate by 25 basis points at the beginning of February to a range of 4.50-4.75%. The wording in the statement and messaging from the press conference suggest that the Fed is not done yet. We expect two more hikes of 25 basis points each at the FOMC’s March and May meetings, followed by a pause lasting into 2024.

Eurozone

- The eurozone appears to have dodged a winter bullet. The economy narrowly avoided a contraction, growing 0.1% quarter over quarter in the fourth quarter of 2022. Optimism is returning to the bloc: consumer confidence improved for the fifth consecutive month. The services sector remains resilient. Purchasing Managers’ Indices are back in expansion territory amid easing supply constraints.

- Eurozone inflation decelerated notably to 8.5% year over year in January, down from 9.2% in December. Lower energy prices continue to drive the headline reading down. But the persistence of underlying price pressures and the strength of the labor market are drawing attention from the European Central Bank (ECB). Recent hawkish comments from ECB speakers suggest that the central bank will hike by 50 basis points again in March, followed by a 25 basis points increase in May.

United Kingdom

- The U.K. economy ducked a technical recession as GDP was flat in the fourth quarter of 2022. The risks of a severe and prolonged downturn are receding, but the economy is still expected to enter a recession. The housing market will remain a drag on growth as tighter policy conditions will continue to impair consumers and hinder house prices.

- The messaging from this month’s Bank of England (BoE) meeting was that rates were close to their peak. However, most labor market measures suggest the conditions remain tight. The minutes of the February meeting show that policymakers are focused on developments in wages and services inflation. Therefore, the fear of not having done enough to tame high core inflation and rising wages will force the Monetary Policy Committee to hike the Bank Rate by 25 basis points in March and May.

Japan

- The Japanese economy disappointed by growing at a sluggish annualized pace of 0.6% in the fourth quarter, well below the consensus forecast of 1.8%. A large drop in inventories was the main downward driver. Consumer spending was robust, led by waning COVID waves and easing border controls that boosted inbound tourism. That said, growth momentum is set to weaken because of the sluggish external backdrop and fading pent-up domestic demand.

- The Japanese government nominated former Bank of Japan (BoJ) policy board member Kazuo Ueda as the next central bank governor. His comments from last July about the sustainability of inflation and the yield curve control (YCC) policy suggest modest policy changes are in the offing. We expect the BoJ, under the new leadership, to tweak the YCC by shortening its target maturity. This move would be the least expensive and disruptive outcome for the economy. Further policy normalization remains unlikely, with inflation expected to fall in the absence of sustained wage gains.

China

- China's reopening and spring festival have spurred a recovery in household consumption, particularly of services. While the Chinese economy will no longer be weighed down by COVID restrictions, the rebound could fizzle out earlier than expected. A combination of weak employment, the housing downturn, diminished household balance sheets and softer export demand will continue to hold the economy back.

- China’s fiscal policy is expected to be pro-growth this year, but without a major focus on infrastructure spending. Instead, policymakers will work to shore up the finances of indebted local governments which are struggling because of lower revenues, rising interest payments and hidden debt burdens.

Copyright © Northern Trust