Technical Notes

Gold Miners ETF $GDX moved below intermediate support at $27.55

IBM an S&P 100 stock moved below intermediate support at $131.19

Palo Alto Networks $PANW a NASDAQ 100 stock moved above $178.97 after reporting higher than consensus quarterly results.

Trader’s Corner

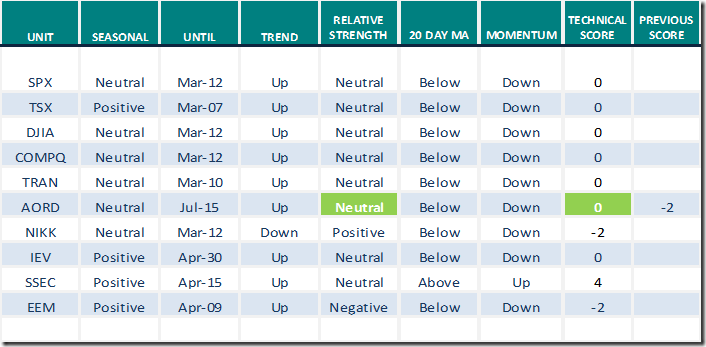

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

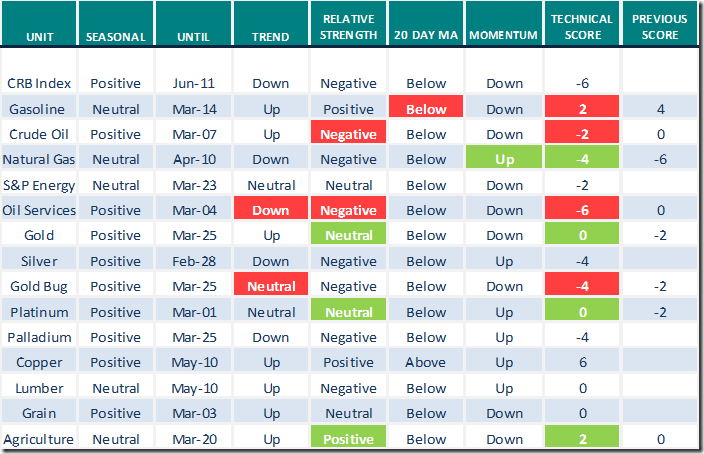

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

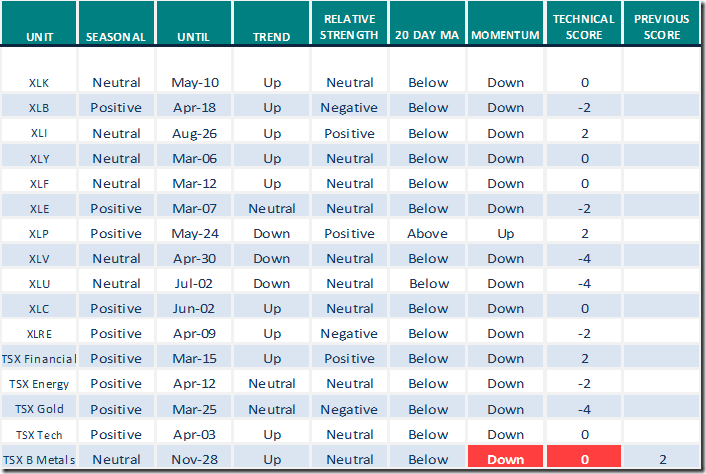

Sectors

Daily Seasonal/Technical Sector Trends for Feb.22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Have We Seen This Before? | Greg Schnell, CMT | Market Buzz (02.21.23)

https://www.youtube.com/watch?v=i08OZ_IogwE

Key Support Levels For 5 Major Charts | Larry Tentarelli | Your Daily Five (02.21.23)

Key Support Levels For 5 Major Charts | Larry Tentarelli | Your Daily Five (02.21.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.00 to 48.40. It remains Neutral. Trend is down.

The long term Barometer slipped 0.60 to 62.40. It remains Overbought. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer added 0.85 to 50.42. It remains Neutral.

The long term Barometer was unchanged at 59.32. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed