by Robert Milano, Senior Investment Strategist and Head—EMEA Equity Business Development, Walt Czaicki, CFA, Senior Investment Strategist—Equities, David Wong, Senior Investment Strategist and Head—Asia Business Development, Equities, AllianceBernstein

Passive equity investing has retained its dominance and outflows from active portfolios have continued amid the market and macro shocks of the past year. But in a world of structurally higher inflation and interest rates, there are good reasons for equity investors to consider active portfolios for equity allocations.

Companies and markets are still digesting the uncertainties that were unleashed in 2022. We believe these changes warrant a rethink of the rationale behind passive portfolios, which continued to see net inflows last year. While passive funds are generally cheaper and have a role to play in allocations, active portfolios offer benefits that are worth paying up for—especially in times of dramatic change. Here are some evolving conditions that we believe reinforce the case for skilled active management in the years ahead.

- Inflation (and Potential Recession) Will Create New Winners and Losers—we’re only in the early innings of the earnings reset triggered by higher inflation and rates. During the first stage of this regime change in 2022, the first order effect of inflation was higher rates, which triggered a compression of stock valuations across the entire market. This year, we think earnings growth will play a greater role in stock performance.

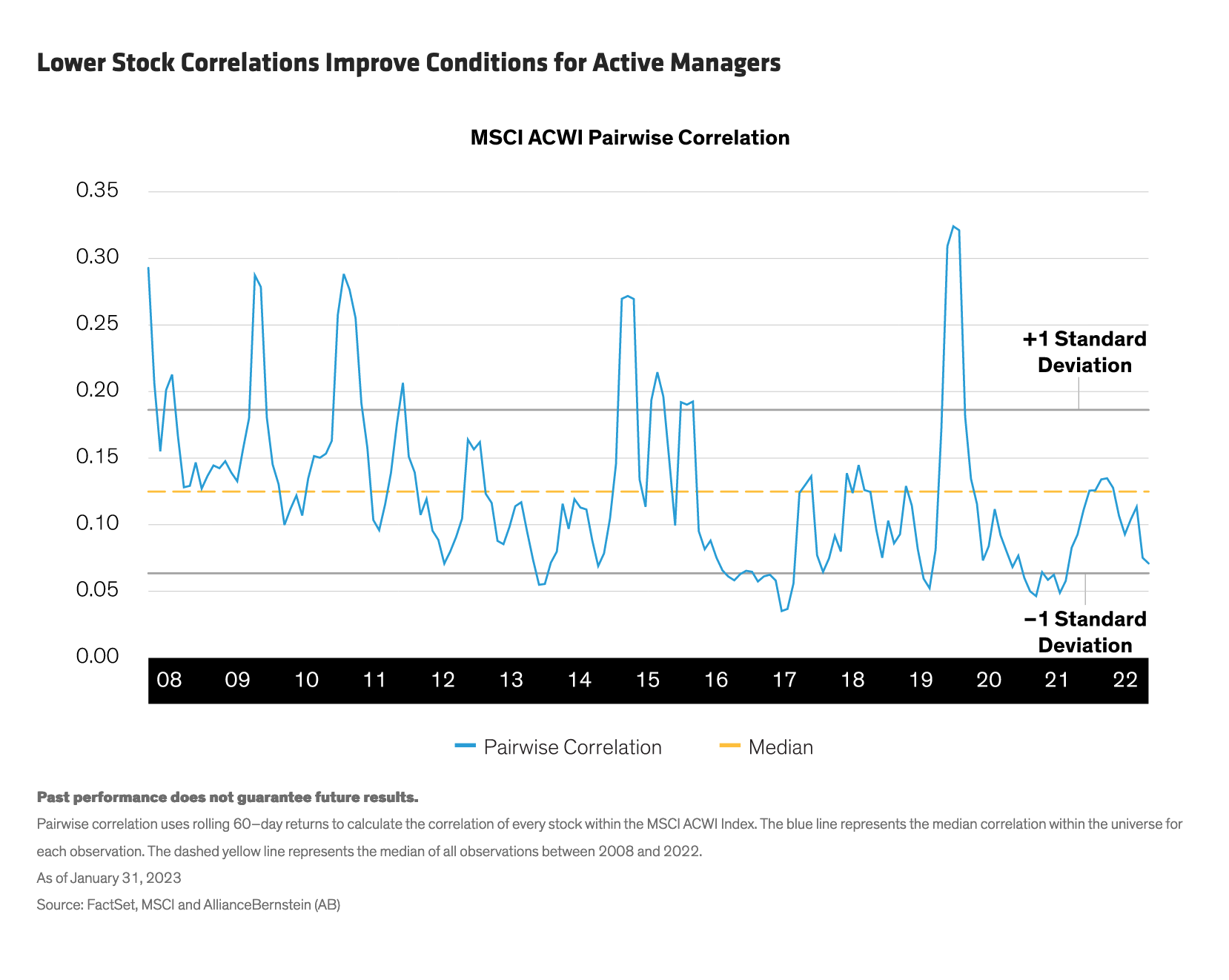

Don’t expect this process to play out neatly. Inflation and a potential recession will affect companies in different ways, which may lead to a wider dispersion of equity returns, in our view. Long gone are the days of virtually free financing and the “growth at any price” mindset. Instead, a higher cost of capital will necessitate corporate discipline, as well as an active approach to identify those companies with pricing power, earnings and profit margin sustainability, lower debt and company-specific business momentum. Taken together, these trends may lead to persistently lower correlations of stock returns, which are currently well below the median since the 2008 global financial crisis (Display). Lower stock correlations mean trading patterns of individual stocks are more pronounced, which tends to offer better conditions for skilled active managers to outperform and can help reduce overall portfolio risk.

- Sector and Style Trends Won’t Be the Same—the prolonged bull market that ended in 2022 was driven by the predictable profitability and outperformance of mega-cap technology stocks. Hypergrowth companies with no profits were hit particularly hard in the sell-off. And many profitable technology companies continue to suffer earnings hangovers from bloated cost bases built out to service the unsustainable pandemic lockdown economy.

The old market order is gone. Investors must now differentiate between businesses that are merely mean-reverting to a pre-pandemic growth rate and those whose business models are structurally impaired or that are positioned to thrive. Active managers can incorporate fundamental research on individual businesses with forward-looking perspectives on sector and style exposure that backward-looking benchmarks cannot. As mega-cap and hypergrowth tech stocks fell back to earth last year, the market broadened. Now, we believe a larger group of stocks is poised to drive future returns, which tends to provide a tailwind for active managers.

- Generating Real Returns Requires Disciplined Selectivity—generating returns that can beat inflation will be vital for investors to meet long-term objectives. As inflation, higher rates and growth challenges squeeze profitability, finding select companies that persistently stand out with market-beating performance will be essential to source real return potential.

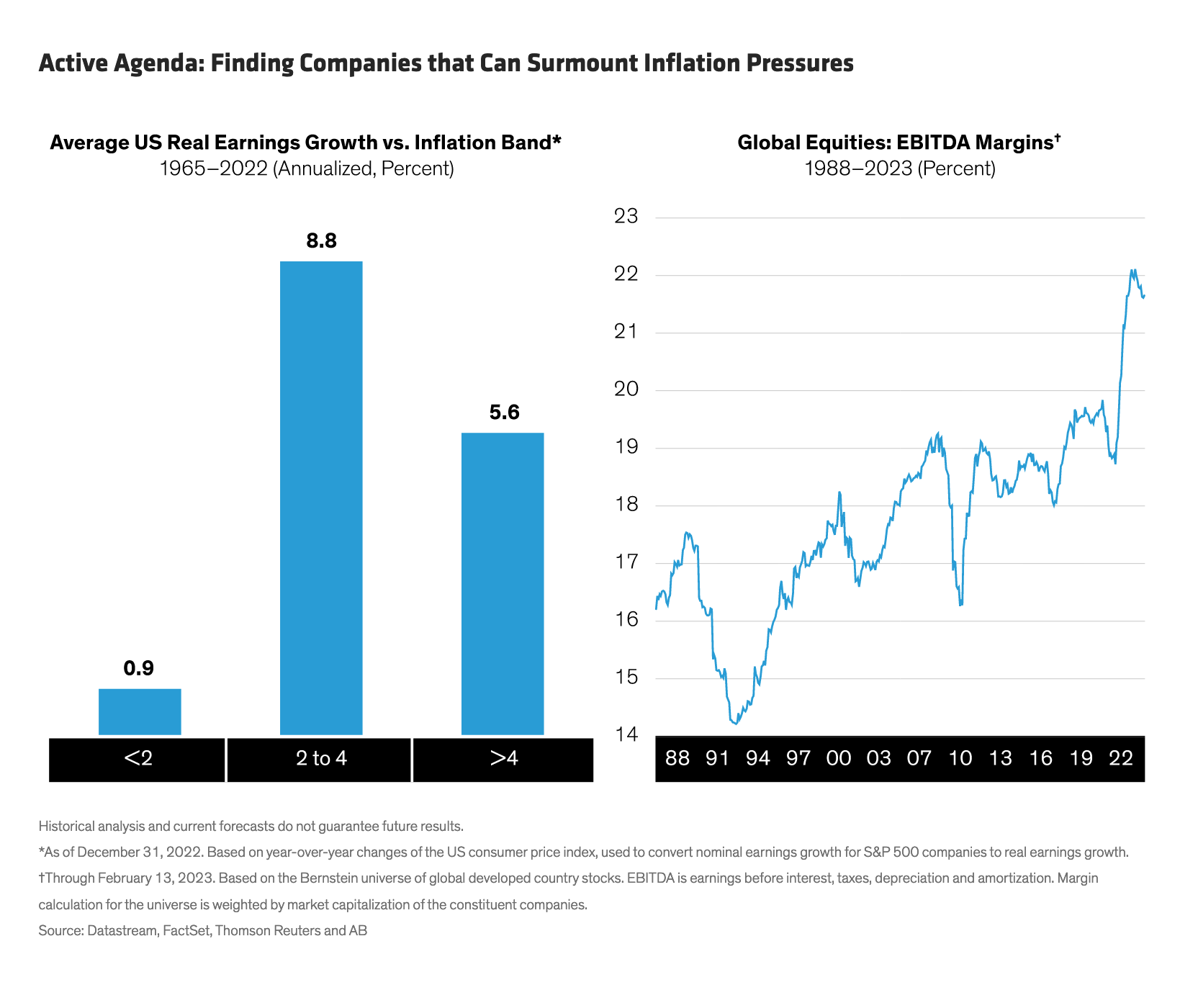

Our research shows when inflation was between 2% and 4% per year, US companies delivered annualized real earnings growth of about 8.8% since 1965 (Display). We’ve observed similar trends for global companies over a shorter time span. But can companies maintain earnings growth in the environment we’re facing? Measures of profitability point to the challenges. Today, global margins have only just begun falling from record high levels, implying that profitability may fall further. The combination of high margins, slower economic growth and input cost pressure will squeeze profitability for many companies, in our view. Equity investors must actively find companies that can maintain margins should these conditions persist.

- Global Divergence Points to Regional Rethink—inflation and its effects are affecting different countries and regions in different ways. After US markets outperformed non-US stocks for eight of the last 10 years, we believe that investors should revisit global equities in their portfolios, as they may pack a bigger punch. However, country-specific macroeconomic conditions and a company’s regional revenue exposure may vary, highlighting the importance of an active approach.

Passive portfolios can’t lean into countries that have underperformed but may offer strong recovery potential. For example, emerging market equities are showing signs of life after prolonged weakness, with China performing particularly well in recent months as the economic reopening gathers momentum. Active managers of global portfolios can tilt allocations to companies around the world that are attractively priced and likely to benefit from exposure to positive macroeconomic and business trends.

- Heightened Volatility Warrants Active Defenses—investors will need exposure to equities to generate inflation-beating returns, but markets are likely to be more volatile in the coming years. Many defensive equity portfolios rely on standard, backward-looking or rules-based recipes for reducing risk. However, these may not be the best way to cushion the downside. Active approaches can include high-quality equities from across the market with lower-volatility features—sourced from diverse sectors that might not typically be seen as defensive. Thematic approaches such as a single-sector healthcare allocation can also offer an active path to reduce risk.

The time is right for investors to take a closer look at their active and passive exposures in this new regime, as relying on what worked in the recent past will not likely prove to be a recipe for success. Higher inflation and interest rates can have far-reaching effects on companies, markets, economies and returns. Portfolios based on disciplined stock picking can help activate allocations with conviction for the twists and turns that lie ahead.

*****

About the Authors

Robert Milano

Robert Milano is a Senior Investment Strategist and Head of EMEA Equity Business Development. He is responsible for partnering with regional sales leadership to set strategic priorities and goals for the EMEA Equities business, develop new products, and engage with clients to represent the market views and investment strategies of the firm. Previously, Milano was a senior investment strategist supporting AB's Select US Equity and US Growth Portfolios. He joined the firm in 2013 as a product analyst on our Fixed Income Business Development team, where he supported the firm's taxable and municipal funds for the US Retail market. Milano holds a BS in finance from Manhattan College. Location: London

Walt Czaicki, CFA

Walt Czaicki serves as a Senior Vice President and Senior Investment Strategist for Equities at AB. He rejoined the firm in 2015 and has been in the investment-management industry since 1986. Czaicki's roles have ranged from a fundamental equity research analyst and portfolio manager to chief investment officer. Prior to rejoining AB, he worked on the buy side for a Regions Financial predecessor organization, as well as at Commerce Trust Company and Bank of America. Czaicki holds a BSBA in finance and an MBA, both from Saint Louis University. He is a CFA charterholder. Location: Dallas

David Wong

David Wong is a Senior Investment Strategist and Head of Asia Business Development for Equities. He joined AB in March 2015, bringing two decades of experience in global equity markets to the firm. Prior to joining AB, Wong was a partner at Janchor Partners, a Hong Kong-based long/short equity hedge fund with US$2 billion in assets under management (AUM). Before that, he had set up the Hong Kong office for GMT Capital, an Atlanta-based long/short equity hedge fund with $5 billion in AUM, where he served as portfolio manager and head of Asian investments. Over Wong's eight years at the two hedge funds, he was responsible for global investments in technology stocks, and also served as a generalist portfolio manager for the Asia-Pacific region, including Japan. He was also the founder and managing director of Mobile Adventures, a pan-Asian wireless content company. Wong started his career as an equity research analyst at Bankers Trust and Deutsche Bank; at Deutsche, he managed a team of five associates as the firm's regional semiconductor analyst. He holds a BA in political science from Yale University. Location: Hong Kong