by Larry Adam, CIO, Raymond James

Key Takeaways

- May see near-term choppiness in inflation prints

- Consumers’ excess savings won’t last in perpetuity

- Outlook for tech earnings may prove to be too pessimistic

Are you ready for the football finale? Over 100 million fans are expected to tune in to see which team – Philadelphia or Kansas City – has the will to win the big game. Even before kickoff, Sunday’s matchup is one for the record books. First, the game will have two starting Black quarterbacks for the first time in history – and its Black History Month. Second, brothers will clash for the first time as Jason and Travis Kelce take the field. But no matter the outcome, you can count on elite perseverance, discipline, preparation and teamwork being on display – the same qualities needed for a successful investment strategy. Ahead of the showdown on Sunday, we draw a few additional parallels between the game’s terminology and our outlook for the economy and financial markets.

- Monetary policy under further review | The markets are still not convinced that the Fed will have to be aggressive for longer in order to tackle still high inflation – anticipating two more hikes at the March and May Federal Open Market Committee (FOMC) meetings but reversing course with at least one interest rate cut by year end. While our economist is in agreement with the expectation for two additional hikes, he foresees the Fed ceasing tightening and pausing for the remainder of 2023. Why are we not scrambling to avoid getting sacked on our view? Because there may be near-term choppiness in the month-over-month inflation prints. And we will get the initial read with the January CPI & PPI reports (February 14 & 16) next week. But to be clear – this does not stop the year-over-year pace of inflation from moving lower. The recent rise in gas prices, which have risen ~$0.17 per gallon over the last month, may lead to a higher than desired increase at the headline level on a month-over-month basis in January and February. But burgeoning trends in real-time shelter data (e.g., Zillow rental rates) – which represent 33% of the CPI index – should continue to decelerate and guide inflation closer to the Fed’s 2% target by year end. As a result, the Fed may be ready to make a final call to end the tightening cycle in May, but that does not mean it’ll change its game plan by year end.

- Consumers the Most Valuable Players | Entering 2023, many market pundits were calling for a challenging first half. We were not on that team. Why? Consumers, who account for 70% of the economy, still had excess savings. This is evidenced by spending for this Sunday’s showdown. Fans attending in person are paying a pretty penny. In fact, ticket prices are the second highest on record – falling only behind 2015’s matchup between Tom Brady and Russell Wilson. And fans enjoying the game in the comfort of home are set to spend $16.5 billion – also the second highest on record! But note that these excess savings won’t last in perpetuity, and the labor market may start to show some weakness as layoffs expand beyond the tech sector. In assessing the health of the consumer, we will be monitoring data points such as credit card usage. And while it may be rising 15% year-over-year – the fastest pace since 1996 – we expect it to slow and lead to a mild recession around midyear.

- Big stars have sights set on the upcoming seasons | The 4Q22 earnings season is well past halftime, with more than 75% of the S&P 500 market capitalization having reported. And this includes many of the big-time players on the S&P 500’s roster (e.g., Alphabet, Apple, Amazon, Microsoft). Unfortunately, these typical tech standouts were unable to move the earnings growth chains, and the Index is on pace for its first quarter of negative earnings growth since 3Q20. With a comeback unlikely at this point, we’re now focused on the prospects for the year ahead and there is reason to believe that the tech sector will return to its glory days of above-average performance. First, tech companies have been at the forefront of cost cutting. If you look at job cuts, ~50% of the layoffs over the last three months have occurred in the tech space. Second, investment in tech continues to grow. Investment in tech currently makes up ~28% of total capex, and a recent Gartner survey suggested that ~80% of CEOs plan to boost tech investment in an effort to combat inflation and labor and supply constraints. Last but not least, a lot of the major headwinds that plagued 2022, such as a more aggressive Fed, higher interest rates, and China’s COVID restrictions are all set to turnaround—which should result in tech earnings gaining yards and helping S&P 500 earnings reach our goal line of $215.

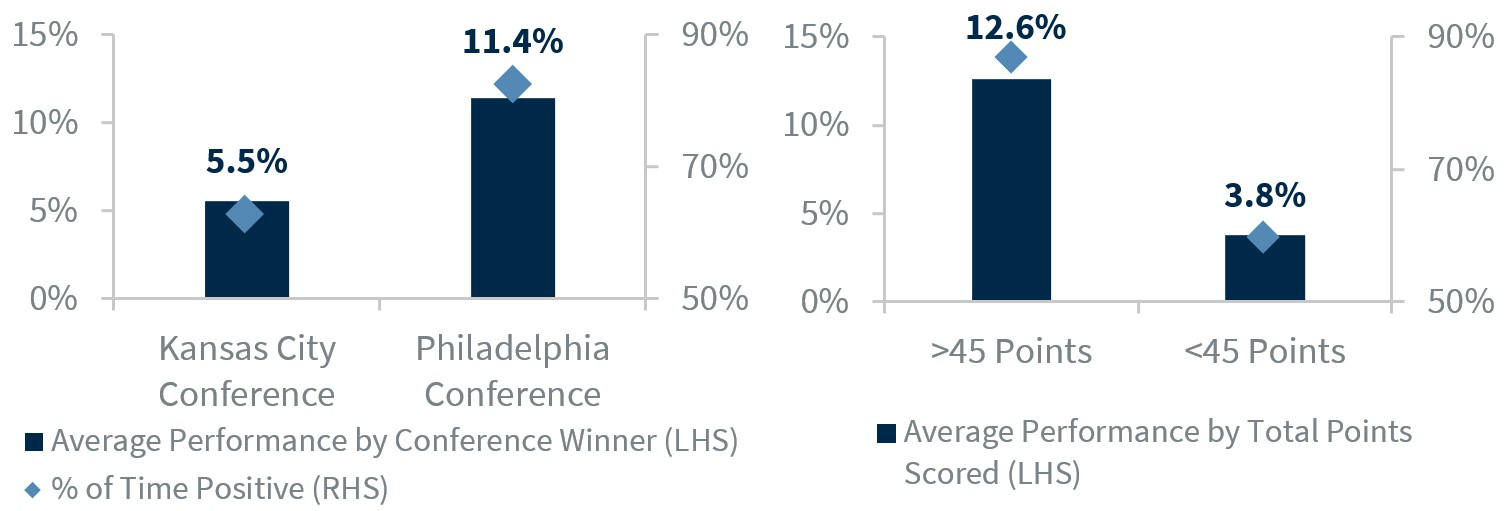

- Fantasy football perspective | Unquestionably, our positive outlook for the U.S. equity market is based on healthy fundamentals. While not statistically significant, sometimes superstitious investors want to ride the wave of interesting historical trends. So, if you have not decided which team to root for, history suggests that the best equity market performance has occurred when Philadelphia’s conference defeats Kansas City’s. But for our friends and followers in Kansas City who are hoping for the franchise to notch its second win in four years, you can at least hope for a high scoring game (>45 cumulative points), as this outcome has coincided with strong equity market returns (average: +12.6%) in the 12 months following the game.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.