Technical Notes

TSX Composite Index $TSX moved above $20,639.48 completing a reversal pattern.

Equal weight S&P 500 ETF $RSP moved above $149.59 extending an intermediate uptrend.

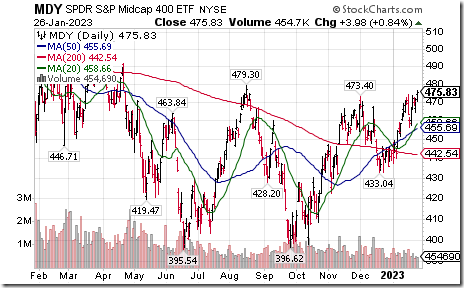

S&P Midcap 400 moved above $473.40 extending an intermediate uptrend.

Steel ETF $SLX moved above $67.02 to a 14 year high extending an intermediate uptrend.

Ansys $ANSS a NASDAQ 100 stock moved above $263.19 extending an intermediate uptrend.

Seagen $SGEN a NASDAQ 100 stock moved above $139.17 completing a reverse Head & Shoulders pattern.

IBM $IBM a Dow Jones Industrial Average stock moved below $137.20 following release of quarterly results setting an intermediate downtrend.

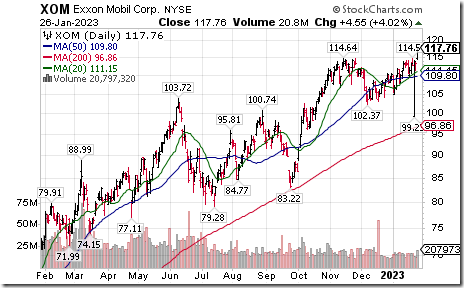

Exxon Mobil $XOM a Dow Jones Industrial Average stock moved above $114.64 to an all-time high extending an intermediate uptrend.

Sherwin Williams $SHW moved below $226.50 following lower than consensus quarterly results extending an intermediate downtrend.

Canadian Pacific $CP.TO a TSX 60 stock moved below $100.37 following release of quarterly results completed a double top pattern.

Cdn. Finanicals iShares $XFN.TO moved above $47.09 completing a reversal pattern.

Bank of Montreal $BMO.TO a TSX 60 stock moved above $134.69 completing a reversal pattern.

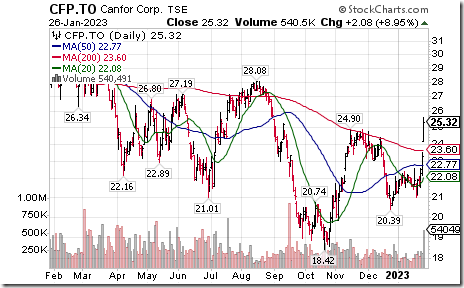

Timber & Forest Products iShares $WOOD moved above $77.87 extending an intermediate uptrend.

Canadian lumber stocks were exceptionally strong on anticipation of a recovery in demand. Also the sector was recommended by CIBC’s analyst. Canfor jumped 8.95%, Interfor gained 10.37% and West Fraser Timber advanced.8.0%.

Trader’s Corner

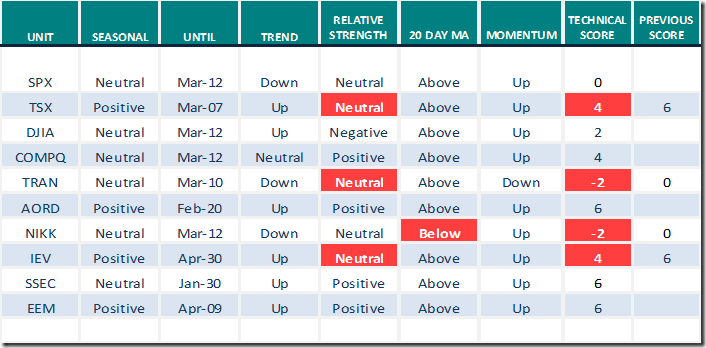

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 26th 2023

Green: Increase from previous day

Red: Decrease from previous day

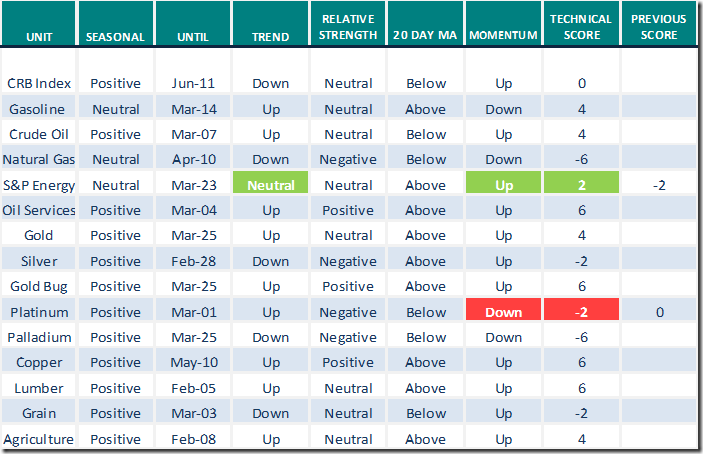

Commodities

Daily Seasonal/Technical Commodities Trends for January 26th 2023

Green: Increase from previous day

Red: Decrease from previous day

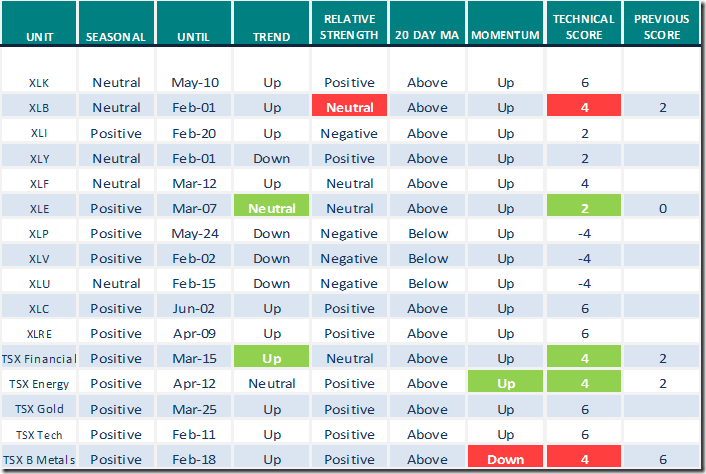

Sectors

Daily Seasonal/Technical Sector Trends for January 26th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Wall Street Manipulation Remains Bullish | Tom Bowley

Wall Street Manipulation Remains Bullish | Tom Bowley | Trading Places (01.26.23) – YouTube

S&P Fighting 200-Day Trend | Greg Schnell, CMT

S&P Fighting 200-Day Trend | Greg Schnell, CMT | Your Daily Five (01.26.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.80 to 72.80. It remains Overbought.

The long term Barometer added 2.00 to 67.20. It remains Overbought. Daily trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 2.12 to 78.39. It remains Overbought.

The long term Barometer added 1.69 to 72.03. It remains Overbought. Daily trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed