by Tony DeSpirito, CIO of U.S. Fundamental Equities, Blackrock

The calendar has turned the page to 2023 but investors are left trying to answer 2022’s difficult questions. U.S. Fundamental Equities CIO Tony DeSpirito weighs in.

A new year begins, and equity investors are grappling with some big but familiar questions. How have the answers evolved since the start of 2022? We offer our take on key concerns around inflation, recession and company earnings and suggest why fundamental-based stock selection may matter more in 2023.

Has the equity market seen bottom?

This is a particularly tortuous question for investors who might be trying to time their entry into U.S. stocks. We are not proponents of market timing. And the reality is that the “bottom” will only be clear in hindsight.

Absent greater clarity around inflation and the Fed’s moves to combat it, we do think stock prices can fall further and that market bounces such as those seen in Q4 2022 are more likely a bear market rally rather than the start of a new bull trend. That said, a lot of damage has already been done and we believe current equity pricing represents a decent entry point versus where we were one year ago.

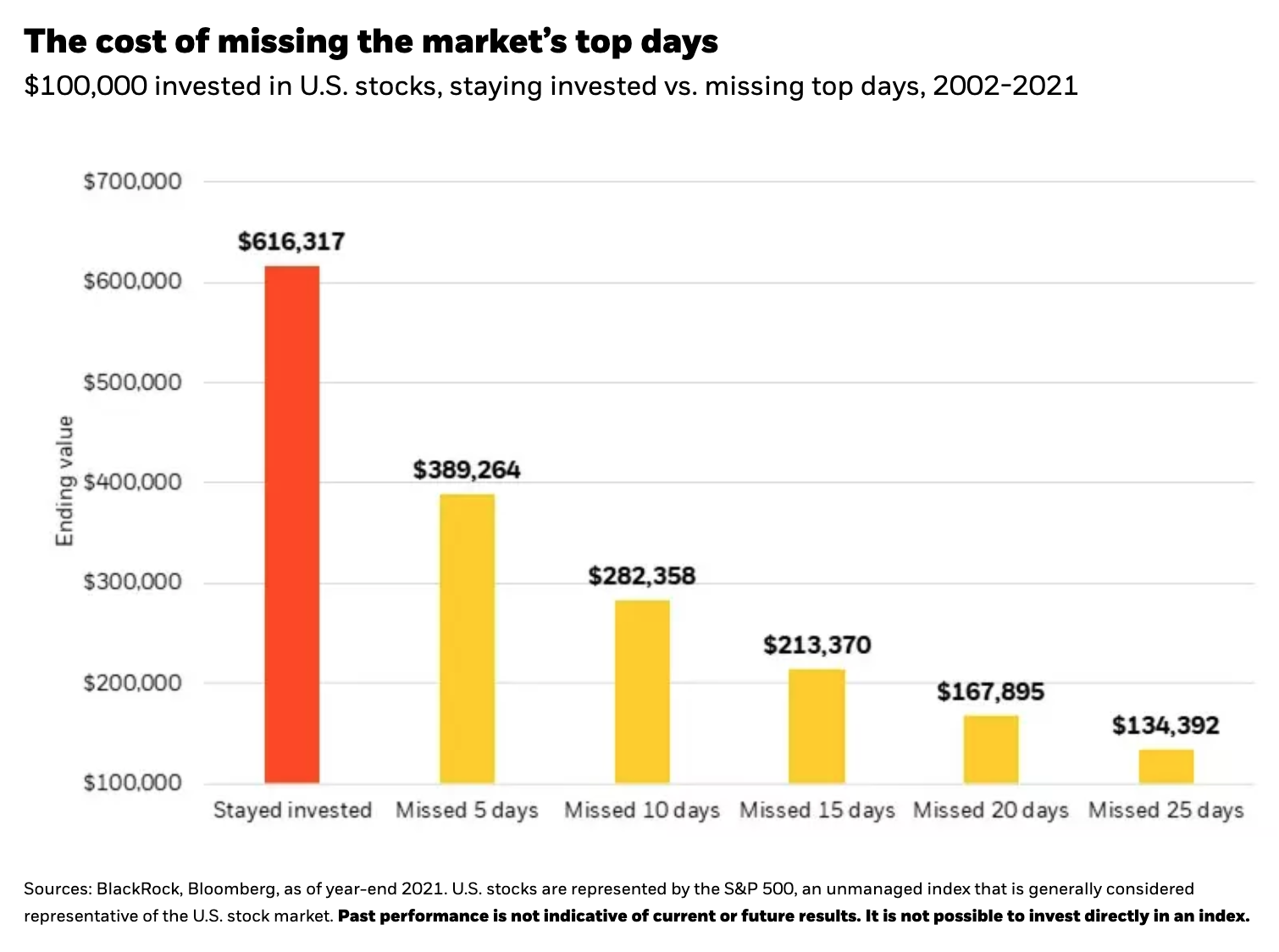

And although those bear market rallies can feel like cruel teasers of a turnaround, history shows that some of the market’s best days come within these episodes. This is a key reason long-term investors should stay invested even when it may not feel good. Missing those top-performing days can have a meaningful impact across time, as shown below.

As U.S. Growth Portfolio Manager Caroline Bottinelli astutely points out in “A stock market outlook for the generations,” it’s time in the market that matters more than timing the market.

Will the economy fall into recession in 2023?

Recession appears likely to us for a few reasons. Inflation above 5% is typically a recipe for recession. And in this cycle, the Fed has made big rate moves in a small span of time to catch up from a late start in addressing inflation. Fed actions historically affect the economy with a lag of anywhere from six to 18 months, so the economic consequences are yet to be fully realized.

Still, we think any recession could be relatively shallow in depth and duration given underlying strength in the U.S. consumer, which accounts for nearly 70% of U.S. GDP. Consumers typically have to repair balance sheets in the wake of a recession. This time balance sheets had improved during the pandemic and shutdowns and remain largely unimpaired.

Equities typically do well post-recession. We looked at average stock returns following five recessions since 1978 and found that the Russell 1000 Index had notched average returns of 7%, 15% and 34% over one, two and three years, respectively. Value stocks had done even better.*

What is the outlook for company earnings?

We see greater uncertainty in company earnings adding a layer of complication to the investment outlook. Companies had largely exhibited pricing power and an ability to pass on rising costs as consumer demand remained strong post-pandemic. But consumer tolerance for higher prices is beginning to fade. And for U.S. companies, the third-quarter earnings season showed the first hints of weakness.

With more uncertainty and greater dispersion in analyst earnings estimates, we see an opportunity for active stock pickers to apply their own research and analysis to identify companies that may be positioned to deliver above-average earnings growth. We expect this will be important as the market recovery unfolds and individual stocks are increasingly rewarded based on their underlying fundamentals.

We also note that the influence of the top-five mega-cap stocks that have been dominating index performance for the past several years may be waning: Despite their largely disappointing earnings results in October, the overall market was strong. This “decoupling” between the top five and the broader market comes as index concentration is declining. The top-five S&P 500 constituents represented a record high of 22% of the index’s total weight in August 2020, according to data from Refinitiv, and has been inching down since.

A continued decline in concentration could give an edge to active selection over index tracking. Because the major averages are market-cap weighted, index trackers benefited from the strong returns in the dominant stocks in recent years. Looking ahead, stock pickers have an opportunity to diversify away from these former drivers and into those stocks with potential to generate more impressive earnings growth as the business cycle moves from recession to recovery to eventual growth.

For more on our equity market outlook, see the latest issue of Taking Stock Quarterly Outlook.

Copyright © Blackrock