Technical Notes

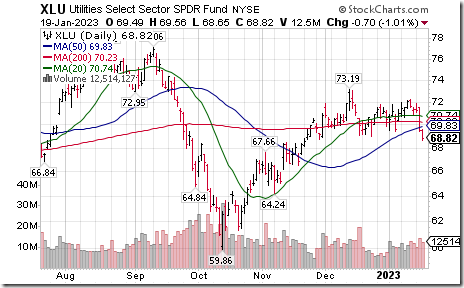

Utilities SPDRs $XLU moved below $69.03 completing a double top pattern.

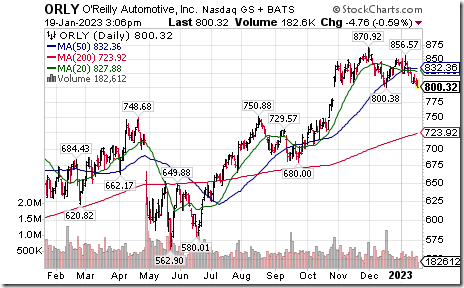

O’Reilly Automotive $ORLY, a NASDAQ 100 stock moved below $800.38 completing a double top pattern.

Xcel Energy $XEL a NASDAQ 100 stock moved below intermediate support at $68.29.

Trader’s Corner

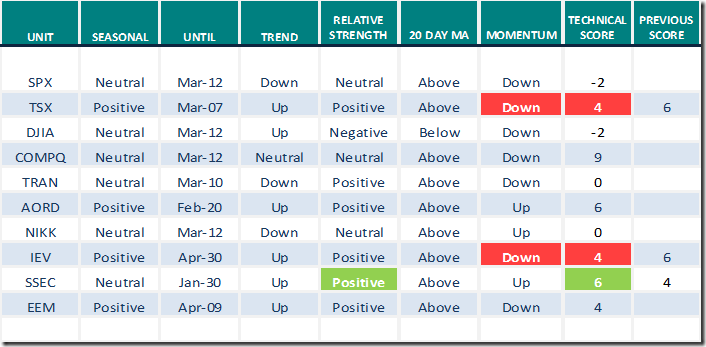

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

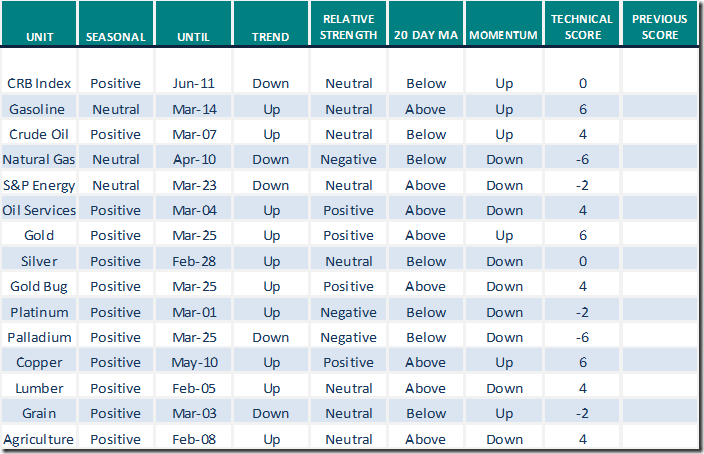

Commodities

Daily Seasonal/Technical Commodities Trends for January 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

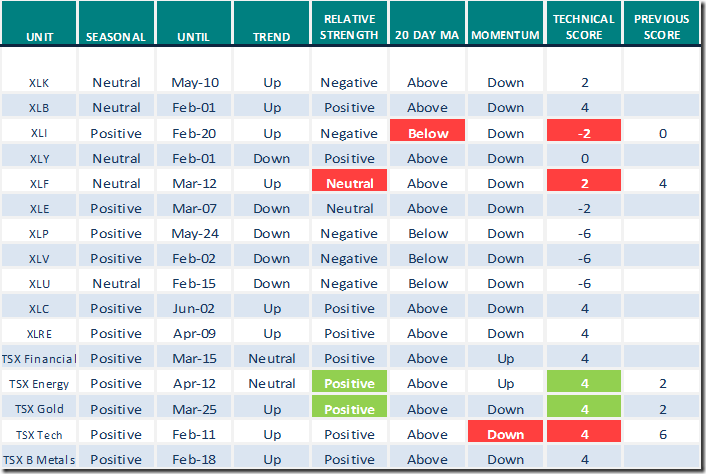

Sectors

Daily Seasonal/Technical Sector Trends for January 19th 2023

Green: Increase from previous day

Red: Decrease from previous day

Don Vialoux on “Wolf on Bay Street”

Don was interviewed as part of the radio program (Corus 640) released this Saturday at 7:00 PM EST. Focus is on the outlook for 2023.

Links offered by valued providers

Sprott special report: 2023 uranium outlook

2023 Uranium Outlook: Is Nuclear Power Out of the Penalty Box? (sprott.com)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 11.00 to 49.00. It changed from Overbought to Neutral on a move below 60.00. Short term trend is down.

The long term Barometer dropped 3.00 to 56.80. It remains Neutral. Short term trend is down.

TSX Momentum Barometers

The intermediate term Barometer dropped 3.39 to 71.19. It remains Overbought.

The long term Barometer added 0.42 to 67.37. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed