by Robert Hopper, Vivek Bommi, Susan Hutman, Will Smith, AllianceBernstein

Persistent inflation and prospects for a global economic slowdown loom large over the credit markets as we transition to 2023. Central banks around the world are attempting to beat back inflation and aggressive monetary tightening is working its way through the global financial markets, with additional rate hikes to come.

Fortunately for investors in investment-grade and high-yield bonds, credit metrics for many issuers are strong relative to their history following the global financial crisis, and they will enter any slowdown from a position of strength. But with the macro picture increasingly murky, investors will need to be selective.

Yields and Spreads Are Elevated

Following a protracted period of rate hikes that began in March 2022, both bond yields and yield spreads are at multi-year highs. To grasp just how much yields have jumped in over a year, consider that as recently as the third quarter of 2021, roughly half of European investment-grade corporates offered negative yields. Today, yields on US investment-grade corporates are at their highest levels since the global financial crisis, while on a currency-hedged basis, European investment-grade yields are even higher than equivalent US credits.

Higher yields are providing not only a significant yield advantage for fixed-income corporates over equity dividend payers, but they are also mitigating the downside of risk assets. In our view, generous credit spreads are also helping to compensate investors for the risk of recession.

Due to stubborn global inflation, our global economics team expects to see additional rate hikes early in 2023, although central banks are likely to slow the pace of monetary tightening in the face of slowing global economic growth. Until this process plays out and investors have more clarity about the direction of rates and corporate earnings, we expect yields—as well as market volatility—to remain elevated.

Company Fundamentals Are Sound

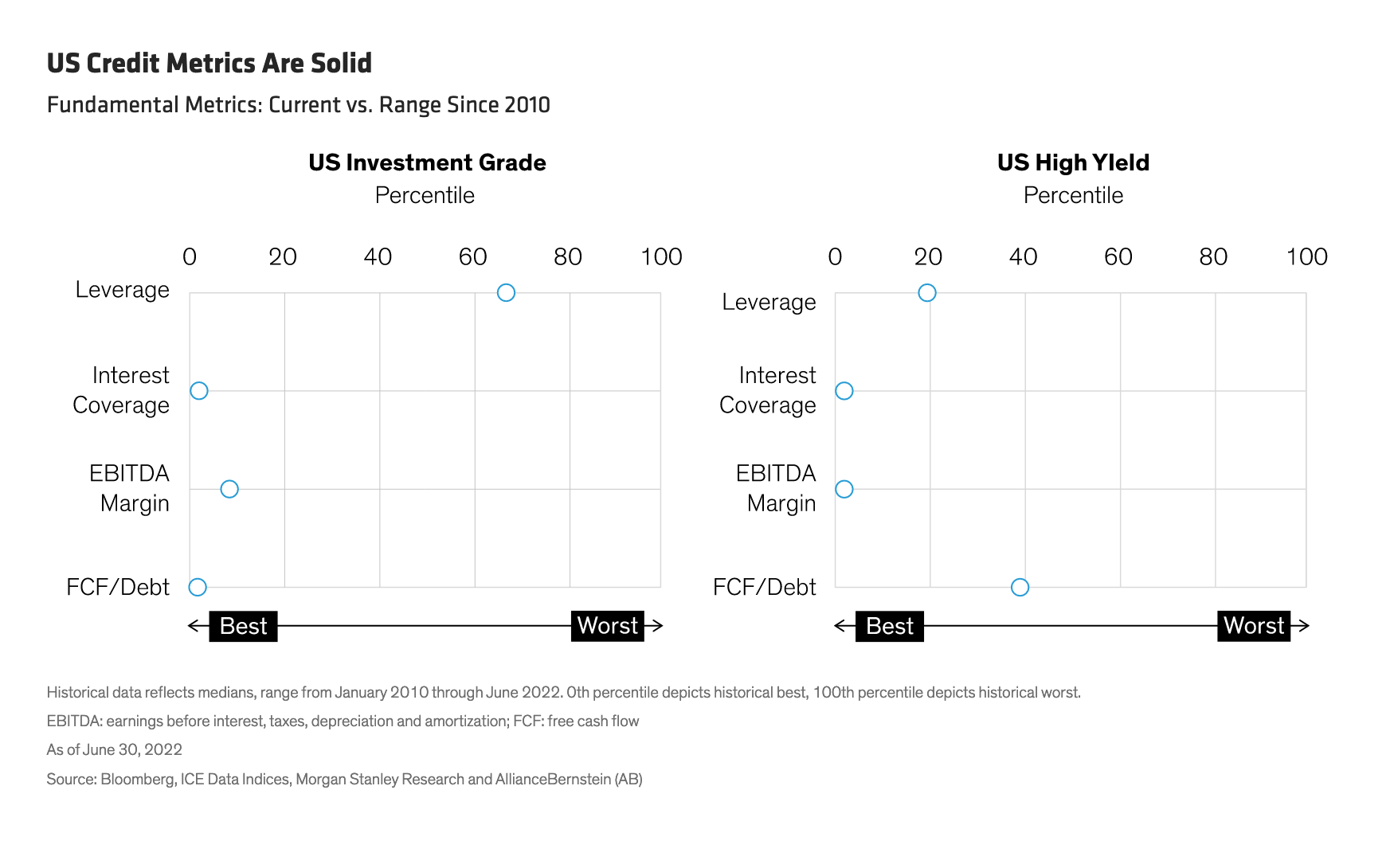

Fortunately, many companies enter 2023 on solid financial ground. Corporate fundamentals in the US and Europe are rebounding nicely from pandemic-related weakness, and commodity prices are retreating. Based on measures of profitability, as well as key credit metrics like leverage and debt-service coverage, most sectors appear solid relative to their ranges following the global financial crisis (Display). This contrasts with past economic slowdowns when corporate fundamentals have typically been much weaker.

Strong fundamentals are due in part to fiscal prudence necessitated by the COVID-19 pandemic, which prompted many companies to manage their balance sheets conservatively. They also reflect that typically procyclical commodity companies have been benefitting from tight supply and high prices, using the related strong free cash flow to reduce debt to post-financial-crisis lows.

Strong fundamentals are due in part to fiscal prudence necessitated by the COVID-19 pandemic, which prompted many companies to manage their balance sheets conservatively. They also reflect that typically procyclical commodity companies have been benefitting from tight supply and high prices, using the related strong free cash flow to reduce debt to post-financial-crisis lows.

This kind of responsible stewardship will be especially important if global growth slows in 2023, as we expect it will. Companies with strong balance sheets and access to funding will be better positioned to weather the reduced demand and tighter credit conditions that typically accompany slower economic growth.

In addition, high-yield bond issuers should enjoy lower coupons over the coming year. That’s because there’s no approaching maturity wall that would force companies to issue debt at higher prevailing rates. In fact, only 20% of the high-yield market will mature by the end of 2025, with most maturities coming between 2026 and 2029. Even if yields remain elevated for the next four years, coupon rates shouldn’t return to pre-COVID levels north of 6% until early 2026.

Credit Stress Could Tick Upward, but Default Surge Not Likely

In the US, high-yield defaults peaked at 6.3% in October 2020, clearing out the weakest companies from the investable universe. In addition, a cohort of fallen angels (formerly investment-grade bonds) bolstered the BB portion of the high-yield universe to 50%, improving the overall quality of high-yield bonds.

Similarly, the European high-yield market has seen BBs increase to 63% of the total. The weight of BBs in both these markets has increased roughly 10 percentage points since the global financial crisis. As a result, both US and European high-yield markets in the aggregate are more creditworthy and should be better able to withstand market stress than in past downturns.

That’s good news for investors, as both European and US corporates are pricing in an uptick in stress over the coming year—but not a significant escalation in defaults. This is consistent with our expectation for only a modest increase in credit downgrades and defaults over the next 12–18 months. In the event the macro picture weakens more materially than expected, we could see greater stress, but given the starting point for corporate balance sheets and conservative financial policies, we would anticipate a less severe impact on corporate issuers in the aggregate.

Technicals Are Supportive of Credit

Technical factors appear to be supportive of credit. The European Central Bank (ECB) has concluded its myriad bond-buying programs, but the ECB continues to invest proceeds from investment-grade holdings. Meanwhile, eurozone credit issuance has fallen, keeping supply and demand relatively well-balanced.

In the US, high-yield technical factors go into 2023 with significant momentum. As investors returned to the market in droves late last year, high-yield mutual funds in November reported their largest monthly inflows since July 2020. Such high demand, which we believe will persist into 2023, should bode well for valuations. We expect that investment-grade corporate bonds will be next in line as elevated yields lure investors from the sidelines.

Given compelling yields, solid corporate fundamentals and potentially strong fund flows, we believe the coming year holds significant potential for corporate bond investors.

About the Authors

Robert Hopper is a Senior Vice President and the Director of Corporate Credit and Economic Research. He joined AB in 2013 and now oversees the teams that provide fundamental analysis of global investment-grade, high-yield and emerging-market corporate and sovereign issuers and global economic analysis. Hopper is also responsible for driving the corporate credit research outlook for the Fixed-Income department. He sits on various internal investment committees and is the author of a number of published papers, focused on insights into corporate defaults and fallen angels during the COVID-19 pandemic, inflation risks, and rising star candidates. Earlier in his tenure at AB, Hopper was responsible for coverage of the high-yield telecom, cable, satellite and media sectors. Prior to AB, he was a managing director and head of the High-Yield and Investment-Grade Credit Analyst team at UBS Investment Bank, where he was also the senior high-yield and investment-grade telecom, media and technology analyst. Earlier in his career, Hopper served as an equity analyst at UBS and Bear Stearns. He holds a BS in accounting from Saint Michael's College and an MBA from Boston College. Location: New York

Vivek Bommi, a Senior Vice President, is Head of European Fixed Income and Director of European and Global Credit at AB. In these roles he leads AB’s European/UK Fixed Income, European Income, Euro High Yield, Euro Credit, Financial Credit and Global Credit teams. Bommi has more than 20 years of investment experience, with a background in both research and portfolio management. Prior to joining AB in 2021, he served as head of European Non-Investment Grade at Neuberger Berman, leading the teams managing European high-yield, loan and collateralized loan obligation portfolios, and global high-yield strategies. Bommi was also a member of Neuberger Berman’s Credit Committee for Non-Investment Grade Credit and the Fixed Income Investment Strategy Committee. He previously served as director of Non-Investment Grade Research. Earlier in his career, Bommi worked in leverage finance at The Carlyle Group and Bank of America. He holds a BS in finance from the University of Illinois at Urbana-Champaign and an MBA from Columbia Business School at Columbia University. Bommi is a CFA charterholder and a Certified Public Accountant. Location: London

Susan Hutman is a Senior Vice President and Director of Investment Grade Corporate Credit Research. She joined AB in 1999 and now oversees a team that provides fundamental analysis of global investment-grade credits and manages AB Fixed Income's broader CRISIL relationships, which include a group of 20 analysts based in India, China and Argentina. As IG research director, Hutman is also responsible for driving the corporate credit research outlook for the Fixed Income department and has authored several published papers on topics that include climate change effects on the energy sector, the impact of COVID-19-induced corporate borrowings on default rates and fallen angels, prospects for rising stars following COVID-19, and US inflation risks. In the past several years, she led the Fixed Income department's efforts to develop its responsible investing strategy, specifically focusing on broadening ESG integration and engagement across asset classes, while leveraging her role in the firmwide Responsible Investing Steering Committee. Hutman was named Director of Investment Grade Corporate Credit Research in 2018. Earlier in her tenure at AB, she was a fundamental credit research analyst and covered a range of consumer and commodity sectors. Before joining the firm, Hutman worked as a fixed-income salesperson at PaineWebber. She holds a BA in economics from Barnard College, Columbia University, and an MBA from Columbia Business School. Location: New York

Will Smith is Director of US High Yield Credit. He is also a member of the High Income, Global High Yield, Limited Duration High Income, Short Duration High Yield and European High Yield portfolio-management teams. Smith designed and is one of the lead portfolio managers for AB’s Multi-Sector Credit Strategy, which invests across investment-grade and high-yield credit sectors globally.

A disciplined process that focuses on a variety of approaches—including quantitative, liquidity and macro models—to generate returns is key to Smith’s investment philosophy. This is an aggressive style within tight limits, one that emphasizes risk management and a longer investment horizon.

“Building better credit portfolios isn't just about humans doing deep research,” Smith says. “It’s focusing that research where and when other approaches won’t be as effective.”

Copyright © AllianceBernstein