Editor’s Note

Although Monday is a holiday in the U.S., Tech Talk will be published as usual.

Technical Notes

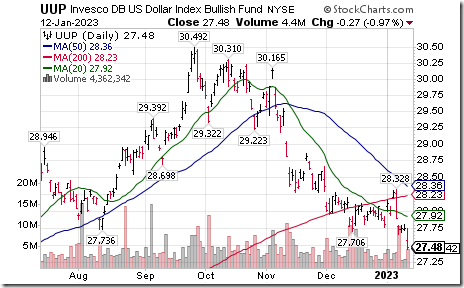

Weakness in the U.S. Dollar Index and its related ETN: UUP on a break below 27.71 triggered strength in commodity prices and stocks including gold, copper and crude oil.

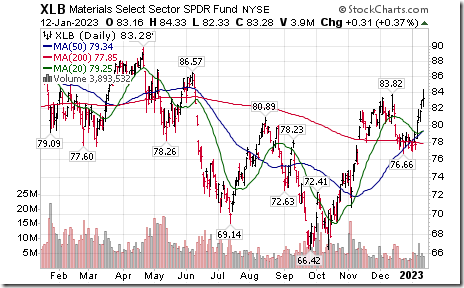

Materials SPDRs moved above $83.82 extending an intermediate uptrend.

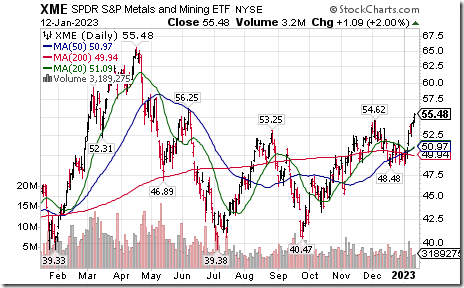

Metals & Mining iShares $XME moved above $54.12 extending an intermediate uptrend.

Southern Copper $SCCO one of the largest copper producers in the world moved above $75.58 and $75.88 to an all-time high

Industrial SPDRs $XLI moved above $102.82 extending an intermediate uptrend.

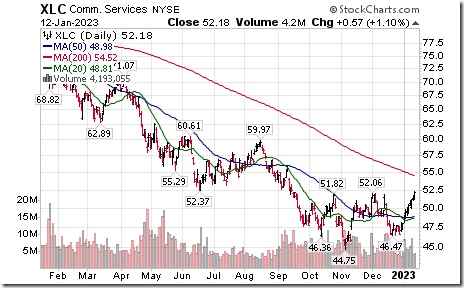

Commercial Services SPDRs moved above $52.06 completing a reverse Head & Shoulders pattern.

Airlines ETF $JETS moved above $19.15 and $19.36 completing a reverse Head & Shoulders pattern.

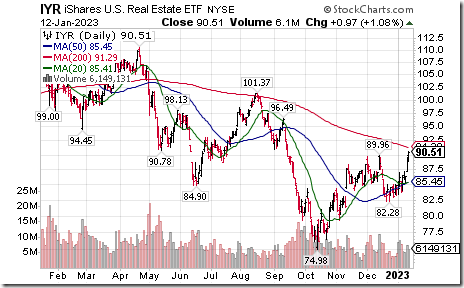

U.S. REIT iShares $IYR moved above $89.96 extending an intermediate uptrend.

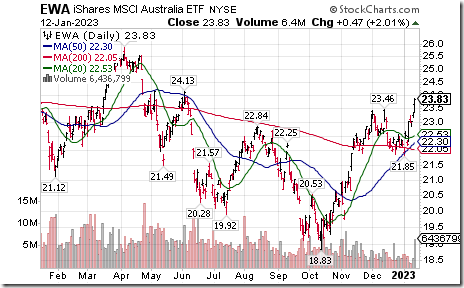

Australia iShares $EWA moved above $23.46 extending an intermediate uptrend.

Pacific ex Japan iShares $EPP moved above $44.81 extending an intermediate uptrend.

Taiwan iShares $EWT moved above $43.31 completing a reverse Head & Shoulders pattern.

Unit is heavily invested in Taiwan Semiconductor.

Biotech ETF $FBT moved above $160.44 extending an intermediate uptrend.

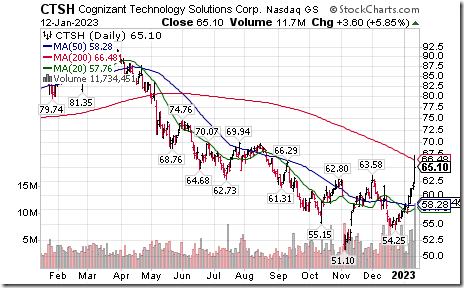

Cognizant $CTSH a NASDAQ 100 stock moved above $63.58 completing a reverse Head & Shoulders pattern.

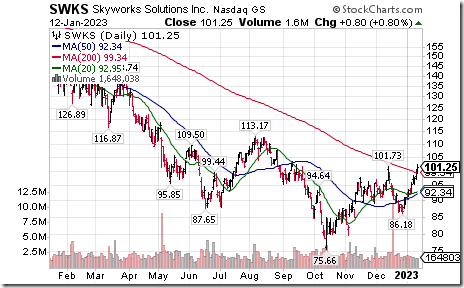

Skyworks Solutions $SWKS a NASDAQ 100 stock moved above $101.73 setting resuming an intermediate uptrend.

KLA Tencor $KLAC a NASDAQ 100 stock moved above $419.57 extending an intermediate uptrend.

Magna International $MG.TO a TSX 60 stock moved above Cdn$85.02 extending an intermediate uptrend.

Power Corp $POW.TO a TSX 60 stock moved above $34.71 completing a reverse Head & Shoulders pattern.

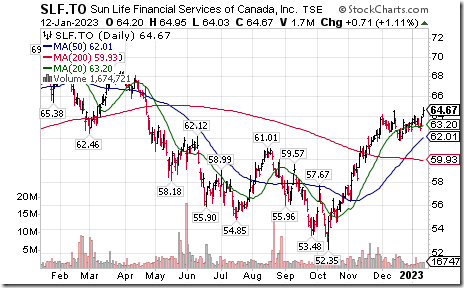

SunLife Financial $SLF.TO a TSX 60 stock moved above Cdn$64.64 extending an intermediate uptrend.

Waste Connections $WCN.TO a TSX 60 stock moved below intermediate support at $172.45.

Trader’s Corner

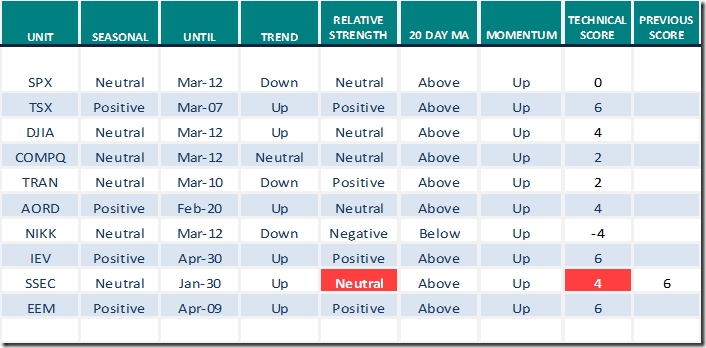

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 12th 2023

Green: Increase from previous day

Red: Decrease from previous day

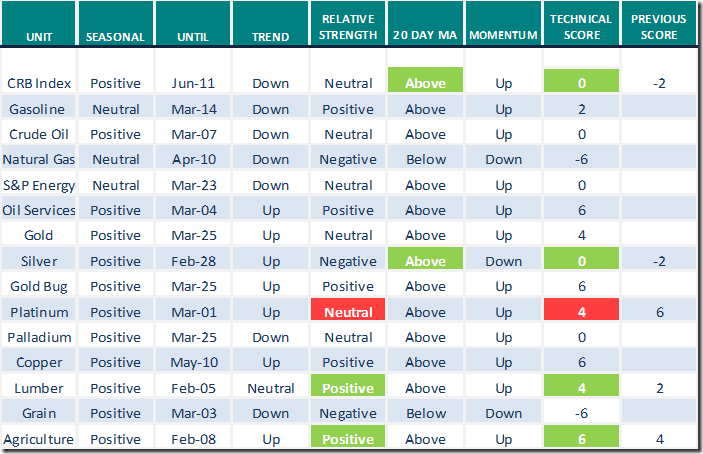

Commodities

Daily Seasonal/Technical Commodities Trends for January 12th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for January 12th 2023

Green: Increase from previous day

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 77.20. It remains Overbought. Short term trend remains up.

The long term Barometer added 1.60 to 66.60. It remains Overbought. Short term trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 1.69 to 72.45. It remains Overbought. Short term trend remains up.

The long term Barometer added 3.30 to 63.98. It remains Overbought. Short term trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed