Technical Notes

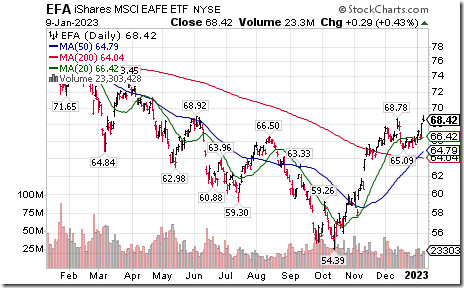

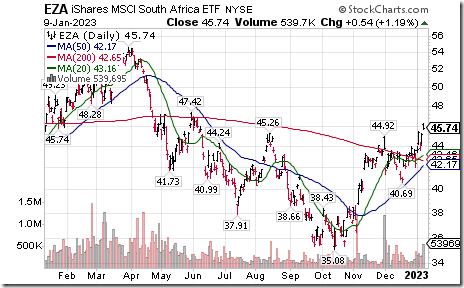

EAFE iShares $EFA moved above $68.58 extending an intermediate uptrend. Notable breakouts in EAFE were breakouts by emerging country ETFs. Emerging markets iShares $EEM moved above $42.22 extending an intermediate uptrend. South Africa iShares $EZA moved above $45.26 completing a reverse Head & Shoulders pattern. South Korea iShares $EWY moved above $60.22 and $61.61 completing a reverse Head & Shoulders pattern.

Schlumberger $SLB an S&P 100 stock moved above $55.85 extending an intermediate uptrend

MasterCard $MA an S&P 100 stock moved above $368.66 extending an intermediate uptrend.

Abbott Labs $ABT an S&P 100 stock moved above $112.91 extending an intermediate uptrend.

IDEXX, a NASDAQ 100 stock moved above $448.01 extending an intermediate uptrend.

Lululemon $LULU a NASDAQ 100 stock moved below $306.38 setting an intermediate downtrend. The company lowered guidance.

Regeneron $REGN a NASDAQ 100 stock moved below $678.02 setting an intermediate downtrend.

DexCom $DXCM a NASDAQ 100 stock moved below $108.68 completing a Head & Shoulders pattern.

Constellation Software $CSU.TO, a TSX 60 stock moved above $2,209.97 and $2,220.39 extending an intermediate uptrend.

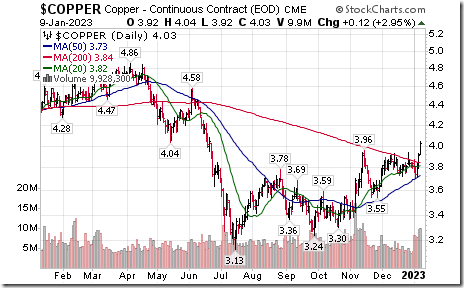

Base Metals iShares XBM.TO moved above $20.24 extending an intermediate uptrend. Units hold HudBay Minerals and BHP Group. HudBay Minerals $HBM.TO a major base metals producer move above $7.92 extending an intermediate uptrend. BHP Group $BHP another major base metals producer moved above $66.51 extending an intermediate uptrend.

Strength in Base Metal equities and ETFs was prompted by a move by spot copper above $3.96 per lb. extending an intermediate uptrend.

Trader’s Corner

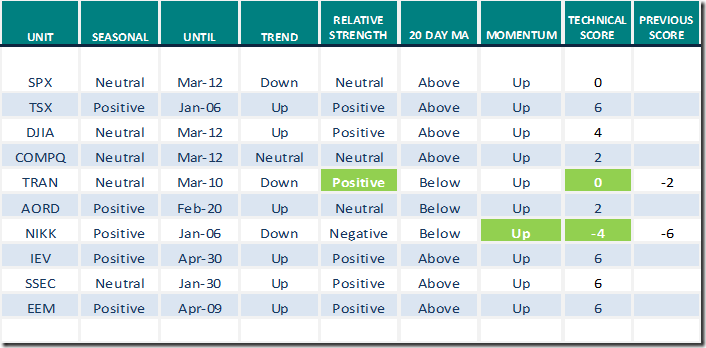

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 9th 2023

Green: Increase from previous day

Red: Decrease from previous day

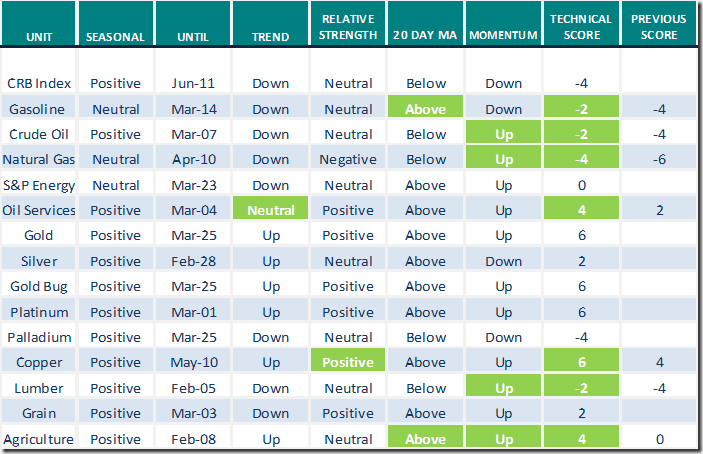

Commodities

Daily Seasonal/Technical Commodities Trends for January 9th 2023

Green: Increase from previous day

Red: Decrease from previous day

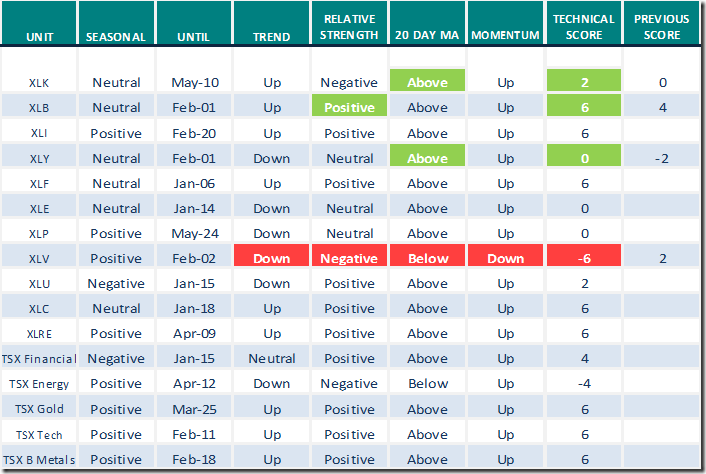

Sectors

Daily Seasonal/Technical Sector Trends for January 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

Next Canadian Association for Technical Analysis Meeting.

Next meeting is scheduled tonight at 8:00 PM EST. Speaker is David Cox from Raymond James. Everyone is welcome. Not a member of CATA? See https://canadianata.ca/

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 3.20 to 64.60. It remains Overbought.

The long term Barometer eased 0.69 to 57.20. It remains Neutral

TSX Momentum Barometers

The intermediate term Barometer added 0.85 to 65.25. It remains Overbought.

The long term Barometer slipped 0.42 to 54.24. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed