Editor’s Note: Next Tech Talk report is released on Tuesday December 27th 20222

Technical Notes

Israel iShares $EIS moved below $56.18 extending an intermediate downtrend.

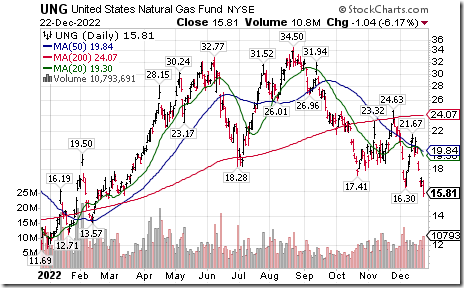

Natural Gas ETN $UNG moved below $16.30 extending an intermediate downtrend.

Platinum ETN $PPLT moved below $90.20 completing a Head & Shoulders pattern.

PayPal $PYPL a NASDAQ 100 stock moved below $67.58 extending an intermediate downtrend.

Canopy Growth $WEED.TO a TSX 60 stock moved below $3.08 extending an intermediate downtrend.

Trader’s Corner

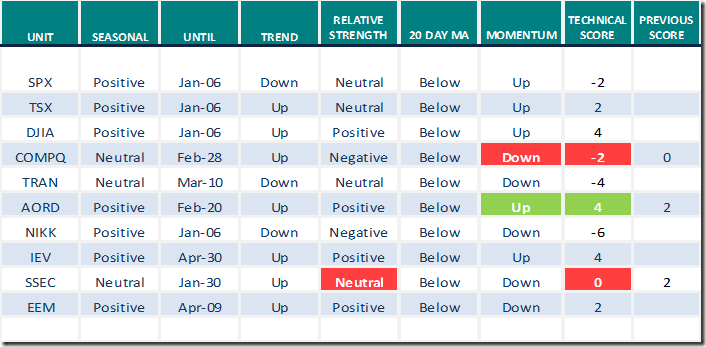

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for December 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

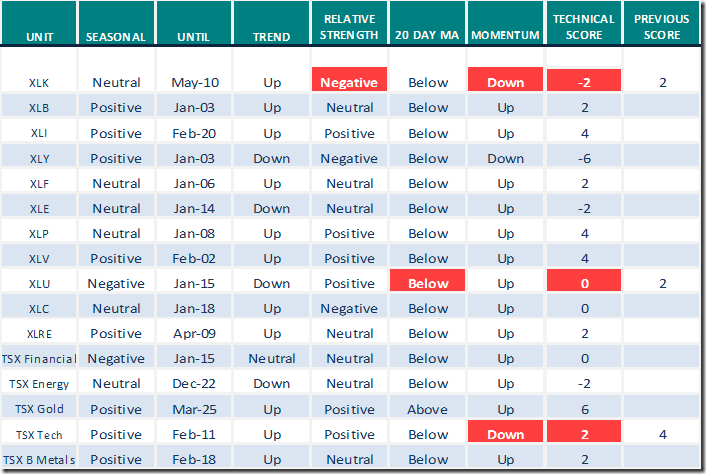

Sectors

Daily Seasonal/Technical Sector Trends for December 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by a valued provider

Greg Schnell summarizes 2022 in review

https://www.youtube.com/watch?v=yl0Bjt4Ajow

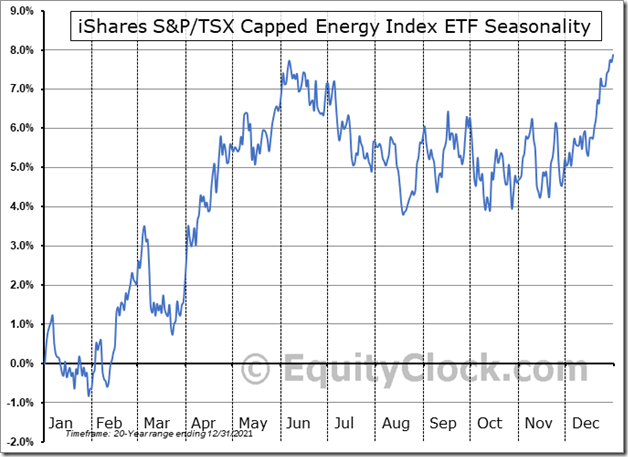

Seasonality Chart of the Day

Seasonal Chart Analysis

Analysis of the iShares S&P/TSX Capped Energy Index ETF (TSE:XEG.to) seasonal charts above shows that a Buy Date of December 22 and a Sell Date of April 12 has resulted in a geometric average return of 1.67% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 15 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 6.67% per year.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 10.00 to 52.60. It returned from Overbought to Neutral on a drop below 60.00.

The long term Barometer slipped 1.80 to 50.20. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 9.08 to 48.31. It remains Neutral.

The long term Barometer slipped 1.07 to 45.34. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed