by James MacGregor, CFA, Chief Investment Officer—US Small and Mid Cap Value Equities; Head—US Value Equities,

Bruce K. Aronow, CFA, Chief Investment Officer—Small and SMID Cap Growth Equities,

Samantha S. Lau, CFA, Co-Chief Investment Officer—Small and SMID Cap Growth Equities, AllianceBernstein

Small-cap companies are usually the most vulnerable to volatility, with their stock prices and earnings getting hit particularly hard and early in economic downturns, much like what occurred in 2022. Yet they also tend to lead the way on both fronts during recoveries.

In fact, after significantly underperforming their large-cap peers over the last few years, small-cap valuations have become more compelling. And recent earnings forecasts are adding to their recovery potential.

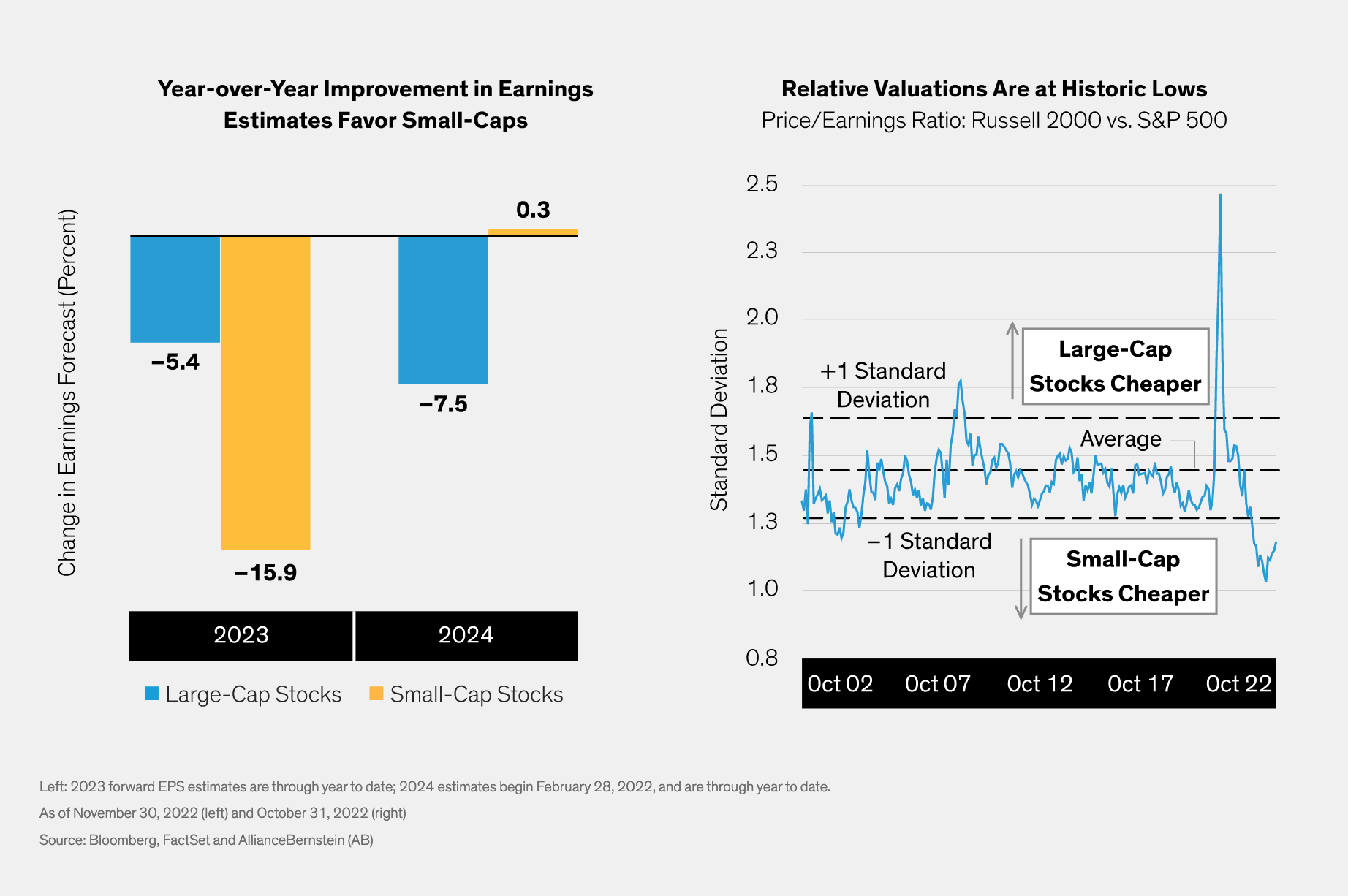

Earnings forecasts reveal an interesting discrepancy between larger and smaller stocks. Consensus 2023 earnings-per-share (EPS) estimates for US small-caps dropped 15.9% from January 1 through November 30, 2022, versus just 5.4% for large-cap estimates (Display).

Further out, preliminary earnings forecast revisions for 2024 have trended much more positive for small-caps (0.3%), while still trending sharply downward for large companies (–7.5%). We think the greater drop in near-term earnings estimates suggests that expectations may already be factoring in more challenges from a potential recession. While estimates further out are harder to have confidence in, they suggest that small-caps can offer greater upside as the economy gradually recovers.

Valuation Gap Looks Extreme

Meanwhile, small-cap stocks are also trading at extremely depressed valuations—the lowest in 20 years—compared to larger companies, based on price-to-earnings ratios. Current geopolitical tensions and macroeconomic uncertainties have disproportionately and indiscriminately impacted small companies. Investors have discounted further potential hazards for small-caps, without regard to company fundamentals. So, we think firms that offer resilient business models will stand out and benefit the most along the road to recovery.

Small-cap stocks are commonly seen as riskier than other asset classes. But their relatively higher volatility can create opportunity, too. We believe that companies that combine attractive valuations and high-quality features such as strong management teams, good business models and solid balance sheets can best navigate the uncertain future.

So, even if there’s more macro pain and market volatility ahead, smaller stocks might be further along the route to recovery. We think small-cap valuations and forward estimates reflect investors having discounted many of the hazards ahead—perhaps more so than for large-caps. Investors who have been underweight small-caps in their allocations might want to consider re-positioning toward portfolios of small or mid-size companies that offer resilient business models currently trading well below their long-term potential.

About the Authors James MacGregor, CFA

James MacGregor, CFA

Deep-dive problem solving brought James MacGregor to AB from the sell side at Morgan Stanley in 1998. As Chief Investment Officer of US Small and Mid Cap Value Equities, the pursuit of differentiated perspectives in an ever-changing landscape characterizes his investment philosophy.

"Investing involves risk. A firm that understands that is critically important," MacGregor says. Finding that great opportunity that offers a compelling return for a prudent level of risk is a product of fundamental research and a disciplined process to understand what makes companies tick. "I think we have a best-in-class idea generation engine. Our ability to access a global research footprint creates an undeniable edge."

The genuine collaboration at AB continues to motivate MacGregor. "You never want to be the smartest person in the room," he says. "I've succeeded in that for 23 years! That's a good thing because I'm constantly being pushed to do better."

Since 2000, Bruce K. Aronow has held the role of Chief Investment Officer for Small and SMID Cap Growth Equities. He is responsible for the Small and SMID Cap Growth consumer/commercial services sector and is a member of AB's Talent Development team.

Consistency and a clearly defined process characterize Aronow's investment strategy. In contrast to other funds run by managers that often shoot from the hip (or “manage based on their gut”), his approach aims to take the emotion out of investing. The result is a defined, repeatable process that provides consistent returns over a full market cycle.

“AB's differentiator is a portfolio that not only outperforms but behaves consistent with expectations,” Aronow says.

Samantha S. Lau was named Co-Chief Investment Officer of Small and SMID Cap Growth Equities in 2014. Previously, she was a portfolio manager/analyst responsible for research and portfolio management for the technology sector of AB's Small and SMID Cap Growth strategies. Prior to joining the firm in 1999, Lau covered small-cap technology companies for INVESCO (NY) (formerly Chancellor Capital Management).

Getting into the weeds and discovering real investment opportunities motivates Lau, and intellectual honesty is a cornerstone to her investment philosophy. “The markets are very humbling,” she says. “The ability to separate emotion from intelligence is hard. It's a skill.”

Quantitative tools, combined with the willingness to re-assess a thesis, helps her build a well-diversified portfolio. “Intelligent people don't like to be wrong,” Lau says. “But you have to be vigilant and see that your thesis is intact.”