Technical Notes

BMO Equal Weight Global Base Metals ETF $ZMT.TO moved above $52.50 extending an intermediate uptrend.

American Express $AXP a Dow Jones Industrial Average stock moved above $158.88 extending an intermediate uptrend

Salesforce.com $CRM a Dow Jones Industrial Average stock moved below $136.04 extending an intermediate downtrend.

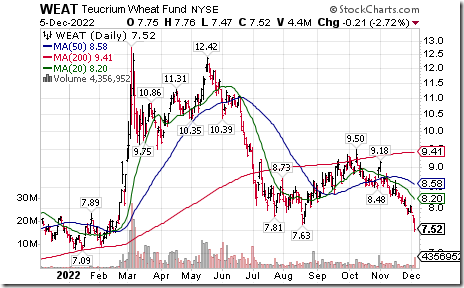

Wheat ETN $WEAT moved below $7.63 extending an intermediate downtrend.

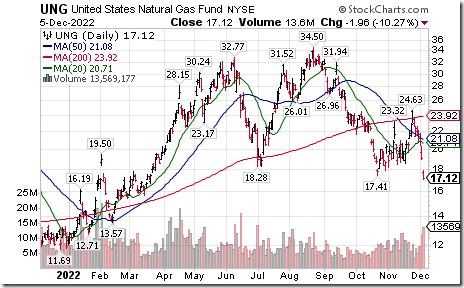

Energy prices and related ETNs dropped sharply. Natural Gas ETN $UNG moved below $17.41 extending an intermediate downtrend. Crude oil ETN dropped more than 3%.

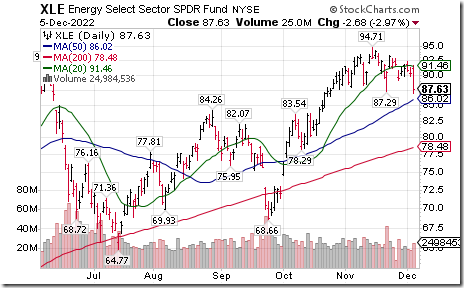

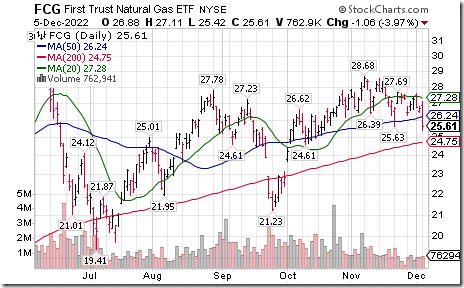

U.S. energy equity related ETFs responded to the drop in natural gas and crude oil prices.

Energy SPDRs $XLE moved below $87.29 completing a Head & Shoulders pattern

Natural Gas Equity ETF $FCG moved below $25.63 setting an intermediate downtrend.

Big cap U.S. energy stocks led the drop by equity energy ETFs. Chevron $CVX a Dow Jones Industrial Average stock moved below $175.82 completing a Head & Shoulders pattern Exxon Mobil $XOM an S&P 100 stock moved below$107.48 and $106.71 completing a Head & Shoulders pattern.

Canopy Growth $WEED.TO a TSX 60 stock moved above Cdn$6.06 extending an intermediate uptrend.

Trader’s Corner

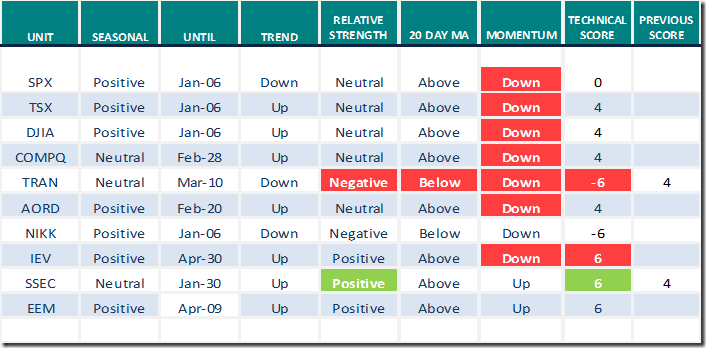

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 5th 2022

Green: Increase from previous day

Red: Decrease from previous day

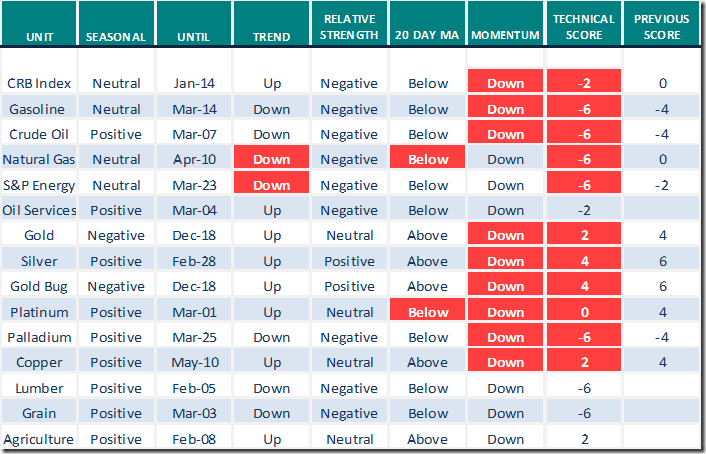

Commodities

Daily Seasonal/Technical Commodities Trends for December 5th 2022

Green: Increase from previous day

Red: Decrease from previous day

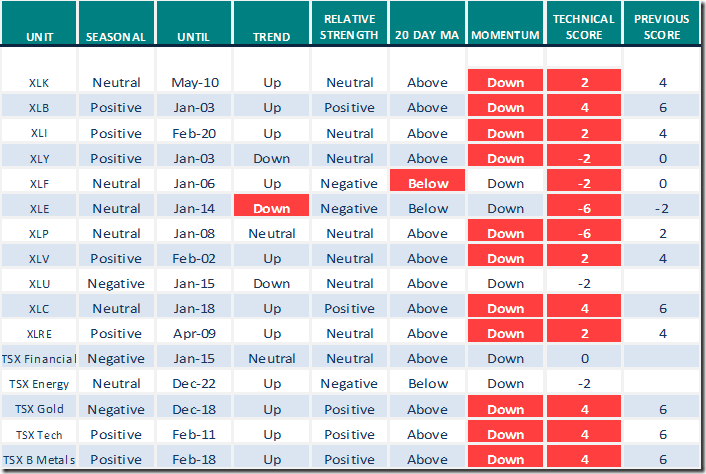

Sectors

Daily Seasonal/Technical Sector Trends for December 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 7.40 to 83.60. It remains Overbought and shows early signs of a peak.

The long term Barometer dropped 4.20 to 59.50. It changed from Overbought to Neutral on a drop below 60.00.

TSX Momentum Barometers

The intermediate term Barometer dropped 6.78 to 77.97. It remains Overbought and show early signs of a peak.

The long term Barometer dropped 5.51 to 51.27. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed