U.S. Dollar Index ETN $UUP moved below $28.52 extending an intermediate downtrend. Crude oil, base metals and gold prices responded by moving higher.

Gold stocks and ETFson both sides of the border followed a break by the gold bullion ETN $GLD above $166.23. Gold Miners ETF advanced 3.4%. Barrick $ABX.TO moved above Cdn$22.23 extending an intermediate uptrend.

Base metal equities and related ETFs also responded to U.S. Dollar weakness. Lundin Mining moved above $8.41 extending an intermediate uptrend.

Timber iShares $WOOD moved above $77.24 extending an intermediate uptrend.

India ETF $PIN moved above $25.81 extending an intermediate uptrend.

Biotech ETF $BBH moved above 168.37 and $168.48 extending an intermediate uptrend. NASDAQ Biotech iShares $IBB moved above $136.89 extending an intermediate uptrend.

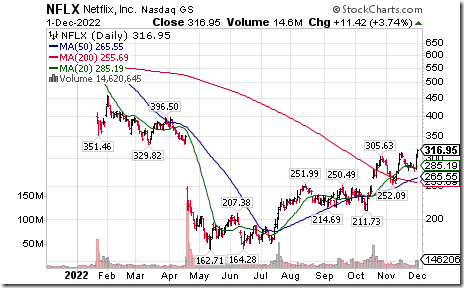

S&P 500 stocks extending an intermediate uptrend included Netflix, Altria, Philip Morris International, Meta Platform, Bristol Myers, MasterCard and Procter & Gamble.

NASDAQ 100 stock extending an intermediate uptrend included Mondelez, Nvidia, Fiserv, Intuit, Splunk and Okta

TSX 60 stocks extending an intermediate uptrend included Waste Connections $WCN.TO on a move above 195.05 and Shopify $SHOP.TO on a move above $57.85.

Trader’s Corner

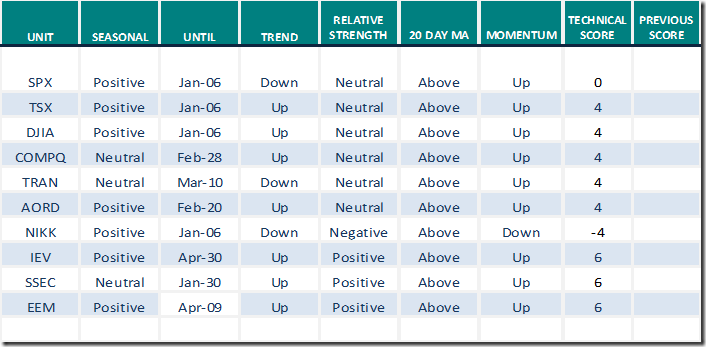

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

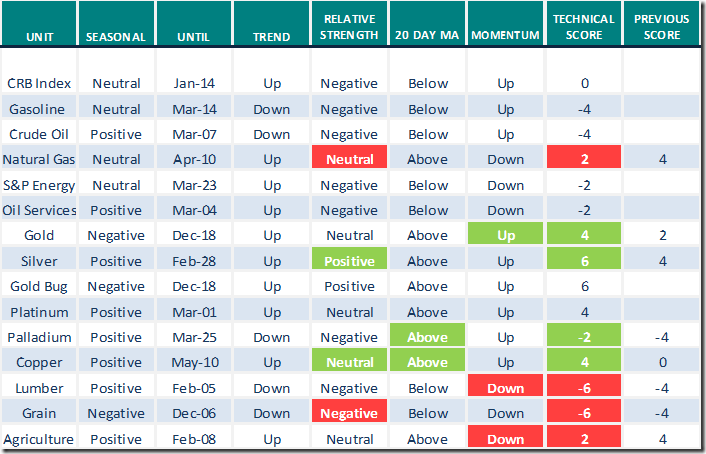

Commodities

Daily Seasonal/Technical Commodities Trends for December 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for December 1st 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.40 to 91.20. It remains Overbought.

The long term Barometer added 0.40 to 65.00. It remains Overbought. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.85 to 83.47. It remains Overbought.

The long term Barometer added 0.85 to 58.05. It remains Neutral. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed