Pre-opening Comments for Thursday December 1st

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged at 7:30 AM EST.

October core PCE Price Index released at 8:30 AM EST is expected to increase 0.3% versus a gain of 0.5% in September. On a year-over-year basis, October core PCE Price Index is expected to increase 5.0 versus a gain of 5.1% in September.

Snowflake $SNOW dropped $7.30 to $135.60 after the company offered a lower than expected outlook

Salesforce.com $CRM fell $10.85 to $149.40 after Bret Taylor, company Chief Executive Officer announced plans to leave the company next spring.

Splunk $SPLK added $6.47 to $84.15 after the company offered higher sales and cash flow forecasts.

Sturm Ruger $RGR gained $3.38 to $58.31 after the company announce a special $5.00 per share dividend.

EquityClock’s Daily Comment

Headline reads “Over the past two decades, the S&P 500 Index has averaged a gain of 0.9% in December with 70% of periods closing higher”.

http://www.equityclock.com/2022/11/30/stock-market-outlook-for-december-1-2022/

Responses to Federal Reserve Chairman’s Speech after 2:00 PM

S&P 500 moved higher moving and advanced above its 200 day moving average.

Long term treasury bond prices moved higher

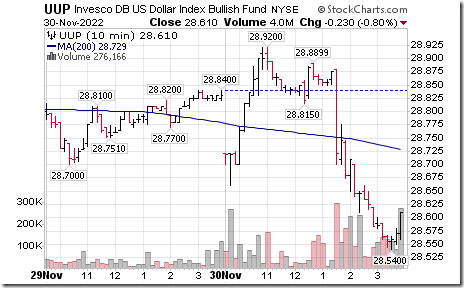

The U.S. Dollar Index ETN moved lower

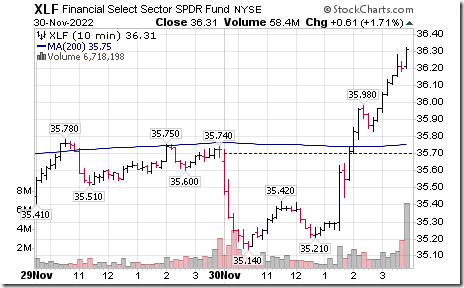

Financials moved higher

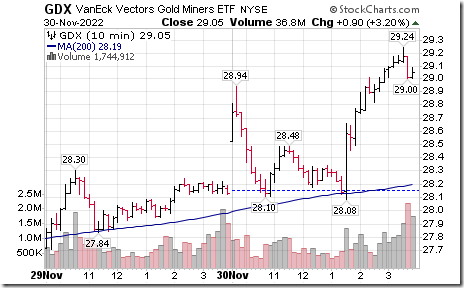

Gold/Silver prices moved higher

Precious metal equity prices moved higher.

Technical Notes

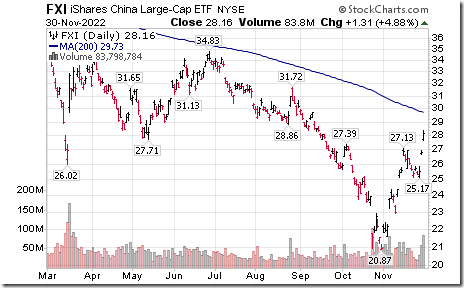

Chinese ETFs $FXI were notably higher. China Large Cap iShares moved above $27.13 extending an intermediate uptrend.

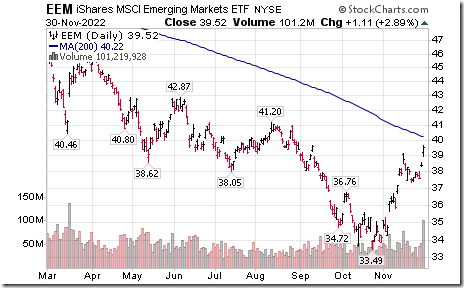

Emerging Markets iShares $EEM, heavily weighted in Chinese equities moved above $39.16 extending an intermediate uptrend.

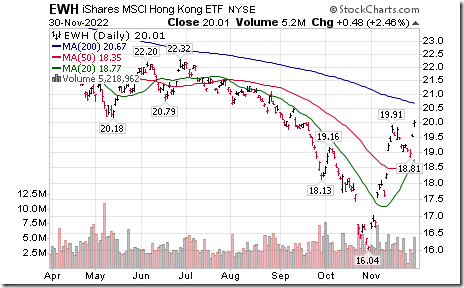

Other emerging markets showing positive technical action include Taiwan and Hong Kong. Taiwan iShares moved above $49.83 extending an intermediate uptrend. Hong Kong iShares moved above $19.91 extending an intermediate uptrend.

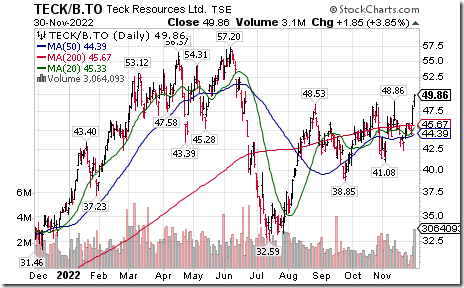

Strength in Chinese equities prompted strength in base metal equities and ETFs. Global Base Metals iShares $PICK moved above $42.06 extending an intermediate uptrend. Global X Copper Miners $COPX moved above $35.60 extending an intermediate uptrend. TSX Global Base Metals iShares XBM.TO moved above Cdn$19.84 extending an intermediate uptrend.

TSX Information Technology iShares $XIT.TO moved above Cdn$34.40 extending an intermediate uptrend. Strength was led by a move by CGI Group $GIB.A.TO above Cdn$116.88 to an all-time high.

EAFE iShares $EFA moved above $66.77 extending an intermediate uptrend.

Other major U.S. sector ETFs that moved above intermediate resistance included XLK, SLX, IYT, XME, IAI, IYR, SLV

S&P 100 stocks moving above intermediate resistance included FDX, BKNG, NKE, MS, USB, PFE, CSCO, MSFT

NASDAQ 100 stocks moving above intermediate resistance included ILMN, WDAY, LULU, CPRT, CSX, GOOG, GOOGL, KLAC, MCHP, MRVL, PAYX, TCOM, TTWO

TSX 60 stocks moving above intermediate resistance included BAM.A, TECK.B, PPL.

Trader’s Corner

Lots of seasonality updates! December tends to be a month when seasonal influences change the most.

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

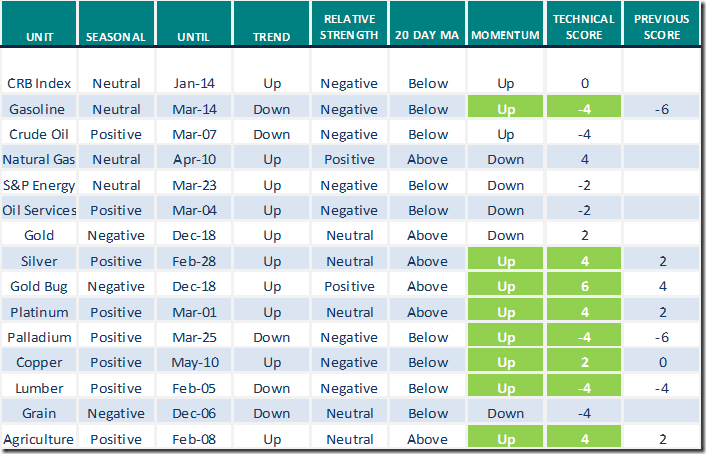

Commodities

Daily Seasonal/Technical Commodities Trends for November 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

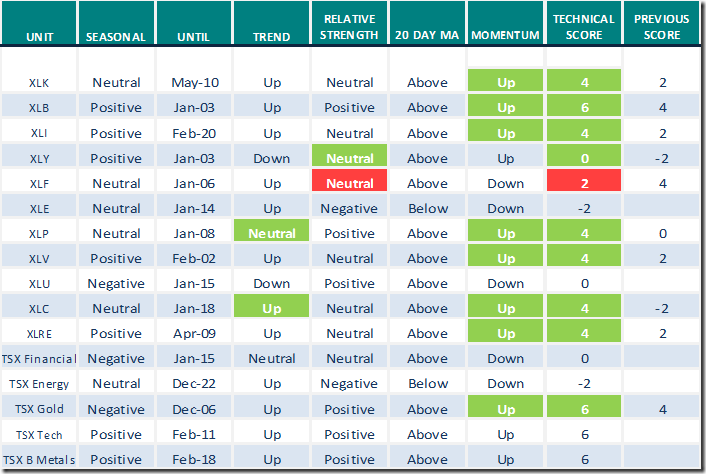

Sectors

Daily Seasonal/Technical Sector Trends for November 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

From Mark Bunting and www.uncommonsenseinvestor.com

Tom Bowley says “S&P 500 support levels must hold”.

S&P 500 Support Levels Must Hold | Tom Bowley | Trading Places (11.29.22) – YouTube

Greg Schnell says “It’s a real bull versus bear battle”

It’s A Real Bull vs. Bear Battle | Greg Schnell, CMT | Your Daily Five (11.29.22) – YouTube

Greg Schnell is “Looking for strong ETFs”.

Looking For Strong ETFs | Greg Schnell, CMT | Market Buzz (11.30.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 6.60 to 92.80. It remains Overbought. Trend remains up.

The long term Barometer added 6.40 to 64.60. It changed from Neutral to Overbought. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 5.51 to 84.32. It remains Overbought. Trend remains up.

The long term Barometer added 5.93 to 57.20. It remains Neutral. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed