Pre-opening Comments Today

With U.S. equity markets on holidays today, no pre-opening comments are offered.

Responses to FOMC Meeting Minutes

Minutes were released at 2:00 PM EST yesterday

U.S. equity indices moved higher after 2:00 PM EST

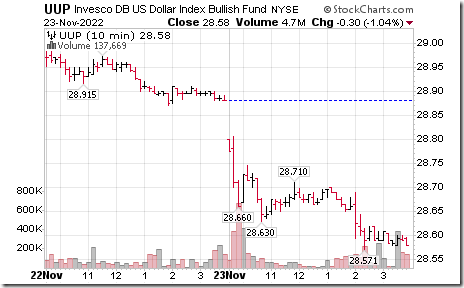

U.S. Dollar and related ETN: UUP moved lower after 2:00 PM EST

Long term U.S. Treasury bond yields moved lower. Long term U.S. Treasury bond prices moved higher after 2:00 PM EST

Gold prices and related ETNs moved higher after 2:00 PM EST.

Technical Notes for Yesterday

Dow Jones Industrial Average $INDU moved above intermediate resistance at 34,281.01.

Junior Gold Miners ETF $GDXJ moved above $35.17 and $35.26 extending an intermediate uptrend.

TSX Gold iShares $XGD.TO moved above Cdn$16.93 extending an intermediate uptrend.

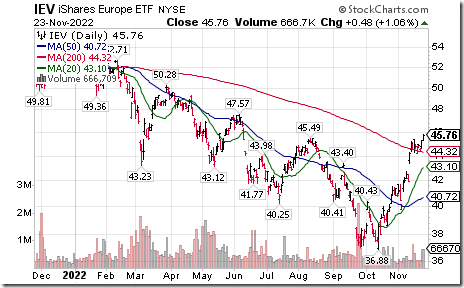

Europe iShares $IEV moved above $45.49 extending an intermediate uptrend.

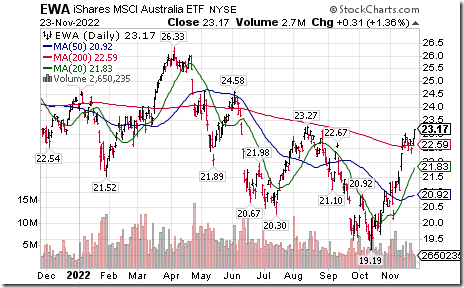

Australia iShares $EWA moved above $23.27 extending an intermediate uptrend.

U.S. Telecommunications iShares $IYZ moved above $23.40 extending an intermediate uptrend.

CDW Corp $CDW a NASDAQ 100 stock moved above $187.79 extending an intermediate uptrend.

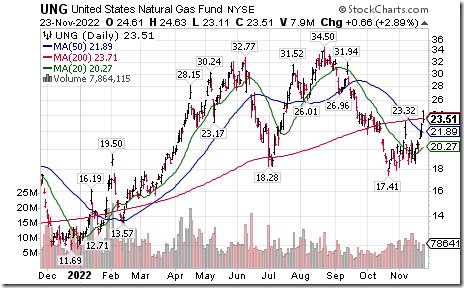

Natural Gas ETN $UNG moved above $23.32 completing a double bottom pattern.

Thomson Reuters $TRI.TO a TSX 60 stock moved above $153.98 extending an intermediate uptrend.

Grain ETN $JJGTF moved below $34.01 extending an intermediate downtrend.

Trader’s Corner

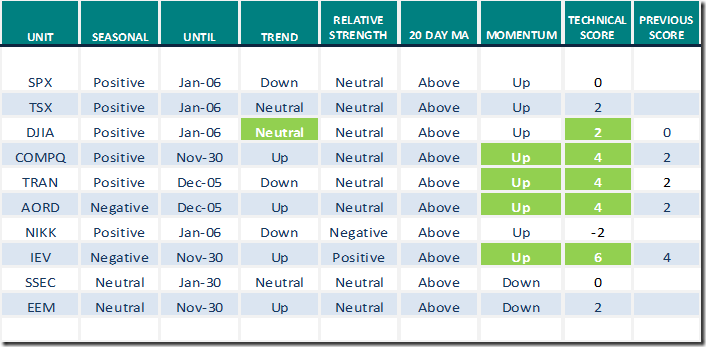

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for November 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for November 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Larry Kudlow says “This is an alarming sign for the economy”

https://www.youtube.com/watch?v=mn3AqOptv2g

Mark Bunting and www.uncommonsenseinvestor.com links

Analyst: These Five Stocks Have 10-Bagger Potential – Uncommon Sense Investor

Glass Half Full As Consumers Keep Spending & GDP Remains Strong – Uncommon Sense Investor

Greg Schnell discusses “Choppy markets”.

Choppy Markets | Greg Schnell, CMT | Market Buzz (11.23.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.80 to 89.00. It remains Overbought. Trend remains up.

The long term Barometer added 2.00 to 61.80. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer added 2.12 to 77.97. It remains Overbought. Trend remains up.

The long term Barometer added 1.69 to 52.54. It remains Neutral. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed