by William Smead, Smead Capital Management

Dear fellow investors,

The era of the dynamic sales growth tech company, with a religious quality to its leadership, appears to be over. Who are these mega-dynamic leaders? What was the key to their extended success in business and the stock market? How long will it be before these former powerhouse stocks get interesting again? In other words, when will Humpty-Dumpy get put back together again?

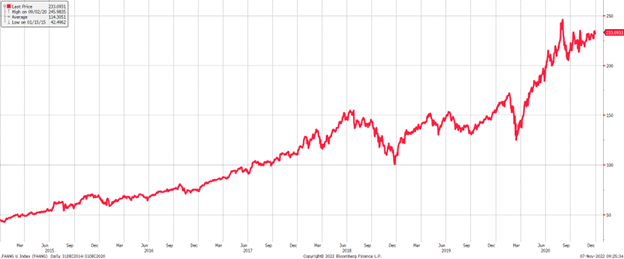

The period from 2014 to 2020 was dominated by the stock market success of the FAANG stocks. These technology companies were heavily promoted by charismatic leaders like Mark Zuckerberg, Jeff Bezos, Tim Cook, Reid Hastings and Sundar Pichai. They laid out aggressive revenue growth targets and hit them. In the process, they developed a cult-like following of growth stock and passive investors.

Source: Bloomberg

These men brilliantly established the rules of the game they played. Zuckerberg (in social media by way of a Harvard dorm), Bezos (by way of DE Shaw’s hedge fund), and Reid Hastings (the Pied Piper of movies by mail) seized the era and never made any effort to temper the dreams of cult-like investors who enjoyed their products. Humpty-Dumpty never had a great fall.

Antitrust laws existed, but none were used on their monopoly positions. Second, revenue growth was the key benchmark, rather than profitability. Third, the more growth targets they hit the more devotion they received from investors.

What perpetuated this game so long were four things. 1) The uninterrupted nature of their sales growth, 2) an extended and historic bull market in stocks, 3) a substantial downward movement of interest rates, and 4) the way the COVID-19 lockdowns accelerated their sales growth with home imprisoned customers.

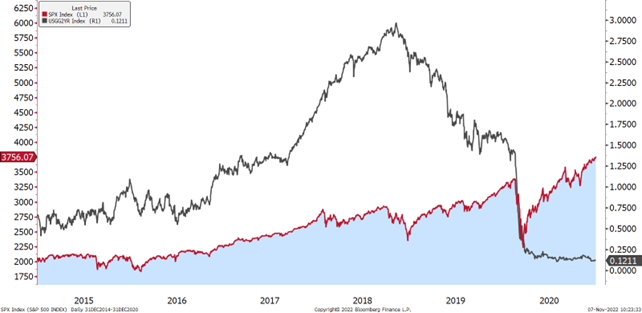

Source: Bloomberg

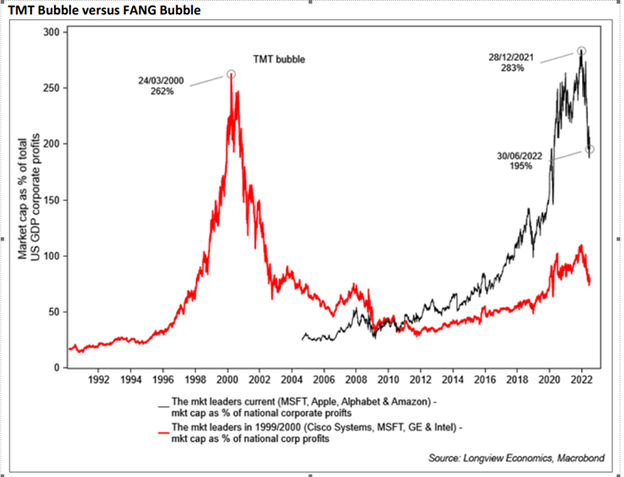

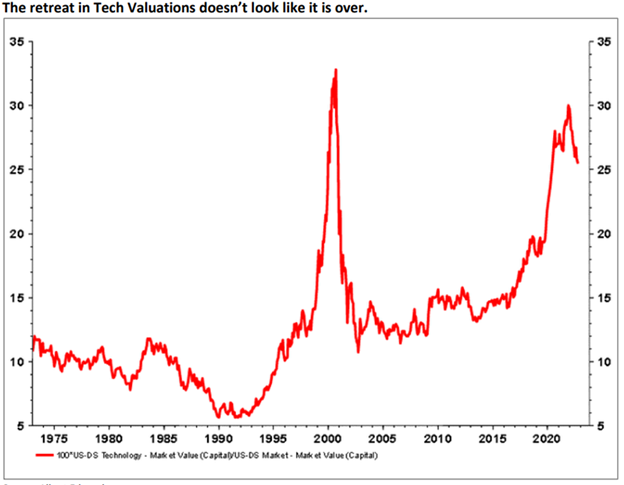

We are asked all the time about when we will go bargain hunting among formerly popular tech stocks, especially the ones promoted by Pied Piper CEOs. Our answer is included in this chart provided by Cypress Capital via Longview Economics/Macrobond:

As you can see, it took years for the tech bubble stocks of 1999 to get interesting. Microsoft (MSFT) peaked at around $58 per share and was $28.50 per share in 2012. Intel (INTC) and Cisco Systems (CSCO) have never made it back to their 2000 highs. Will Amazon (AMZN), Facebook (FB/META), Netflix (NFLX), Alphabet (GOOGL), and Apple (APPL) be any different?

John Kenneth Galbraith, in his seminal book, A Short History of Financial Euphoria, stated our marching orders on the glam tech stocks this way:

“A further rule is that when a mood of excitement pervades a market or surrounds an investment prospect, when there is a claim of unique opportunity based on special foresight, all sensible people should circle the wagons; it is time for caution. Perhaps, indeed, there is opportunity. Maybe there is that treasure on the floor of the Red Sea. A rich history provides proof, however, that, as often or more often, there is only delusion and self-delusion.”

As we said in our prior missive, Hannibal Lecter said to Clarisse in the movie The Silence of the Lambs, “Have the lambs stopped screaming?” The chart above answers no. In the Smead Capital Management world, they have yet to start screaming in today’s S&P 500 stock market! Therefore, we will resist the temptation to bottom fish because investors need to “rub the lotion on [their] skin” or investors will “get the hose again.”

Leave Humpty-Dumpty for later because “all the king’s horses and all the king’s men couldn’t put Humpty-Dumpty together again!” We aren’t in a hurry.

Fear stock market failure,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2022 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com